- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- How can I enter boxes 2d and 2e from 1099-DIV, there is no place to enter on the Turbo Tax input form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I enter boxes 2d and 2e from 1099-DIV, there is no place to enter on the Turbo Tax input form?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I enter boxes 2d and 2e from 1099-DIV, there is no place to enter on the Turbo Tax input form?

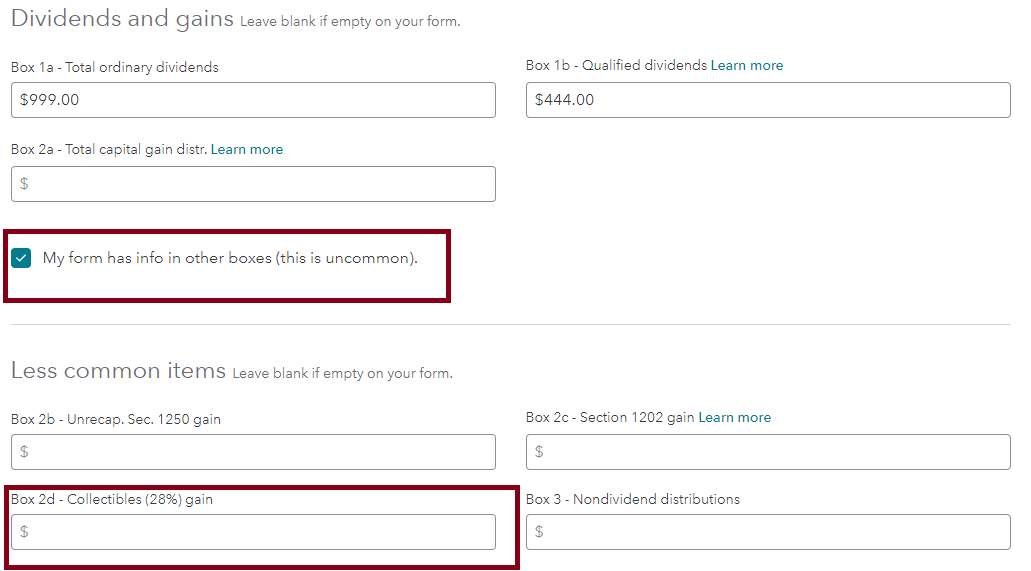

Yes, you can post box 2d.

- Toward the bottom of the 1099-DIV input form you have a check box My form has info in other boxes (this is uncommon).

- You will then have Box 2d available to post.

You do not have to post Box 2e if you are a U.S. individual.

See note under box 2(f) in Instructions for Form 1099-DIV

Note. Only RICs and REITs should complete boxes 2e and 2f. Boxes 2e and 2f do not need to be completed for recipients that are U.S. individuals. Boxes 2e and 2f apply only to foreign persons and entities whose income maintains its character when passed through or distributed to its direct or indirect foreign owners or beneficiaries.

If this does not completely answer your question, please contact us again and provide some additional details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ripepi

New Member

stephen-doherty25

New Member

swick

Returning Member

rspalmera

New Member

Talhakhan104

Returning Member