- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Form 8915-E

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

Why can't I report these Level 15 users?

What a bunch of goofballs that don't read the comments.

Originally TT said February 24th, now they say 25th?

Is TurboTax trolling their own users? Bravo

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

🤔🤔

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

HR Block’s website says 3/4/21 for when it’s available for e-file, so I’m not sure how people are saying that HR Block is live with it.

https://www.hrblock.com/tax-software/updates-back-editions/fed[product key removed]able.html

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

@WendyN2 If you look really good on the IRS website it shows the form is ready to use. The form was released on Feb. 12. There's other tax sites using the verbiage from the form which is what the IRS said they could do.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

Why discounts are you talking about?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

Good news They just updated its now available. Whooo

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

Home and business desktop here. It is not available yet. Online version is available, someone said they had to upgrade to “self employed” to get it.

Please let us know if any desktop users get the update

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

I just checked my return and 8915E is not available for us, i live in Georgia>

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

Just logged into TT Deluxe. No updates for me today. Still can't get the 8915-E to come up. It is the same as it has been for a few weeks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

I'm in GA available for me

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

Is it only available on the ONLINE version and not the installed DELUXE version maybe?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

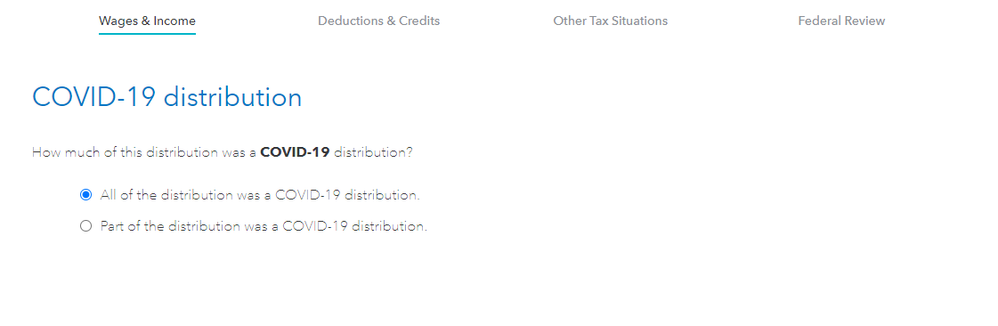

Form 8915-E is available in the online version, but it does not let you make the income tax payments ratably for Covid-related Roth withdrawals. It says I reported $0 as a Covid-19 withdrawal when on the previous question I responded that ALL of it was due to Covid. If I check the box "pay tax on entire. . . ," it still shows $0 at the top, but it calculates the correct amount of tax, with no penalty, for the entire amount.

Hopefully, they get the issue with 1/3 payments squared away or I will have to use another software to do my taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

@benihana740 wrote:

Form 8915-E is available in the online version, but it does not let you make the income tax payments ratably for Covid-related Roth withdrawals. It says I reported $0 as a Covid-19 withdrawal when on the previous question I responded that ALL of it was due to Covid. If I check the box "pay tax on entire. . . ," it still shows $0 at the top, but it calculates the correct amount of tax, with no penalty, for the entire amount.

Hopefully, they get the issue with 1/3 payments squared away or I will have to use another software to do my taxes.

I just went through this process using the TurboTax online editions and it worked as required by the Form 8915-E for a covid related withdrawal.

Suggest that you delete the Form 1099-R that you entered and re-enter manually.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-E

Thank you for your response.

Still no luck. I inputted everything manually according to the form. The amount shown is $0

FYI, I am using the online premier version..

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

javigilante8243

Level 2

rrectanus

New Member

apcoulte

Level 2

ccsnreg

New Member

gmmayes94

Returning Member