- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Form 8853 p1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8853 p1

I received a 1099-SA form for a Medicare Advantage MSA and it won't let me file saying that form 8853 p1 must be filed. It indicated that the form will be available on 2/11/21. Not sure what this is or why I need to file it.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8853 p1

No, just answer yes if you used it for medical expenses ONLY. Since you said you spent most on medical enter NO and then answer the follow-up questions.

See the screenshot below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8853 p1

You need the form because this is the form that records all the information from your MSA.

Please see this LINK for more information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8853 p1

Thanks ColeenD3. I used most of my distribution for dental expenses and my plan categorizes these as covered. That is why I got the MSA in the first place. Do I need to itemize these on the 8853. I don't have the cancelled checks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8853 p1

No, just answer yes if you used it for medical expenses ONLY. Since you said you spent most on medical enter NO and then answer the follow-up questions.

See the screenshot below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8853 p1

I am in a similar situation. I withdrew a small amount from my MSA during 2021 and it was all used for medical expenses. I checked the Yes box indicating such on the Turbotax prompt. TurboTax now is withholding filing my taxes because it is ostensibly waiting on form 8853 p1 from the IRS. It now says the form is due 3/31/2022. This makes no sense. Instructions for the form have been out since December. Turbotax must have it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8853 p1

It takes every tax software vendor time to get the final IRS form, make a mock-up that the IRS approves, code the XML generator that is used for the e-file format, write the code to populate the form, test the heck out of it not only on the 8853 itself but also every form that feeds into it and the form it feeds into (the 1040).

Of course, if you assume that there will be zero changes from the previous year, you might do a lot of this before the final form is released by the IRS...but you have to balance the workloads of the 8853 accountants and programmers and testers with all the other last minute work that is going on. I am sure that the Development staff is still busy trying to make sense of all the things they had to do in early 2021 as the IRS (and Congress) were changing the rules and forms during the 2020 tax season. It is likely that they did things in a hurry for last tax season that they have been fixing ever since.

Then it becomes a matter of scheduling, as the Development Team has only finite resources. Please keep watching the Federal Forms Availability page for updates to the availability date for the 8853.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8853 p1

Form 8853 is clearly available on the IRS web site right now.

Who can I contact at Turbotax to get a refund of my already paid program fees?

I will submit my income tax via hard copy, rather than wait another 45 days for Turbotax to get it's version done.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8853 p1

As I noted above, the IRS putting a form on its website is only the first step in making a tax form available in the offerings of any tax software company.

Furthermore, I would strongly encourage you not to print and mail your return, if you still have the option to e-file. The IRS is severely backlogged, and the backlog is getting worse. There are nearly 24,000,000 return that have not yet been processed from last year, and any return you file this year on paper will have to compete with all those returns from last year.

See "IRS backlog hits nearly 24 million returns, further imperiling the 2022 tax filing season"

If you are expecting a refund, do what the IRS suggests and e-file and use direct deposit...

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8853 p1

I got a message saying that I can't eFile but will have to mail my return because Form 8853 has more than one page which TurboTax does not support. So, the workaround is as follows --- when you are asked if you used all of the MSA for medical expenses say NO and when it asks how much was used towards Medical Expenses indicate a dollar less than the Gross Distribution. Example: I had a Gross Distribution of $1,699 and I entered that the amount used towards Medical Expenses was $1,698. After this workaround I am now able to eFile.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8853 p1

Never mind - I ran the Smart Check and I still get the same error message. I still have to file by mail. I will wait a week to see if TurboTax solves this issue to allow me to file electronically.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8853 p1

Do you get this message about not being able to e-file in the Review or in the final filing process?

This is a strange situation, since this form (the 8853) has been around for a long time. Could you do us a favor and send us a "token"? The token is a pointer to a sanitized version of your tax return that would allow us to examine your return and see what is really the issue here.

To send us a token, please do the following:

TurboTax Online:

Click Tax Tools in the menu to the left.

Click Tools, and then

Click Share my file with Agent.

A pop-up message will appear. Click OK to send the sanitized diagnostic copy to us.

Provide the token number that is generated onto this thread.

TurboTax Desktop:

Select Online menu if the customer is using Windows. Select “Help” if using a Mac.

Select Send Tax File to Agent.

A pop-up message will appear, and the customer will select, Send. If using Mac "Send Tax File to TurboTax Agent"

Note: Desktop will save a file to your computer unless you uncheck the box.

Another message will appear. Provide the token number that is generated onto this thread.

At the bottom of your reply (with the token) add "@" "BillM223" (without the space in between) so I will be notified.

This will let us see what is happening on your return. Thanks.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8853 p1

Bill,

You sent me an email asking I provide you with a token which I did but I've not received a reply so I'm sending it via this medium. The token # is 1115386 @BillM223 @BillM223.

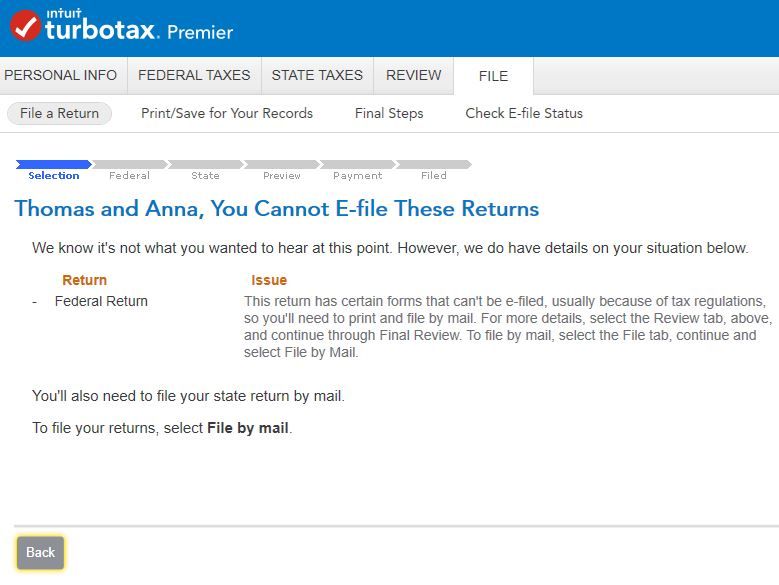

I've attached a screenshot which indicates that I can't E-file my return but have to print and mail it. What do I have to do to E-file my return?

Thanks,

Tom

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8853 p1

I am looking at your return. I see this message:

This is a different message than what you got - I used the CD/download version - did you use the Online version of TurboTax? No matter, I did have couple of questions on your return.

I noticed on both your 1099-SAs that you indicated that all by one or two dollars of each MSA distribution was for medical expenses, thus causing one or two dollars to be taxable in each case. Is this correct?

Second, the error message I got was that TurboTax did not support e-filing more than one worksheet on the 8853. This struck me as odd since the 8853 in your case did not have more than one worksheet.

So I deleted one 1099-SA (the smaller one) and ran the Review - it was clean. Then I added back a slimmed down version of the 1099-SA, and ran the Review again - this time it was also clean.

I suggest you try this:

1. Examine this situation of each 1099-SA having all but one or two dollars of the distribution being for medical expenses and make corrections as needed.

2. Delete a 1099-SA and then re-add it and run the Review again and see if it runs clean. If it doesn't, try it with the other 1099-SA.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8853 p1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8853 p1

1. Did you amend your return for 2021? If so, try entering the AGI on your original return, or try 0 (zero)

2. Check this TurboTax FAQ.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

spillman75

New Member

jenkins613

New Member

maryskaconnolly

New Member

Sunny1219

New Member

taxes54321

Level 1