- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- For 1099-K I sold items at a loss. There is supposed to be a "box" somewhere to designate that, but I cannot find it. Where is it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 1099-K I sold items at a loss. There is supposed to be a "box" somewhere to designate that, but I cannot find it. Where is it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 1099-K I sold items at a loss. There is supposed to be a "box" somewhere to designate that, but I cannot find it. Where is it?

I believe you mean you sold personal items at a loss and don't want to be taxed on them.

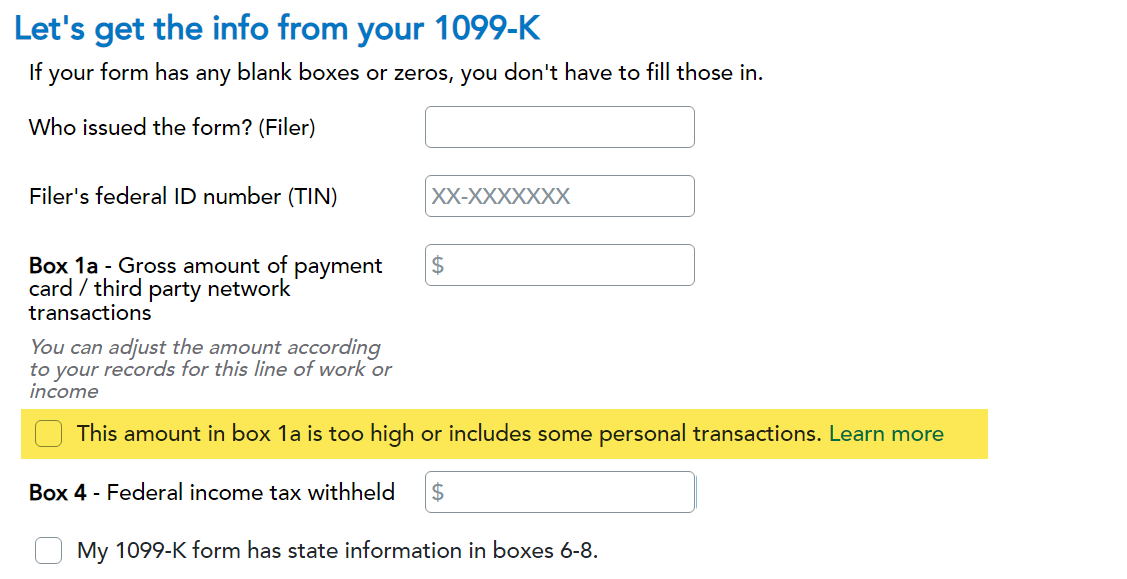

If so, when you enter your Form 1099-K, indicate that you sold personal items. On the page that says Let's get info from your 1099-K, choose the box that says This amount in box 1a is too high or includes some personal transactions:

Once you do that you can enter in the amount of the proceeds in the box that says Enter the amount that shouldn't be included, and then you won't be taxed on the proceeds:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 1099-K I sold items at a loss. There is supposed to be a "box" somewhere to designate that, but I cannot find it. Where is it?

That did not work for me. I subtracted the entire amount. The entire amount is still listed as income and the form did not pass review. My 2023 form says "personal items - sold at a loss." I don't know whether I entered "sold at a loss," but in 2024, I cannot find a place for it.

-- Also I seem the ability to see the forms, I can't find that now (or maybe I'm just freaking out.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 1099-K I sold items at a loss. There is supposed to be a "box" somewhere to designate that, but I cannot find it. Where is it?

The second screen that you encounter when you enter the IRS form 1099-K is titled Personal Item Sales.

There are two options on the screen:

- I sold some items at a loss or had no gain, and

- All items were sold at a loss or had no gain.

The posting of IRS form 1099-K for personal item sales is a two-step process.

- First, you post the IRS form 1099-K amount of box 1a.

- Second, you post the IRS form 1099-B Proceeds From Broker and Barter Exchange Transactions to report the sales proceeds and the cost of sales.

Make sure that the amount reported on the IRS form 1099-K box 1a equals the Proceeds reported for the multiple entries of IRS form 1099-B.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

XAM330

Level 3

Tamlea222

New Member

Olundy21

New Member

user17628882651

New Member

ashraf-yacoub6

New Member