- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

I believe you mean you sold personal items at a loss and don't want to be taxed on them.

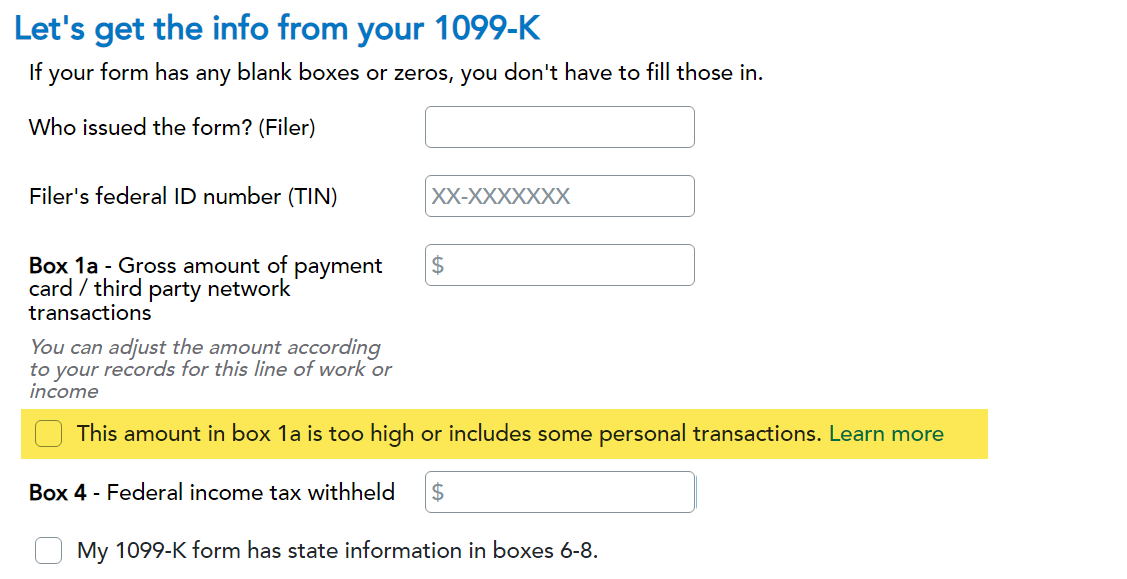

If so, when you enter your Form 1099-K, indicate that you sold personal items. On the page that says Let's get info from your 1099-K, choose the box that says This amount in box 1a is too high or includes some personal transactions:

Once you do that you can enter in the amount of the proceeds in the box that says Enter the amount that shouldn't be included, and then you won't be taxed on the proceeds:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 20, 2025

11:59 AM