- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Filing form 1099r retired from NYS and we do not pay state taxes on our pension where do I show this? I should not owe NYS $1613!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing form 1099r retired from NYS and we do not pay state taxes on our pension where do I show this? I should not owe NYS $1613!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing form 1099r retired from NYS and we do not pay state taxes on our pension where do I show this? I should not owe NYS $1613!

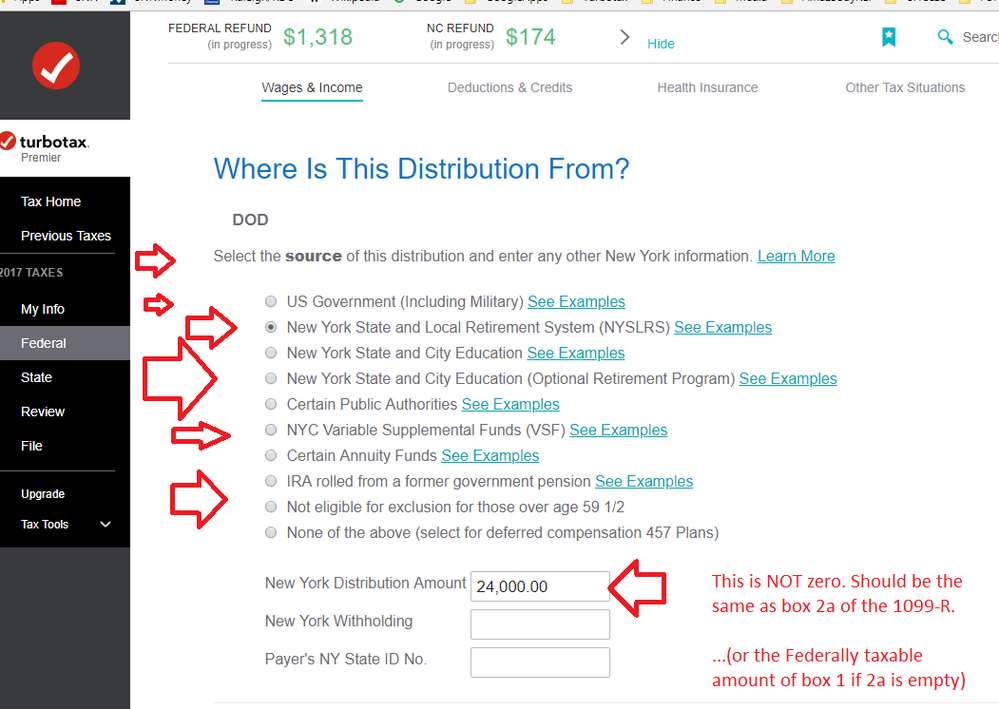

yo enter it just as any 1099-R is entered...BUT...there is a follow-up page where you have to indicate the exact NY Pension source.

______________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing form 1099r retired from NYS and we do not pay state taxes on our pension where do I show this? I should not owe NYS $1613!

If you suspect an error, you are right to start over from scratch. If you have previous years returns, you can compare them with your 2020 to see any discrepancies. Before deleting the state return, try deleting the 1099-R first and redoing it.

To delete your state:

Here's the general procedure for viewing the forms list and deleting unwanted forms, schedules, and worksheets in TurboTax Online:

- Open or continue your return in TurboTax.

- In the left menu, select Tax Tools and then Tools.

- In the pop-up window Tool Center, choose Delete a form.

- Select Delete next to the form/schedule/worksheet in the list and follow the instructions

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tothtamas

New Member

InTheRuff

Returning Member

JRretires

Level 2

brian-h-bell

New Member

Justinmcken

Level 2