- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Does state of LA exempt LA State Retirement benefits and social security income? If so, why do we have $1175 in LA tax due?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does state of LA exempt LA State Retirement benefits and social security income? If so, why do we have $1175 in LA tax due?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does state of LA exempt LA State Retirement benefits and social security income? If so, why do we have $1175 in LA tax due?

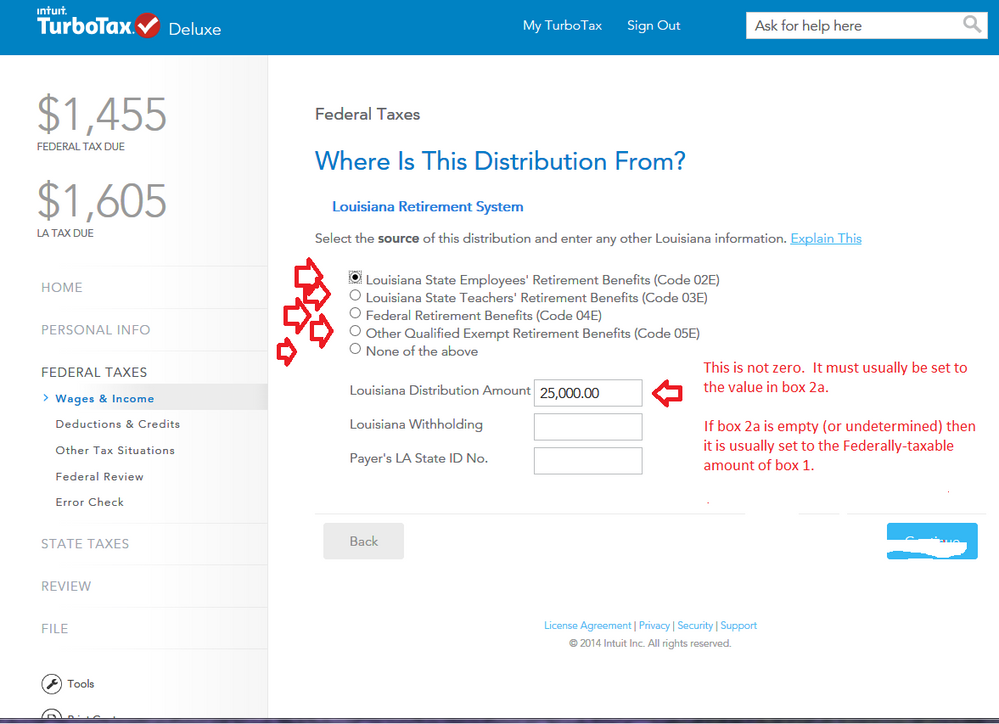

One other thing to check, is to make sure you properly filled out the Follow-up page where you entered your LA 1099-R back in the federal section (Edit it and go thru all of the pages that follow the main form).

Make sure your LA distribution amount is not a zero....once you select the proper source of the LA pension at the top of the page, the State form uses the Distribution Amount to "subtract" that $$ amount from LA income. (A "None of the above" selection at the top would leave the same $$ amount in as LA income).

That $$ amount to be removed, should show up on one of the line 4's of the LA State Schedule E as a $$ amount to be removed from your starting Federal AGI.

If there was any SS taxed on your Federal tax return (line 5b of the form 1040 or 1040SR) that $$ amount should also show up in the LA Schedule E. The tax software for that $$ amount would automatically transfer it from the Federal form, to the LA Schedule E without any specific action on your part...other than making sure you've fully filled out all your Federal income and Deductions&Credits (since the Federally taxable part of your SSA-1099 depends on the Federal section being fully filled in first)

____________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does state of LA exempt LA State Retirement benefits and social security income? If so, why do we have $1175 in LA tax due?

Here is the link to the Lousiana Department of Revenue: https://revenue.louisiana.gov/Individuals

Louisian does exempt Louisiana State Employees' Retirement Benefits, Louisiana State Teachers Retirement Benefits, and Social Security Benefits.

In addition, there is an Annual Retirement Income Exclusion that allows persons 65 years or older to exclude up to $6,000 of annual retirement income from their taxable income. Taxpayers that are married filing jointly and are both age 65 or older can each exclude up to $6,000 of annual retirement income. If only one spouse has retirement income, the exclusion is limited to $6,000.

We can't see your return, so it is impossible to determine why you have a balance due. If you provide more specific information as to your income situation, we might be able to make a possible determination.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does state of LA exempt LA State Retirement benefits and social security income? If so, why do we have $1175 in LA tax due?

One other thing to check, is to make sure you properly filled out the Follow-up page where you entered your LA 1099-R back in the federal section (Edit it and go thru all of the pages that follow the main form).

Make sure your LA distribution amount is not a zero....once you select the proper source of the LA pension at the top of the page, the State form uses the Distribution Amount to "subtract" that $$ amount from LA income. (A "None of the above" selection at the top would leave the same $$ amount in as LA income).

That $$ amount to be removed, should show up on one of the line 4's of the LA State Schedule E as a $$ amount to be removed from your starting Federal AGI.

If there was any SS taxed on your Federal tax return (line 5b of the form 1040 or 1040SR) that $$ amount should also show up in the LA Schedule E. The tax software for that $$ amount would automatically transfer it from the Federal form, to the LA Schedule E without any specific action on your part...other than making sure you've fully filled out all your Federal income and Deductions&Credits (since the Federally taxable part of your SSA-1099 depends on the Federal section being fully filled in first)

____________________________

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Joanne9rose

New Member

TMM322

Level 2

user17539892623

Returning Member

Ustak

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

lanyah88

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill