- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

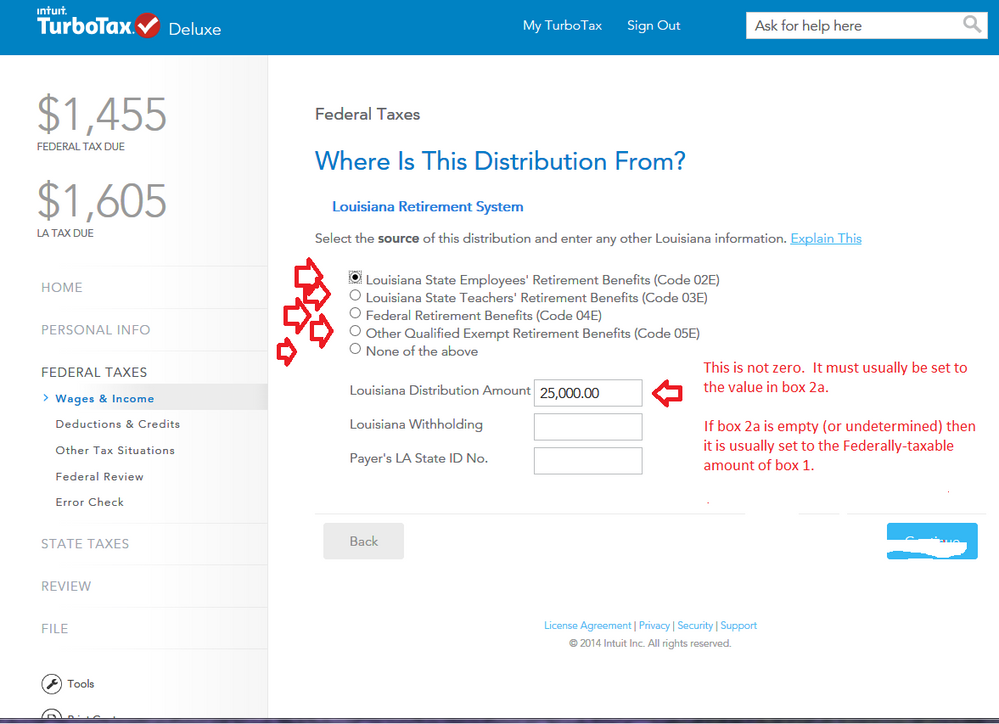

One other thing to check, is to make sure you properly filled out the Follow-up page where you entered your LA 1099-R back in the federal section (Edit it and go thru all of the pages that follow the main form).

Make sure your LA distribution amount is not a zero....once you select the proper source of the LA pension at the top of the page, the State form uses the Distribution Amount to "subtract" that $$ amount from LA income. (A "None of the above" selection at the top would leave the same $$ amount in as LA income).

That $$ amount to be removed, should show up on one of the line 4's of the LA State Schedule E as a $$ amount to be removed from your starting Federal AGI.

If there was any SS taxed on your Federal tax return (line 5b of the form 1040 or 1040SR) that $$ amount should also show up in the LA Schedule E. The tax software for that $$ amount would automatically transfer it from the Federal form, to the LA Schedule E without any specific action on your part...other than making sure you've fully filled out all your Federal income and Deductions&Credits (since the Federally taxable part of your SSA-1099 depends on the Federal section being fully filled in first)

____________________________