- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Can I enter which retirement funds are under bailey settlement on the federal part or is it only of the state part?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I enter which retirement funds are under bailey settlement on the federal part or is it only of the state part?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I enter which retirement funds are under bailey settlement on the federal part or is it only of the state part?

The primary place to enter it as being Bailey Settlement eligible....is in the Federal Section when you enter that Bailey-eligible 1099-R form

IF you imported that 1099-R, then you absolutely have to edit it and go thru the follow-up questions to find the spot where you designate it as being Bailey Settlement retirement $$.

_________

New this year, After the fact of entering it in the Federal section, there is also a Bailey Retirement menu selection in the NC Q&A session....if already properly entered in teh Federal section, sit shows the same $$ amount as being deducted.

Normally you wouldn't change that $$ amount...but there is something noted there about perhaps reducing it in the NC Q&A section, if you happened to take a Coronavirus distribution that is being spread over three years. I have no idea how that is playing into that section if you did....but it would have had to come from a Bailey eligible plan in the first place. But if you didn't take the coronavirus distribution in a prior year and spread it over multiple years, then that doesn't apply to you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I enter which retirement funds are under bailey settlement on the federal part or is it only of the state part?

There was no place on the federal Turbotax form to enter the Bailey status of the 5 funds on the 100-R. It seems I'll have to wait to get to the State form. Any body else have suggestions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I enter which retirement funds are under bailey settlement on the federal part or is it only of the state part?

It depends, you need to confirm that the NC distribution amount on the 1099-R is not empty. It should be the amount in box 2a, or the taxable amount in Box 1 if Box 2a is empty or undetermined. If the NC distribution amount is blank or zero, there is nothing to subtract from North Carolina income. Enter the amount that is subject to the Bailey amendment.

Go back to the "Income" tab and "Edit" the 1099R. After confirming the form entries, there will be a follow on question for NC residents that asks if the distribution is part of the Bailey Settlement. You would need to select "Yes."

After completing the Federal Interview return to the NC state interview. Click through the initial pages and you will arrive at the page titled "Here's the income NC handles differently." The Bailey deduction should show at the top of that page with a button allowing you to edit if needed. This is where to double-check the amount that is subject to the Bailey amendment.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I enter which retirement funds are under bailey settlement on the federal part or is it only of the state part?

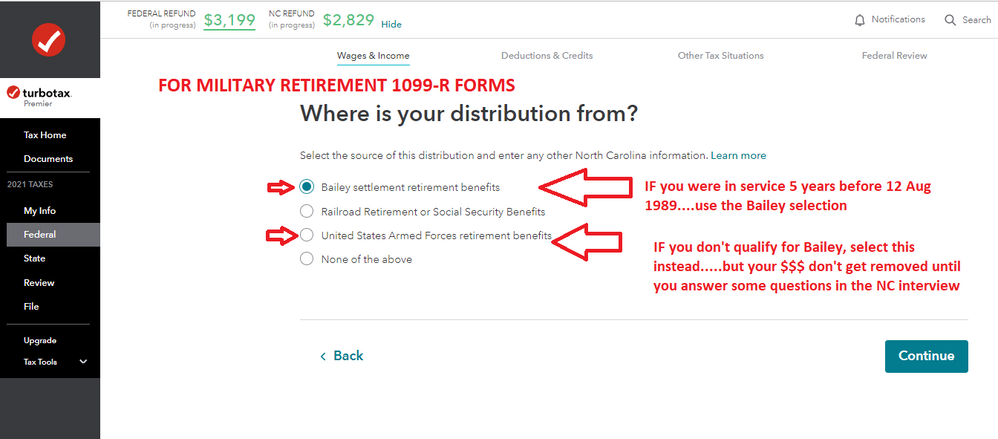

The page after the Main 1099-R entry in the Federal section would look something like the following (they may have changed the order of the list for 2022, but Bailey is still one selection):

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Kh52

Level 2

dfv331

New Member

tomodwyer2005

New Member

alrobin12

Level 1

swimjim819

New Member