- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Can Fidelity issue a Corrected 1099-R due to the incorrect 1099-R they sent to the IRS? Our AGI will go up & SS down. What to do? Fidelity does not answer their phones?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can Fidelity issue a Corrected 1099-R due to the incorrect 1099-R they sent to the IRS? Our AGI will go up & SS down. What to do? Fidelity does not answer their phones?

No, WE NEVER RECEIVED ANY MONEY FROM OUR 401k WITHDRAWAL. WITHIN 7 DAYS, WE ROLLED THE 401k MONEY OVER TO AN IRA. FIDELITY TOOK 20% OUT FOR FEDERAL TAXES AND PAID IT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can Fidelity issue a Corrected 1099-R due to the incorrect 1099-R they sent to the IRS? Our AGI will go up & SS down. What to do? Fidelity does not answer their phones?

@macuser_22 wrote:

@Trabia78 wrote:

We really appreciate all of your help. What does it mean that the IRS gives us 60 days within which to rollover money from a 401K to an IRA in order to get a Code G in Item 7 of the 1099-R?

The IRS give you 60 days do an indirect rollover for the code 7 1099-R to avoid tax on the money. That does NOT make it a code G it remains a code 7 as a rollover.

Again a code G is for a DIRECT ROLLOVER which means that YOU never received the money. The financial institution that holds the account itself made the transfer to the other account and YOU never saw the money at all. The 60 day rule does not apply to direct rollovers.

This is what it should look line (Online screens might look somewhat different).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can Fidelity issue a Corrected 1099-R due to the incorrect 1099-R they sent to the IRS? Our AGI will go up & SS down. What to do? Fidelity does not answer their phones?

But either code G or 7 will come out the same way. When you enter a 7 you say how much you rolled over. The part you rolled over it's not taxable unless you put it in a ROTH IRA. You only pay tax on the amount that wasn't rolled over - the 20% unless you added it back in from you own money.

If you are looking at a summary screen or review screen those show the full amount as income and lump a lot of stuff together. You need to check the actual 1040 form and make sure it's right.

If you rolled it over it should say Rollover to the left of the taxable amount on 4b or 5b.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can Fidelity issue a Corrected 1099-R due to the incorrect 1099-R they sent to the IRS? Our AGI will go up & SS down. What to do? Fidelity does not answer their phones?

You had what is called "constructive receipt" of the money because the way it was distributed from the 401(k) it placed the money under your control outside of a retirement account whether or not you had physical possession of the money. Because you had constructive receipt, it does not qualify as a direct rollover and cannot have been reported with code G on the Form 1099-R. As others have said, since you completed the indirect rollover by the deadline, entering the code-7 Form 1099-R and indicating that you rolled over the entire gross amount produces exactly the same result on Form 1040 as you would have gotten had the rollover instead been a direct rollover.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can Fidelity issue a Corrected 1099-R due to the incorrect 1099-R they sent to the IRS? Our AGI will go up & SS down. What to do? Fidelity does not answer their phones?

Thank you for all of your help. It has been great information. The problem we face is that if we apply the Code 7, then our AGI will go way up and our social security checks will go down. We live on $64,000 a year before deductions. We need to figure out how we can prevent our AGI from going up as a result of our mistake. We did not know that the amount a retired person gets in social security depends on your AGI. It is very discouraging after working so many years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can Fidelity issue a Corrected 1099-R due to the incorrect 1099-R they sent to the IRS? Our AGI will go up & SS down. What to do? Fidelity does not answer their phones?

Entered as macuser_22 showed in the screenshots, your AGI will remain unchanged. Be sure to delete and reenter the Form 1099-R exactly as macuser_22 described.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can Fidelity issue a Corrected 1099-R due to the incorrect 1099-R they sent to the IRS? Our AGI will go up & SS down. What to do? Fidelity does not answer their phones?

Thank you again. I will do exactly as Macuser_22 shows in the screenshots. I hope that the AGI shows our true social security only earnings and not the amount that includes SS earnings + the 401K withdrawal. We did not do a distribution, because the IRS indicated on 3-27-2020 that it was not required due to the Pandemic. We did not know about it until I started our taxes in TurboTax a week ago. Fidelity never told us. And we were well within the 60-day rollover period for an IRA. We rolled the money to an IRA within one (1) week of the

401K withdrawal. But a million thanks again for all of your help. Take good care. Donna

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can Fidelity issue a Corrected 1099-R due to the incorrect 1099-R they sent to the IRS? Our AGI will go up & SS down. What to do? Fidelity does not answer their phones?

This is the problem. I entered the data exactly according to Macuser_22 shows in the screenshots. (Thank you Macuser_22 for your help.) The result is that TurboTax included the 401K withdrawal in our AGI. Now, if we file the taxes like this,it increased our AGI significantly and our SS checks will go down. I just don't know what to do, because we need the SS checks that we currently receive.

I think that I will enter in the 1099-R with the Code G and check off the IRA. That is exactly what happened in June 2020 within a 6-day period of time. On page 2 of the 1099-R it states as follows:

1. Box 7: Entry No. 7. "Normal Distribution." We did not take a normal distribution because the IRS on 3-27-2020 ruled that due to the Pandemic taxpayers did not need to take an RMD.

2. Box 7: Entry No. G. "Direct roller of a distrtibution to a qualified plan....or an IRA.

We withdrew the money and within 6 days we opened the IRA, but Fidelity paid the taxes before the rollover.

What do you think?

Take care & a million thanks again.

Donna

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can Fidelity issue a Corrected 1099-R due to the incorrect 1099-R they sent to the IRS? Our AGI will go up & SS down. What to do? Fidelity does not answer their phones?

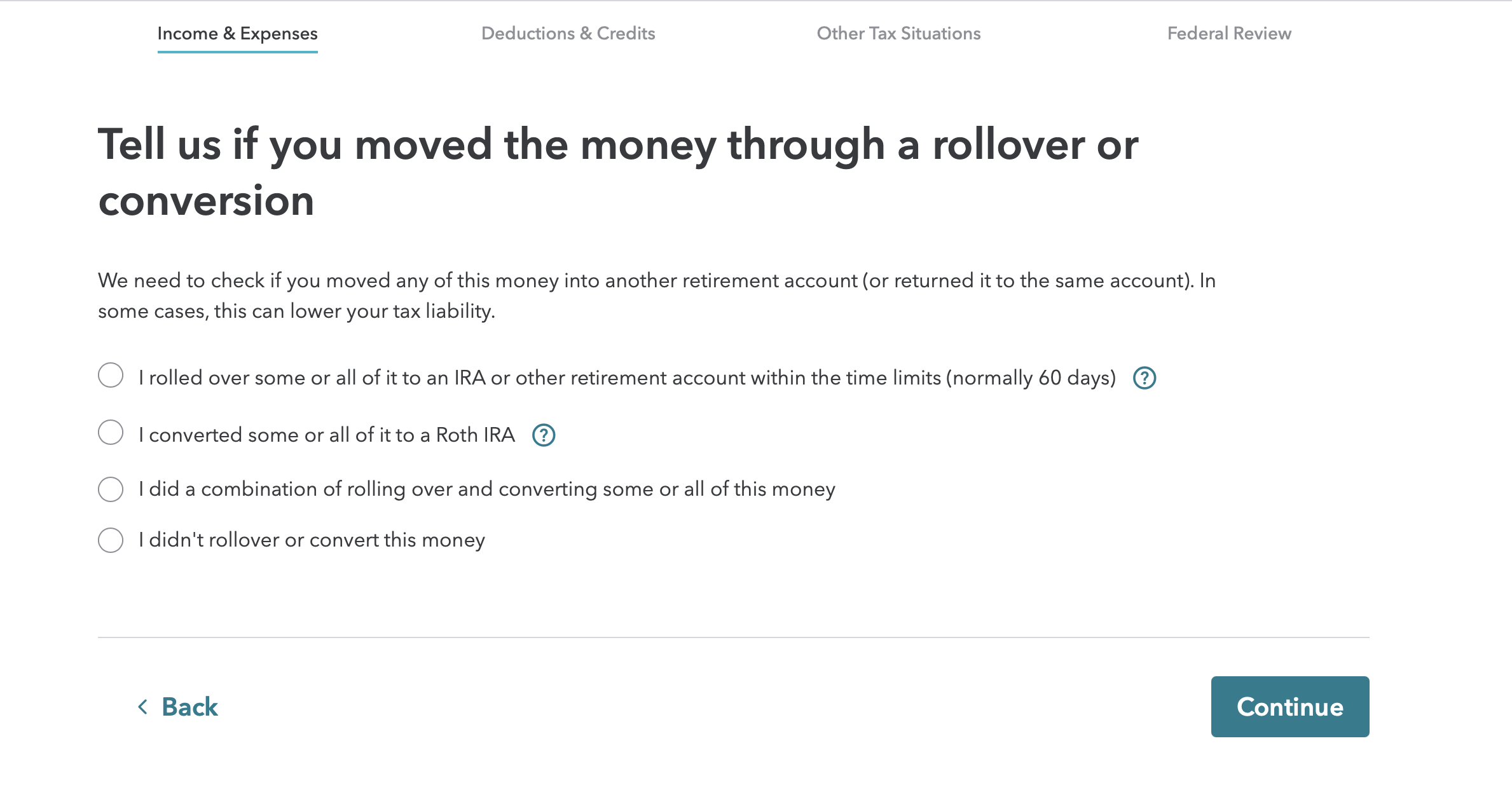

Did you get this screen where you enter the rollover?

Did you look at the actual 1040 form? - What is on line 4b?

If you file with a code G you will most likely get letter from the IRS in about a year with a bill for the tax on the line 1 amount on the code 7 1099-R because you did did not report it as a rollover. The IRS will ignore the code G - the IRS computer generate letters does not look for misreported income with a different form.

Also as has been pointed out - the box 4 tax withholding does not apply to a code G and will not be entered on the 1040 form.

I suggest that you call customer support for assistance to correctly report this.

There is no single published number because it changes contently depending on the nature of the call and agent availability. Following the link below will either give a current number for you to call or take your number for a callback.

(Note that phone support is for paying customers only. There is no phone support for Free Customers.)

Here is a TurboTax FAQ for contacting customer support.

https://ttlc.intuit.com/questions/1899263-what-is-the-turbotax-phone-number

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can Fidelity issue a Corrected 1099-R due to the incorrect 1099-R they sent to the IRS? Our AGI will go up & SS down. What to do? Fidelity does not answer their phones?

Enter the 1099-R exactly as it was sent to you - Box 7, Code 7 - Normal Distribution.

It was still a Normal Distribution, even if you weren't required to take it.

Since the money came to you, it was NOT a direct rollover. A direct rollover only applies when the distribution goes directly from one retirement account to another retirement account. You had the funds for 6 days.

It is still a "rollover and not taxable - you just have to answer the 1099-R interview questions accurately.

When asked "What did you do with the money", the answer is "I rolled over some or all of it to an IRA or other retirement account within the time limits (normally 60 days)"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can Fidelity issue a Corrected 1099-R due to the incorrect 1099-R they sent to the IRS? Our AGI will go up & SS down. What to do? Fidelity does not answer their phones?

Hi Todd:

1. Fidelity put the money into a retail account.

2. Fidelity took the 20% taxes out of the withdrawal and sent it to the IRS.

3. Because Fidelity took 20% out for taxes, we could not rollover all of the 401K money to the IRA. We rolled over the entire amount minus 20% for taxes.

4. We did the withdrawal in June, 2020 and within 6 days we rolled it over to the IRA.

5. What is the meaning of the IRS giving taxpayers 60 days within which to rollover a 401K withdrawal into an IRA?

6 I clicked on Forms in TT, but it is not going to the 1040. It went directly to the 1099-R form.

I have used TT for 21 years. I always pay for Audit Defense and the right to contact a TT tax expert. However, there is an excessive 1 hour wait to talk to TT.

Donna

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can Fidelity issue a Corrected 1099-R due to the incorrect 1099-R they sent to the IRS? Our AGI will go up & SS down. What to do? Fidelity does not answer their phones?

I'll try to explain this part again. Actually when you rolled it over you needed to replace the 20% taxes with money from your own checking or savings account. So 100% would go back. Since you did not roll over the full 100% gross amount then the 20% they kept out for withholding becomes a taxable distribution by itself. But you also get credit for the 20% withholding .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can Fidelity issue a Corrected 1099-R due to the incorrect 1099-R they sent to the IRS? Our AGI will go up & SS down. What to do? Fidelity does not answer their phones?

Thank you so much. We did not know what we were doing when we did the 401K withdrawal. We did not know that our AGI would go up and our SS checks would go down. When your AGI goes up, the SS Administration takes out more money from your check for Medicare B & D. It is totally f****. Remember that for your future!!

Take care.

Donna

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can Fidelity issue a Corrected 1099-R due to the incorrect 1099-R they sent to the IRS? Our AGI will go up & SS down. What to do? Fidelity does not answer their phones?

Donna, is it getting clearer now? How much was it? Like did you take out 150,000 and so they took 20% (30,000) for taxes? You have to use the code 7. Code G would be only if they put the whole 100% (150,000) into the IRA (or back into the 401K). But it sounds like you only rolled over 80%. You should have 150,000 on 1040 line 5a and 30,000 (the 20%) as taxable on line 5b with the word ROLLOVER by 5b .

The 20% for taxes would be like if they sent you a check for the 100% to start with and then you sent the 20% to the IRS yourself as an estimated tax payment. You got the full 100% but you only rolled over 80%.

Are you using the Online version or the Desktop program? Sounds like the Desktop program if you can see the forms? By the way, The income summary and review screens will show the full gross amount as income so you need to check the actual 1040 line 4 or 5 and make sure it says ROLLOVER by 4b/5b and has the right taxable amount. Which in your case should be the 20%.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can Fidelity issue a Corrected 1099-R due to the incorrect 1099-R they sent to the IRS? Our AGI will go up & SS down. What to do? Fidelity does not answer their phones?

@Trabia78 wrote:

2. Fidelity took the 20% taxes out of the withdrawal and sent it to the IRS.

3. Because Fidelity took 20% out for taxes, we could not rollover all of the 401K money to the IRA. We rolled over the entire amount minus 20% for taxes.

The 20% withholding is part of your distribution. If you did not also rollover that 20% by replacing it with other funds (which you are allowed to do) then the 20% will remain as a taxable distribution and WILL add to your AGI as it is required to do. If replaces with other funds then the 20% withholding is applied to all other withholding for 2020 and will be part of your refund - so you get that money back.

If you did not replace the tax withheld with other funds that that 20% will be a taxable distribution because it was sent to the IRS and not rolled over.

If you do not report it properly as taxable income on line 4b on the 1040 then the IRS WILL bill you for the missing tax in about a year and add interest charges starting on April 15 and increasing each month until paid.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

xiaochong2dai

Level 3

revntadken

New Member

edmarqu

Level 2

kare2k13

Level 4

Stevecoh1

Level 2