- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Enter the 1099-R exactly as it was sent to you - Box 7, Code 7 - Normal Distribution.

It was still a Normal Distribution, even if you weren't required to take it.

Since the money came to you, it was NOT a direct rollover. A direct rollover only applies when the distribution goes directly from one retirement account to another retirement account. You had the funds for 6 days.

It is still a "rollover and not taxable - you just have to answer the 1099-R interview questions accurately.

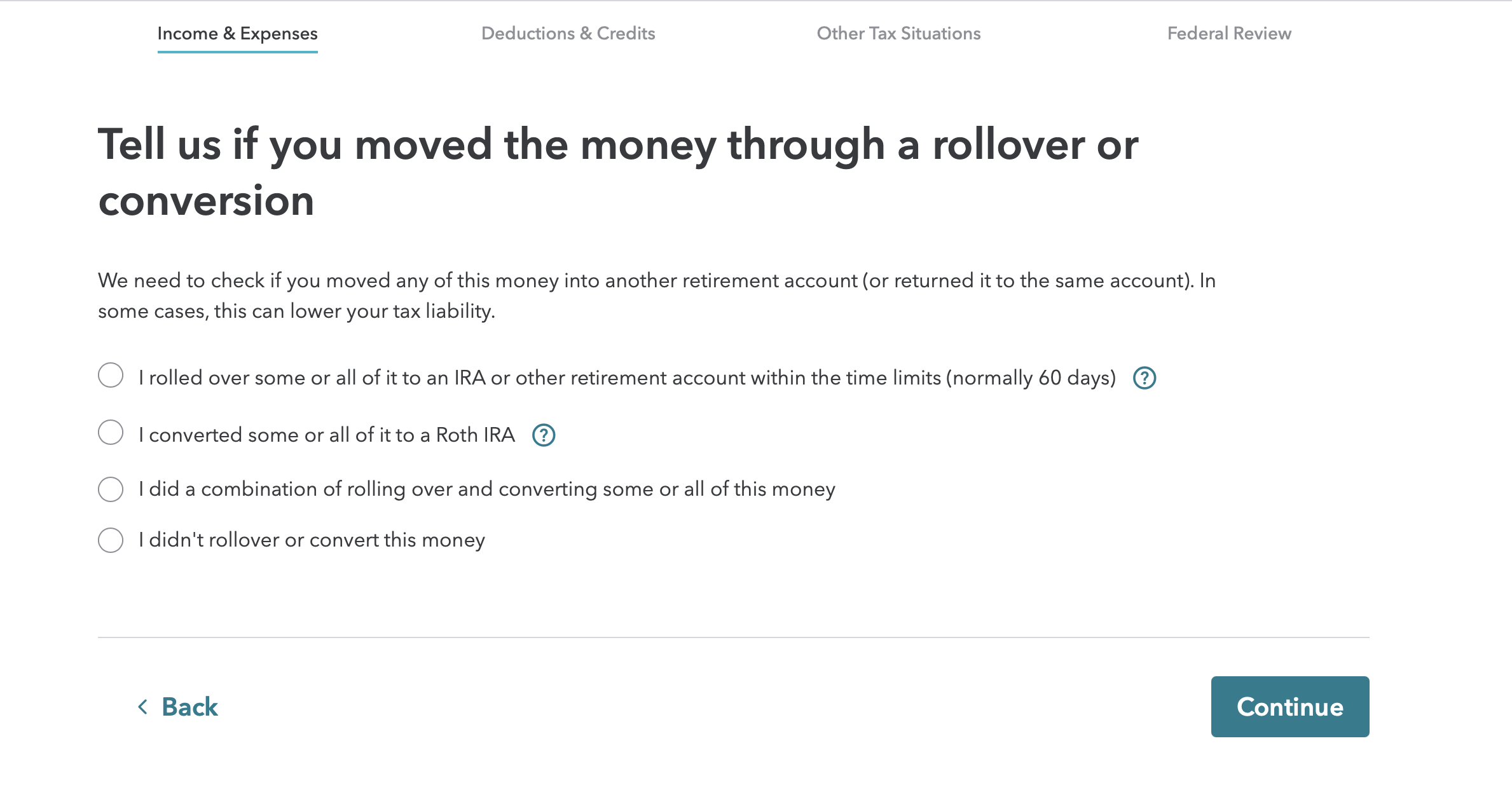

When asked "What did you do with the money", the answer is "I rolled over some or all of it to an IRA or other retirement account within the time limits (normally 60 days)"

February 15, 2021

10:47 AM