- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Backdoor Roth IRA conversion multiple years

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA conversion multiple years

Hi,

I have a situation very similar to https://ttlc.intuit.com/community/retirement/discussion/backdoor-roth-with-rechar-and-conversion-mul... except I've not been able to figure out how to enter this into turbo tax.

Sometime in 2019: Contributed $2K to Roth IRA for Year 2019

2020 January: Realized 2019 income will be too high, so recharacterized $2K to IRA.

2020 January~April: Contributed $4K to traditional IRA and then backdoor converted to Roth for year 2019

Later in 2020: Contributed $6K to traditional IRA and backdoor converted to Roth IRA for year 2020.

As a result, I received 2 1099-Rs: One for $2xxx for the Roth IRA account (which I assume is for the recharacterization), and one for $14yyy for the traditional IRA (for the backdoor conversions).

Now when I go through entering the IRA contributions on turbotax, in the "tell us how much you contributed" screen it asks for how much I contributed in 2020 and I enter $6K (should I be entering $12K?). Which leads to the 1040 line 4b being $(14yyy-6000) = $8yyy, and hence my tax liability ends up being much higher than I'd hope. My understanding is that line 4b should be something like $(14yyy-12000) = $2yyy which is the capital gains I incurred between converting my IRA to Roth.

Could someone please help me in how to enter this properly in Turbo?

cc @dmertz apologies for the tag but since you seem to know how to deal with such situations would really appreciate any thoughts.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA conversion multiple years

Please make sure that you reported the 2019 recharacterization correctly and made it nondeductible. If not then please see How do I amend my 2019 return?.

2019 tax return enter the traditional IRA contribution and recharacterization of the Roth IRA:

- Login to your TurboTax Account

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select "traditional IRA" and “Roth IRA”

- Answer “No” to “Is This a Repayment of a Retirement Distribution

- Enter the traditional IRA contribution amount of $4,000

- Roth IRA question: Answer “No” to the recharacterized question on the “Did You Change Your Mind?” screen

- Answer “No” to “Is This a Repayment of a Retirement Distribution

- Enter the Roth contribution amount of $2,000

- Answer “Yes” to the recharacterized question on the “Did You Change Your Mind?” screen and enter the $2,000 contribution amount (no earnings or losses)

- TurboTax will ask for an explanation statement where it should be stated that the original $xxx.xx plus $xxx.xx earnings (or loss) were recharacterized.

- On the screen "Choose Not to Deduct IRA Contributions" answer "Yes" (if you are thinking about doing a backdoor Roth. If you have a retirement plan at work and are over the income limit it will be nondeductible and you only get a screen saying $0 is deductible)

A 2020 1099-R with code R belongs on your 2019 return but will not do anything on your return. But you can ignore the 1099-R with code R for the recharacterization since you can only enter the recharacterization as mentioned above.

On your 2020 tax return:

To enter the nondeductible contribution to the traditional IRA:

- Login to your TurboTax Account

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select “traditional IRA”

- Answer “No” to “Is This a Repayment of a Retirement Distribution?”

- Enter the amount you contributed

- Answer “No” to the recharacterized question on the “Did You Change Your Mind?” screen

- Answer the next questions until you get to “Any Nondeductible Contributions to Your IRA?” and select “Yes” since you had a nondeductible contributions before this tax year.

- Enter the $6,000 basis amount

- On the “Choose Not to Deduct IRA Contributions” screen choose “Yes, make part of my IRA contribution nondeductible” and enter the amount.

To enter the $14,000 1099-R conversion:

- Click on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Click "Continue" and enter the information from your 1099-R

- Answer questions until you get to “Tell us if you moved the money through a rollover or conversion” and choose “I converted some or all of it to a Roth IRA”

- On the "Your 1099-R Entries" screen click "continue"

- Answer "yes" to "Any nondeductible Contributions to your IRA?" if you had any nondeductible contributions in prior years.

- Answer the questions about the basis and value

Yes, only the $2,000 gain should show on line 4b as taxable amount if entered correctly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA conversion multiple years

Please make sure that you reported the 2019 recharacterization correctly and made it nondeductible. If not then please see How do I amend my 2019 return?.

2019 tax return enter the traditional IRA contribution and recharacterization of the Roth IRA:

- Login to your TurboTax Account

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select "traditional IRA" and “Roth IRA”

- Answer “No” to “Is This a Repayment of a Retirement Distribution

- Enter the traditional IRA contribution amount of $4,000

- Roth IRA question: Answer “No” to the recharacterized question on the “Did You Change Your Mind?” screen

- Answer “No” to “Is This a Repayment of a Retirement Distribution

- Enter the Roth contribution amount of $2,000

- Answer “Yes” to the recharacterized question on the “Did You Change Your Mind?” screen and enter the $2,000 contribution amount (no earnings or losses)

- TurboTax will ask for an explanation statement where it should be stated that the original $xxx.xx plus $xxx.xx earnings (or loss) were recharacterized.

- On the screen "Choose Not to Deduct IRA Contributions" answer "Yes" (if you are thinking about doing a backdoor Roth. If you have a retirement plan at work and are over the income limit it will be nondeductible and you only get a screen saying $0 is deductible)

A 2020 1099-R with code R belongs on your 2019 return but will not do anything on your return. But you can ignore the 1099-R with code R for the recharacterization since you can only enter the recharacterization as mentioned above.

On your 2020 tax return:

To enter the nondeductible contribution to the traditional IRA:

- Login to your TurboTax Account

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select “traditional IRA”

- Answer “No” to “Is This a Repayment of a Retirement Distribution?”

- Enter the amount you contributed

- Answer “No” to the recharacterized question on the “Did You Change Your Mind?” screen

- Answer the next questions until you get to “Any Nondeductible Contributions to Your IRA?” and select “Yes” since you had a nondeductible contributions before this tax year.

- Enter the $6,000 basis amount

- On the “Choose Not to Deduct IRA Contributions” screen choose “Yes, make part of my IRA contribution nondeductible” and enter the amount.

To enter the $14,000 1099-R conversion:

- Click on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Click "Continue" and enter the information from your 1099-R

- Answer questions until you get to “Tell us if you moved the money through a rollover or conversion” and choose “I converted some or all of it to a Roth IRA”

- On the "Your 1099-R Entries" screen click "continue"

- Answer "yes" to "Any nondeductible Contributions to your IRA?" if you had any nondeductible contributions in prior years.

- Answer the questions about the basis and value

Yes, only the $2,000 gain should show on line 4b as taxable amount if entered correctly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA conversion multiple years

Thank you @DanaB27. I got a similar suggestion from @dmertz's response on the other thread: https://ttlc.intuit.com/community/retirement/discussion/re-backdoor-roth-with-rechar-and-conversion-...

So looking at my current 2019 Form 8606, I see:

Line 1: $6000

Line 2: $0

Line 3: $6000

Line 14: $6000

And this tax return was also filed through my same turbotax account and it has the $6K amount I assumed turbo will pick it up automatically. But let me try to go through your steps to amend my 2019 return first.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA conversion multiple years

Hi @DanaB27 I went through the steps you described for amending 2019 return and turns out I exactly did that last year (including adding the explanation etc).

The only screen that never showed up was your step 12 "Choose Not to Deduct IRA Contributions". It went from "Roth IRA Explanation Statement" -> Did You Open a Roth IRA Before 2019? (No) -> Income Too High To Deduct an IRA Contribution -> Your IRA Deduction Summary (which shows "Your IRA Deduction: $0")

So I assume I filled the 2019 return correctly?

Let me try your 2020 tax return steps now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA conversion multiple years

Ok I think I figured it!

I was not entering the basis correctly in my 2020 return (step 9 in 2020 return instructions https://ttlc.intuit.com/community/retirement/discussion/re-backdoor-roth-ira-conversion-multiple-yea...)

I was entering 0 while I was supposed to enter $6K. It's surprising TurboTax didn't pick it up automatically from my 2019 form 8606 (which mentions $6K in line 14 -- total basis for traditional IRAs 2019).

Now my 1040 line 4b also reads $2yyy, which is what I'd expect. Thanks @DanaB27 !

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA conversion multiple years

Hi @DanaB27

I have one follow up question here: When filling the state tax return (New Jersey), it asks on a screen:

Roth Conversion for You

Enter the following information to determine the New Jersey taxable amount of your Roth conversion

[Company name] total distribution of 14yyy.

Value of account on date of distribution: 14yyy

Contributions related to this distribution previously taxed by New Jersey: 12000. <-- This is what it should be, right? Since the 12K is the non deductible amount, and will lead to a taxable amount in New Jersey to be 2yyy, which is what I'd expect.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA conversion multiple years

If your filed 2019 tax return already includes 2019 Form 8606 that shows on line 1 the $6,000 nondeductible contribution for 2019, resulting in $6,000 on line 14, there is nothing to amend with regard to your 2019 tax return.

If you began your 2020 tax return by transferring in the tax file that includes this Form 1099-R, TurboTax should have automatically transferred in this $6,000 from line 14 of your 2019 Form 8606 as your basis from years prior to 2020 and included it on 2020 Form 8606 line 2. You can confirm this by clicking the Continue button on the page that lists your 1099-Rs ad proceeding to the page that asks you to enter or confirm your basis carried in from 2019. Your 2020 Form 8606 will also have $6,000 on line 1 from your $6,000 (not $12,000) contribution that you entered as your 2020 contribution. With a $0 year-end balance in traditional IRAs, the taxable amount of the Roth conversion will be the amount in excess of your $12,000 of basis ($2yyy).

You can ignore the code R 2020 Form 1099-R. That recharacterization should have been addressed with an explanation statement included with your 2019 tax return. If no explanation statement was included, be prepared with an explanation statement in case the IRS questions your reporting of a traditional IRA contribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA conversion multiple years

I have a similar situation to those above but in my case I did a backdoor for 2020 and 2021 and would like to report both of them appropriately on my 2021 (i.e. current tax return). While filing the amount shows up as $12,000 because I did the rollover for both amounts. Should I just follow the normal process as outlined here https://www.whitecoatinvestor.com/how-to-report-a-backdoor-roth-ira-on-turbotax/ or is there anything special that I need to do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA conversion multiple years

Please review the instructions below. If you made a contribution for 2020 that you converted in 2021 then you will have a basis on your 2020 Form 8606 line 14. You will need to enter this basis during the interview (steps 8 and 9).

To enter the nondeductible contribution to the traditional IRA:

- Login to your TurboTax Account

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select “traditional IRA”

- Answer “No” to “Is This a Repayment of a Retirement Distribution?”

- Enter the amount you contributed

- Answer “No” to the recharacterized question on the “Did You Change Your Mind?” screen

- Answer the next questions until you get to “Any Nondeductible Contributions to Your IRA?” and select “Yes” if you had a nondeductible contributions before this tax year.

- If you had a basis in the Traditional IRA before then enter the amount.

- On the “Choose Not to Deduct IRA Contributions” screen choose “Yes, make part of my IRA contribution nondeductible” and enter the amount (if you have a retirement plan at work and are over the income limit it will be nondeductible automatically and you only get a warning and then a screen saying $0 is deductible).

To enter the 1099-R distribution/conversion:

- Click on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Click "Continue" and enter the information from your 1099-R

- Answer questions until you get to “Tell us if you moved the money through a rollover or conversion” and choose “I converted some or all of it to a Roth IRA”

- On the "Your 1099-R Entries" screen click "continue"

- Answer "yes" to "Any nondeductible Contributions to your IRA?" if you had any nondeductible contributions in prior years.

- Answer the questions about the basis from line 14 of your 2020 Form 8606 and the value of all traditional, SEP, and SIMPLE IRAs

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA conversion multiple years

Thanks for the response @DanaB27 !

Do you happen to have the steps for what I need to do on the Desktop version? I am still a little confused and I wanted to restate my situation to make sure we are on the same page.

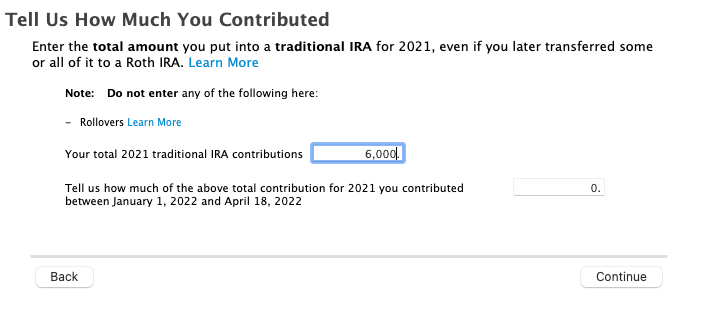

I did not backdoor when I filed my taxes in 2020. After I filed my 2020 taxes I did a backdoor for both 2020 and 2021 in 2021. Here is a screenshot of the form I got from Vanguard. Now that I am filing my 2021 taxes I want to make sure I am reporting both of the backdoors correctly. Should the amount in this field be $6,000 or $12,000?

If I am understanding this correctly I also need to fill out an 8606 for 2020 and an 8606 for 2021. On the desktop version of TurboTax it already auto created an 8606 for 2021 but I don't have one for 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA conversion multiple years

Yes, you will need Form 8606 for 2020 and 2021. TurboTax creates this automatically when you enter the nondeductible contributions. If you didn't do that on your 2020 tax return then you will have to amend your 2020 tax return to enter the nondeductible contribution (same steps as for 2021).

Yes, you will enter $6,000 for the screen "Tell us how much you contributed" since your contribution for 2021 is $6,000.

Here are the steps for TurboTax Desktop:

To enter the nondeductible contribution to the traditional IRA:

- Open your return

- Click “Deductions &Credits” on the top

- Click "I'll choose what to work on"

- Scroll down to “Traditional and Roth IRA Contributions” and click “Start”

- Select “traditional IRA”

- Answer “No” to “Is This a Repayment of a Retirement Distribution?”

- Enter the amount you contributed $6,000

- Answer “No” to the recharacterized question on the “Did You Change Your Mind?” screen

- Answer the next questions until you get to “Any Nondeductible Contributions to Your IRA?” and select “Yes” since you had nondeductible contributions before this tax year

- Enter your $6,000 basis from line 14 of your 2020 Form 8606.

- On the “Choose Not to Deduct IRA Contributions” screen choose “Yes, make part of my IRA contribution nondeductible” and enter the amount (if you have a retirement plan at work and are over the income limit it will be nondeductible automatically and you only get a warning and then a screen saying $0 is deductible).

To enter the 1099-R distribution/conversion:

- Click "Federal Taxes" on the top and select "Wages & Income"

- Click "I'll choose what to work on"

- Scroll down and click "Start" next to "IRA, 401(k), Pension Plan (1099-R)"

- Answer "Yes" to the question "Did You Have Any of These Types of Income?"

- Click "I'll Type it Myself"

- Choose "Form 1099-R, Withdrawal of Money from 401(k) Retirement Plans, Pensions, IRAs, etc."

- Click "Continue" and enter the information from your 1099-R

- Answer questions until you get to “What Did You Do With The Money” and choose “I moved it to another retirement account”

- Then choose “I did a combination of rolling over, converting, or cashing out money.” and enter the amount next to "Amount converted to a Roth IRA account"

- On the "Your 1099-R Entries" screen click "continue"

- Answer "yes" to "Any nondeductible Contribution to your IRA?"

- Answer the questions about the basis from line 14 of your 2020 Form 8606 and the value of all traditional, SEP, and SIMPLE IRAs

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

anastrophe

Level 3

user17715481922

New Member

garrettbuck512

New Member

jwu2030

New Member

2Double

Level 3