- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Thanks for the response @DanaB27 !

Do you happen to have the steps for what I need to do on the Desktop version? I am still a little confused and I wanted to restate my situation to make sure we are on the same page.

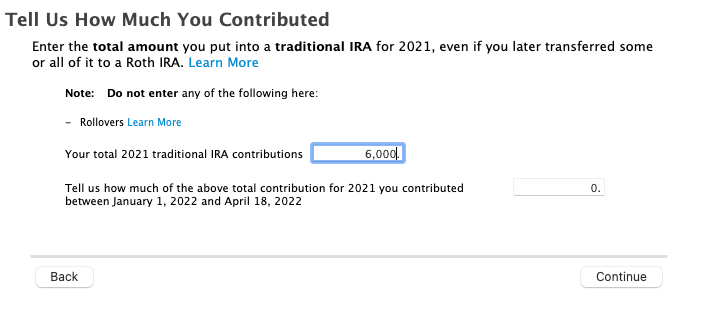

I did not backdoor when I filed my taxes in 2020. After I filed my 2020 taxes I did a backdoor for both 2020 and 2021 in 2021. Here is a screenshot of the form I got from Vanguard. Now that I am filing my 2021 taxes I want to make sure I am reporting both of the backdoors correctly. Should the amount in this field be $6,000 or $12,000?

If I am understanding this correctly I also need to fill out an 8606 for 2020 and an 8606 for 2021. On the desktop version of TurboTax it already auto created an 8606 for 2021 but I don't have one for 2020.