- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Alabama tax for Roth IRA Conversion

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alabama tax for Roth IRA Conversion

I'm trying to calulate Alabama tax for Roth IRA conversion using TurboTax Premier before I do the conversion.

For Federal tax, I followed the instruction, "How do I enter a backdoor Roth IRA conversion?" and I'm all good for this.

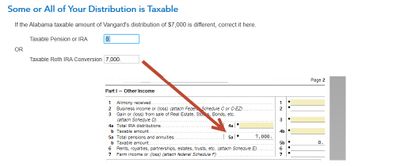

But, for Alabama tax, what I could only find is " Taxable Roth IRA Conversion" in the step, "Some or All of Your Distribution is Taxable" and I found that it went to "5a" as shown below.

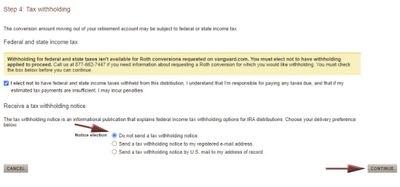

Can you confirm if it is the right worflow to file Alabama tax for Roth IRA conversion with the option in Vangard below?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alabama tax for Roth IRA Conversion

The way the backdoor IRA works is you make a contributions to a traditional IRA and then transfer it to a ROTH IRA. If the contribution you made is non-deductible, then the withdrawal of it would not be taxable, and in that case your entry would be correct.

You need to be sure that the 1099-R that you receive list "0" in box 2a "Taxable Amount." Otherwise, if you made a deductible contribution to the IRA, you will need to add that in as a deduction and the pension distribution will show as taxable and the two will cancel each other out. If you account for it that way, then you need to enter $7,000 in the Taxable Pension or IRA box on the Alabama return, and your IRA contribution deduction will appear in box Part II, line 1(a) on the Alabama form 40.

Hopefully, you made a non-deductible IRA contribution and it is reported as such with "0" listed on form 1099-R as taxable amount, in which case you are all done!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alabama tax for Roth IRA Conversion

The way the backdoor IRA works is you make a contributions to a traditional IRA and then transfer it to a ROTH IRA. If the contribution you made is non-deductible, then the withdrawal of it would not be taxable, and in that case your entry would be correct.

You need to be sure that the 1099-R that you receive list "0" in box 2a "Taxable Amount." Otherwise, if you made a deductible contribution to the IRA, you will need to add that in as a deduction and the pension distribution will show as taxable and the two will cancel each other out. If you account for it that way, then you need to enter $7,000 in the Taxable Pension or IRA box on the Alabama return, and your IRA contribution deduction will appear in box Part II, line 1(a) on the Alabama form 40.

Hopefully, you made a non-deductible IRA contribution and it is reported as such with "0" listed on form 1099-R as taxable amount, in which case you are all done!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alabama tax for Roth IRA Conversion

I did a Roth conversion in 2021. I know this is taxed on the Federal level. Is this also taxed in Alabama?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alabama tax for Roth IRA Conversion

@Al1702 Yes, it is taxed in Alabama also. Only the states of Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming do not tax these conversions since they do not have a state income tax requirement.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alabama tax for Roth IRA Conversion

I entered my IRA conversion amount from my 1099-R and in the Alabama section it shows up as Federal/Total Pension IRAs and as AL Taxable Roth IRAs, but Alabama Taxable Pensions/IRAs is zero. The conversion amount doesn't appear anywhere on my Alabama tax forms. How do I report Roth IRA conversions on the Alabama tax forms?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alabama tax for Roth IRA Conversion

The taxable amount of your traditional IRA to Roth IRA conversion should appear on AL Form 40, Part 1, line 5a. A possible explanation why you are not seeing the taxable Roth IRA conversion on your AL Form 40 could be because the type of distribution, as recorded on your 1099-R, may not be accurate or perhaps such information was not entered.

It does appear that you received a Form 1099-R, from your financial institution reporting the Roth conversion. It will be coded as a rollover to a Roth IRA. You'll use the information from that form to report your Roth conversion income on Form 8606 with the taxable portion of the conversion income reported on your Form 1040 as well as AL Form 40.

The starting point in your analysis should be with your federal return. In our test return, we entered a $5,000 IRA to Roth conversion and the distribution was reflected as a Code G, direct rollover and rollover contribution. What does your 1099-R reflect in Box 7? You should enter the Box 7 information as it appears on your 1099-R; however, if it reflects something other than a rollover to a Roth IRA, perhaps you should see if you can get a corrected 1099-R from the entity that issued the 1099-R.

In our test return, we also saw the following screen, in the federal section, which asked about whether we had rolled the funds into a Roth IRA. We responded to that question with a "yes." Did you see this screen or a similar screen? Upon checking our AL test return, we did see that the $5,000 IRA to Roth IRA conversion was taxable and appeared, as noted above, in Part I, line 5a of AL Form 40.

Lastly, you should receive Form 5498 from the financial institution that received the Roth IRA funds. This form reports the value of the funds received and the value of the account at the end of the year. This form is generally for information purposes only. The data doesn't have to appear anywhere on your tax return. Form 5468 is usually mailed out by May 31st.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gwalls2002

New Member

tcondon21

Returning Member

martinmcarreno

New Member

martinmcarreno

New Member

MM18

Level 1

in [Event] Ask the Experts: Investments: Stocks, Crypto, & More