- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alabama tax for Roth IRA Conversion

I'm trying to calulate Alabama tax for Roth IRA conversion using TurboTax Premier before I do the conversion.

For Federal tax, I followed the instruction, "How do I enter a backdoor Roth IRA conversion?" and I'm all good for this.

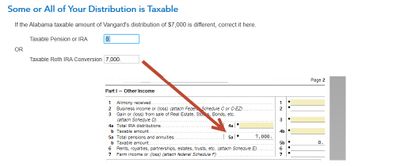

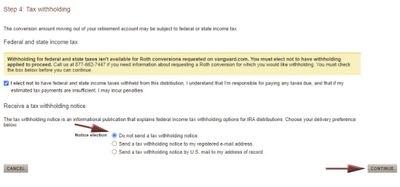

But, for Alabama tax, what I could only find is " Taxable Roth IRA Conversion" in the step, "Some or All of Your Distribution is Taxable" and I found that it went to "5a" as shown below.

Can you confirm if it is the right worflow to file Alabama tax for Roth IRA conversion with the option in Vangard below?

January 12, 2021

9:09 AM