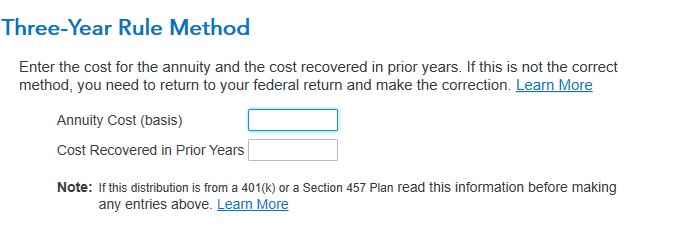

If you will be recovering all of your contributions back in the three year period. It will ask after you enter the 1099-R in the federal side how you are treating it for NJ use the selection for 3 year rule pension. Otherwise use the General pension rule.

When you get to the NJ return it will ask for you basis or amounts previously taxed.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"