- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- Virginia

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia

Why doesn’t Turbo Tax recognize and identify the Virginia military retirement credit?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia

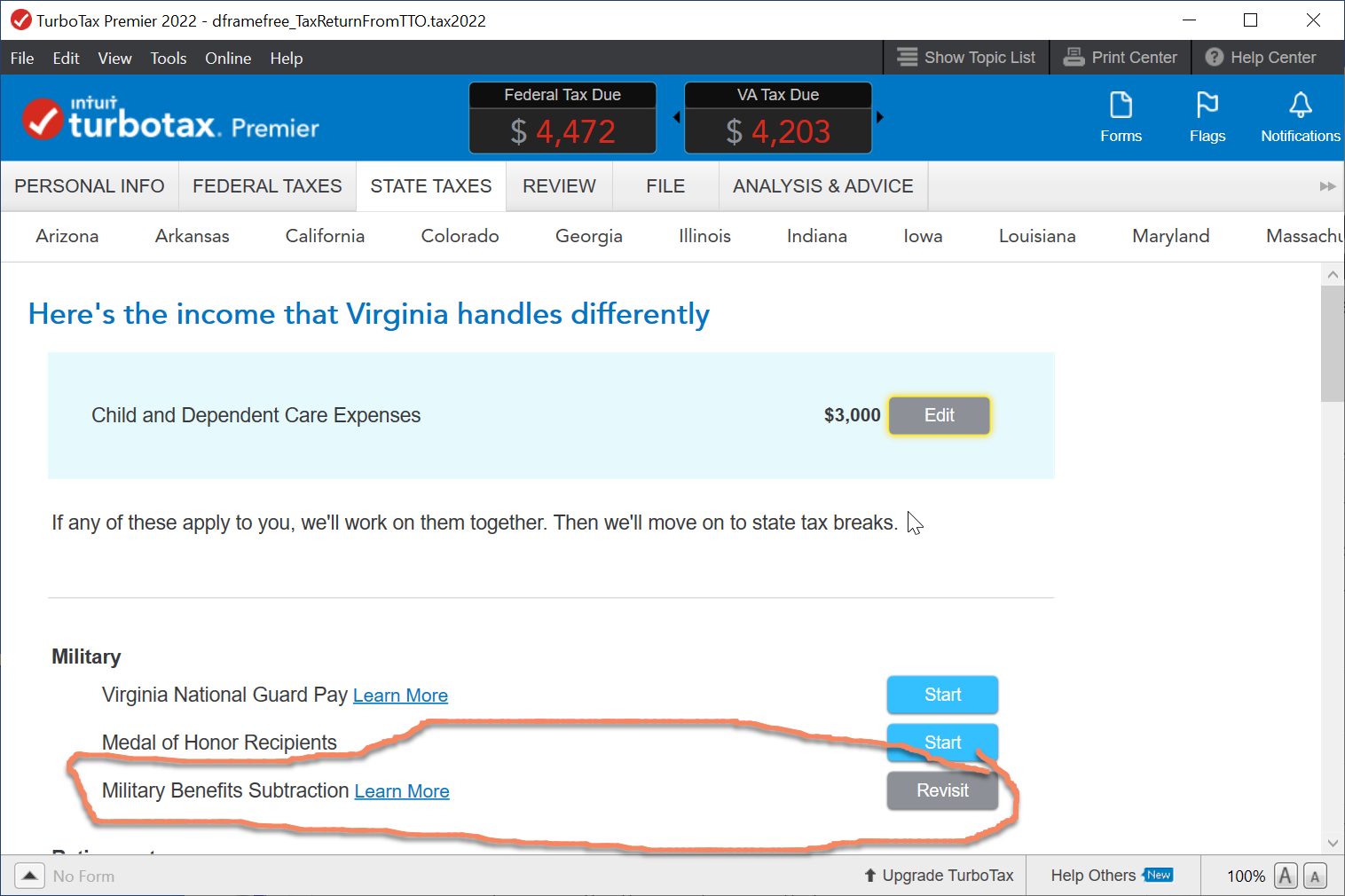

You need to claim it as you prepare your Virginia state tax return. As you proceed through the return, you will reach a page entitled Here's the income Virginia Treats Differently. Then go to military>military benefits subtraction. Once you complete this, up to $10,000 will be subtracted from VA taxable income if you are filing single or $20,000 if filing a joint return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia

Yes @DaveF1006 I completed that portion but what I’m saying is when I completed my federal then the the Virginia state edition Turbo tax did not pull in from my federal return my mil retirement.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Virginia

It would be helpful to have a TurboTax ".tax2022" file that is experiencing this issue.

You can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions:

If using Turbo Tax online:

- Click on Tax Tools in the black left menu bar

- Click on Tools>share my file with agent

- press ok and you should get a token number

At the top menu in the black line at the top of the page go to Online.

- From the menu, select Send Tax File to Agent.

- You will see a message explaining what the diagnostic copy is. Click Send and then you will get a Token number.

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

We will then be able to see exactly what you are seeing and we can determine what exactly is going on in your return and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

emlakerr

Returning Member

Ambabje

Level 1

Sam Hopi

Level 3

user17686807177

New Member

darnell861

New Member