- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- Disability severance pay military

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disability severance pay military

Are you asking how long it takes for an amended return to be processed?

Three weeks after mailing your amended return, you can start tracking it at the IRS Where's My Amended Return? tracking tool. Please allow at least 16 weeks for the IRS to process your amended return.

Processing times for amended state returns vary from state to state. If it's been more than 12 weeks since you mailed your amended state return, and you haven't heard anything, we suggest you contact your state tax agency.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disability severance pay military

My husband received a disability severance pay and was also taxed. It wasn't too difficult to receive a corrected W-2 from the Army at the time. We were able to receive the taxed amount back that year. I did so much research and could not find assistance, even the on post tax office didn't help me. Hope this will help someone looking for those answers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disability severance pay military

I get disability pay from VA do I pay tax on that

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disability severance pay military

No, you do not pay income tax on disability benefits you receive from the Department of Veterans Affairs.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disability severance pay military

Hello,

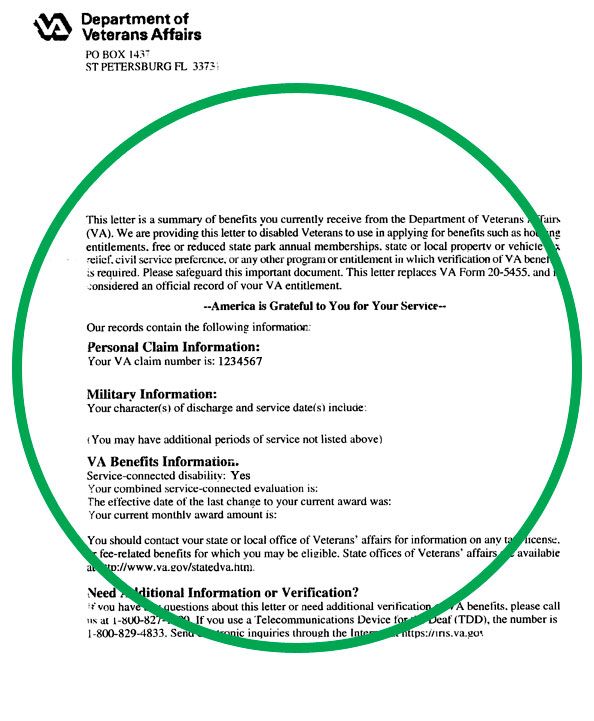

I am filing my tax return right now, through turbo tax (I understand it is very close to the deadline). In 2019 October, I was separated from the military due to medical reasons with a 60% VA disability and 0% DoD. Hence, I received a disability severance pay as well. I understand that the severance pay is taxed before it arrives to your account. Would I just follow these directions in this guide and send my DD214, VA Award Letter, and Orders? Also, what document specifically is the VA Award Letter? Is it it like the one attached? Thank you very much, and have a beautiful day.

Very Respectfully,

Fellow Vet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disability severance pay military

So here is what I did. I still e-filed. Don't fill out an ammended tax return because you're not ammending anything. The VA instructions are stupid and don't guide you down the right path if you've filing for the first time since receiving severance.

DFAS should have issued you a 1099-R around January of this year. If they did not, you will need to call DFAS Retired Pay and request this urgently. (eight hundred, three two one, one zero eight zero > option 5 > option 3 and don't let them transfer you to your branches DFAS department because it was DFAS Retired Pay that gave you the money, so they have to give you the 1099-R. DFAS is great about not knowing how to do their job and not wanting to do their job, so they will immediately try to transfer you... but the department of DFAS for your military branch won't be able to help you, it must be DFAS Retired Pay.) They will tell you they've requested it on your behalf, but you will want to write up a letter and fax the request as well, otherwise they will "forget" or some crap (it's a scam, they want you to give up).

It took me a couple of months to get one from them, but they finally provided it.

Once you have that 1099-R you file it as such on TurboTax. Once you've added the 1099-R, you will need to go into other income and claim a negative income of the exact same amount of the severance pay, so that it removes that from what you owe. Give it a title of something like "MILITARY DISABILITY SEVERANCE PAY", which is what I gave mine.

This will calculate how much taxes to return to you and add it to your return. You can still e-file, you don't need to send in a dd214 or any other documentation. If they want to see it, they will audit you and ask for it.

KEEP IN MIND - I'm not a tax expert. I used the TurboTax Live CPA assistant and spoke to a gentleman that walked me through this and that is how he told me to file it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disability severance pay military

Thank you for the reply, I'll check DFAS for it right now. Did it work for your case (did you actually get your refund)? Also, just to double check the eligibility, you are eligible if you got severance pay and received a VA rating correct (VA compensation)? Last thing is, I tried to do the negative income thing that was suggested, is it normal to see your refund sky rocket by thousands (like $4,000, for my case)? Thank you once again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disability severance pay military

Yes to all of the above. Your refund goes up because you are getting back what was paid by DFAS on your behalf.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disability severance pay military

Okay sounds good. I actually may not be able to get the 1099 R in time, but if that is the case, I will just send my refund with the original directions of this discussion forum. I was just really worried when I saw my refund amount sky rocket to nearly $5,000 more. Thank you for the assistance once again though, and you have a beautiful day! Oh actually, one more thing, is there an official/specific "VA Award Letter" we must send in? I was looking on ebenefits and Va.gov, but I don't think there is a document that specifically states "VA Award Letter". All I could find was Benefit Summary Letter and Benefit Verification Letter. I plan on sending both just in case, since I assume one of those are correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disability severance pay military

You only get one copy of your award letter to my knowledge, but you can get a copy of it from the VA. But you probably won't need it unless you get audited. You don't need to send anything in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disability severance pay military

Is anyone else having any problems with Turbo Tax and the EIC after using the directions provided? I've started over multiple times and each time I input it under the 1099-A,1099-C it only adjusts for roughly $800, after finishing the federal portion and reviewing my credits I saw that my EIC was super low because my earned income on my W-2 is $49K when in reality my earned income is actually $27K. If I file as is will I still get all of the money I'm owed or is there something I need to fix on my end?

"Is this just a Turbo Tax program issue?" is what I'm asking I suppose.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disability severance pay military

You will need to follow these steps to enter your military disability severance pay:

- Click Federal from the left side of your screen.

- Click Wages & Income on the top

- Go to the Less Common Income and click Show more

- Scroll down to Miscellaneous Income and click Start

- Enter the full amount of your severance pay (do not reduce by the income taxes withheld) as a negative number (use "minus" - sign)

- Describe the entry as Military Severance Reclassified as Disability

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disability severance pay military

Yes @PattiF as previously stated, I did all of those steps multiple times however the program still continues to show that my EIC is based on the information on my W-2 not my adjusted income once my severance check has been deducted. Which is why I asked whether or not that's a turbo tax program issue or if that's just what I'm getting back

I.E.

W-2 says 49K taxable income.

Severance check= 21K

Actual taxable income=27K

EIC(Earned income credit) not adjusting in the program for the change in taxable income. My question is whether or not the IRS is going to fix that or if the numbers Turbo Tax is giving me as a refund is final?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disability severance pay military

The rules are: Earned Income Credit eligibility:

1)The greater of AGI or earned income must be less than:

- $15,820 ($21,710 for MFJ) with no qualifying children,

- $41,756 ($47,646 for MFJ) with one qualifying child,

- $47,440 ($53,330 for MFJ) with two qualifying children, or•$50,954 ($56,844 for MFJ) with three or more qualifying children.

2)The taxpayer (and spouse if MFJ) must have a valid SSN. Any qualifying child listed on Schedule EIC (Form 1040) must also have a valid SSN.

3)Filing status cannot be “Married Filing Separately.”

4)The taxpayer must be a U.S. citizen or resident alien all year. A nonresident alien can claim the credit if married to a U.S. citizen or resident alien and the nonresident alien chooses to be treated as a resident for all of 2020 by filing a joint return.

5)The taxpayer cannot file Form 2555 (relating to foreign income).

6)Investment income must be $3,650 or less.

7)The taxpayer must have earned income.

PLUS rules regarding child or no child as below.

Qualifying child:

- The child must meet the relationship, age, residency, and joint return tests.

- The qualifying child cannot be used by more than one person to claim the EIC.

- The taxpayer cannot be a qualifying child of another person.

No Qualifying child:

- The taxpayer must be at least age 25 but under age 65. For MFJ, only one spouse needs to meet the age test.

- The taxpayer cannot be the dependent of another person.

- The taxpayer cannot be a qualifying child of another person.

- The taxpayer must have lived in the United States more than half the year. United States does not include Puerto Rico or U.S. possessions, such as Guam. United States military personnel stationed outside the United States on extended active duty are considered to live in the United

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disability severance pay military

I received my disability severance pay in October 2020 and 22% taxes were withheld from my lump sum payment. I did not receive a w2 or 1099R from DFAS. I am receiving VA disability. How can I get the taxes back?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kpcomm

Level 1

Missgina320

New Member

rutkowski98

New Member

luraann1984

New Member

user17611583623

New Member