- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- Can not find a way to get my Maryland Military Tax Credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can not find a way to get my Maryland Military Tax Credit

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can not find a way to get my Maryland Military Tax Credit

I believe you are referring to your tax exemption for military retirement distributions. If so, you need to indicate that your pension distribution is from active or reserve military retirement after you enter your Form 1099-R in the federal section of TurboTax:

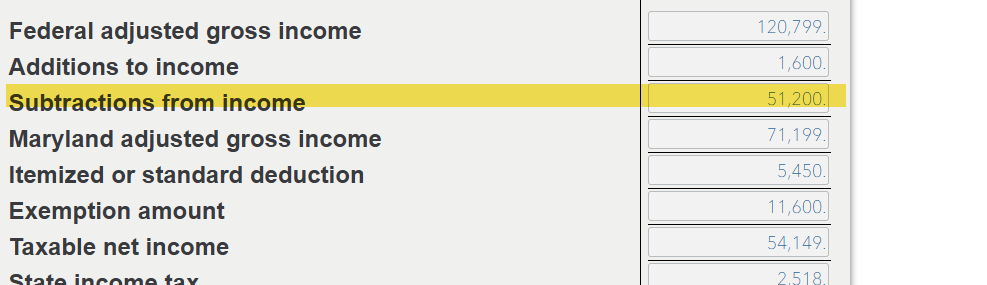

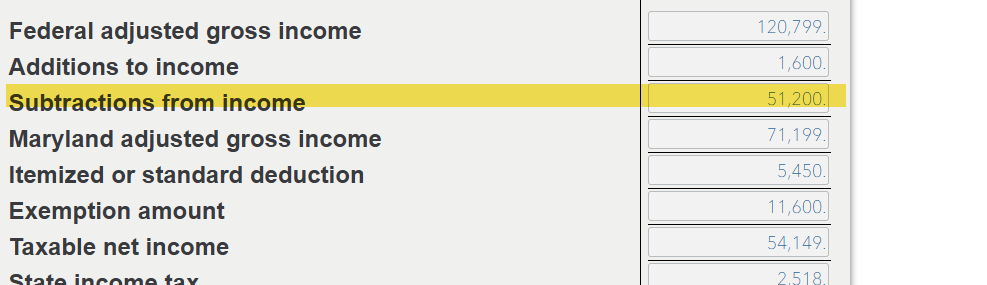

When you are working on your Maryland return, you can look at your tax summary and you will see the deduction under Subtractions from income:

You can follow these instructions to see your tax summary while working in the state program:

- Choose Tax Tools from your left menu bar in TurboTax Online

- Choose Tools

- Choose View Tax Summary

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can not find a way to get my Maryland Military Tax Credit

I believe you are referring to your tax exemption for military retirement distributions. If so, you need to indicate that your pension distribution is from active or reserve military retirement after you enter your Form 1099-R in the federal section of TurboTax:

When you are working on your Maryland return, you can look at your tax summary and you will see the deduction under Subtractions from income:

You can follow these instructions to see your tax summary while working in the state program:

- Choose Tax Tools from your left menu bar in TurboTax Online

- Choose Tools

- Choose View Tax Summary

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can not find a way to get my Maryland Military Tax Credit

Thank you for you help. That is exactly what I needed to do!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can not find a way to get my Maryland Military Tax Credit

I have the same problem/question, and when I to to Tax Tools -> Tools -> Tax summary it does *not* show any subtractions to my income for Maryland like your screenshot shows. Clearly Turbo Tax is not working as expected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can not find a way to get my Maryland Military Tax Credit

Let's go through this step by step;

- Go back to the federal income section.

- Scroll down to your 1099-R.

- Edit

- Continue

- No to IRA

- Continue

- No to PSO

- Continue

- Select MD

- Continue

- Select active or reserve military retirement

- continue

- From a Non-Qualified Plan

- Continue

Please review your state summary again as the information should have subtracted out the allowed amount based on your age.

Form 502SU, Subtractions from Income states:

Military Retirement Income. Individuals at least 55 years of age on the last day of the taxable year may claim up to $20,000 of military retirement income, including death benefits, received in the taxable year.

Individuals under the age of 55 on the last day of the taxable year may claim up to $12,500 of military retirement income received in the taxable year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can not find a way to get my Maryland Military Tax Credit

Sorry but these instructions do not follow. I am using the online version of TT, and your instructions do not reflect what I see on the screen. When I go to Federal, I go to Wages and Income, I can find the 1099-R I entered and edit it, but nowhere do I see the options you mention, and nowhere does it show or indicate the 502su form. Your screenshot does not match what I see on my screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can not find a way to get my Maryland Military Tax Credit

In TurboTax Deluxe Online, I am able to report the Maryland Income Tax Subtraction for Military Retired Pay.

This Maryland website states:

Retired Service members under age 55 can subtract up to $12,500 of their military retired pay from their gross income before determining their Maryland tax. At age 55 this subtraction increases to $20,000.

Who is eligible for Maryland Income Tax Subtraction for Military Retired Pay?

This subtraction is available to retired Service members who are receiving military retired pay from an active or reserve component of the U.S. Armed Forces.

I am reporting the taxpayer age over 55 who was Active duty military and reported such under My Info.

The retirement distribution was designated as a non-qualified plan and as Military retirement or military survivor's benefit.

Within the Maryland state income tax return, I reported as You served on active duty in the military.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can not find a way to get my Maryland Military Tax Credit

That's great, but TT doesn't show me that form at this time. I think I have to finish filing and pay for everything before it will let me see that, and I want to make sure it's accounting for that subtraction *before* I file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can not find a way to get my Maryland Military Tax Credit

You do have to pay to see all of your forms. You can pay anytime and continue working on your return. Take a look at your 502SU and let us know if you need additional help with the form. You have selected military on the federal and state return, so you should be good.

For online:

- On the left side, select Tax Tools

- Select Print center

- Select Print, save or preview this year's return

- If you have not paid, select pay now.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jfbmgysgt

New Member

dcrago

Returning Member

jhall20613

New Member

chenxiaotax

Level 2

wilonet

New Member