- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

I believe you are referring to your tax exemption for military retirement distributions. If so, you need to indicate that your pension distribution is from active or reserve military retirement after you enter your Form 1099-R in the federal section of TurboTax:

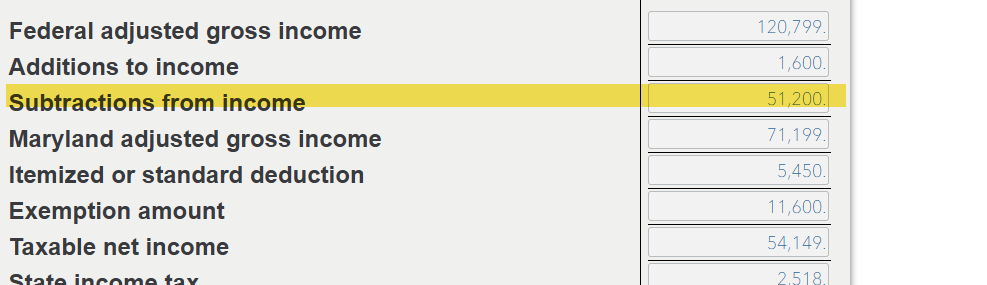

When you are working on your Maryland return, you can look at your tax summary and you will see the deduction under Subtractions from income:

You can follow these instructions to see your tax summary while working in the state program:

- Choose Tax Tools from your left menu bar in TurboTax Online

- Choose Tools

- Choose View Tax Summary

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 6, 2025

4:47 PM