- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- Bailey Settlement on the Retirement Benefits Deduction Worksheet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bailey Settlement on the Retirement Benefits Deduction Worksheet

Bailey Settlement on the Retirement Benefits Deduction Worksheet appear to be correct but the program keeps flagging the Taxpayer number. Where is the error?

The program reports the total allowed and the total of the two numbers in the Taxpayer and Spouse seem to match the allowed.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bailey Settlement on the Retirement Benefits Deduction Worksheet

Another thing I can think of is that the 1099-R forms are assigned to the wrong spouse on the original 1099-R forms......The taxpayer is the first person listed on the Personal Information page.....that may or may not be yourself.

Then the table at top, on the worksheet you are referring to, right next to the Payers Name...the column has a T or an S, for Taxpayer or spouse. Then the $$ from that line that are a "T" or "S" and also marked "B" must go into the appropriate Taxpayer, or spouse column down in line 4. Make sure the $$ are in the correct column at line 4.

Make sure the $$ are not pink/red and "Marked as Estimated"

________________________

Something else too. If the Taxpayer $$ are from a Military pension, that has historically been eligible for the Bailey Settlement exemption.....DO Not double claim it as a Military pension during the NC interview. It's either one, or the other (NC DOR has not said whether former Bailey-eligible Military pensions are supposed to switch over or not)

_______________________

OR....delete any of your 1099-R forms, and re-enter them carefully thru the interview.

I haven't seen such Bailey errors in my test files, but I'll go thru them again late tody to see if soemthing crops up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bailey Settlement on the Retirement Benefits Deduction Worksheet

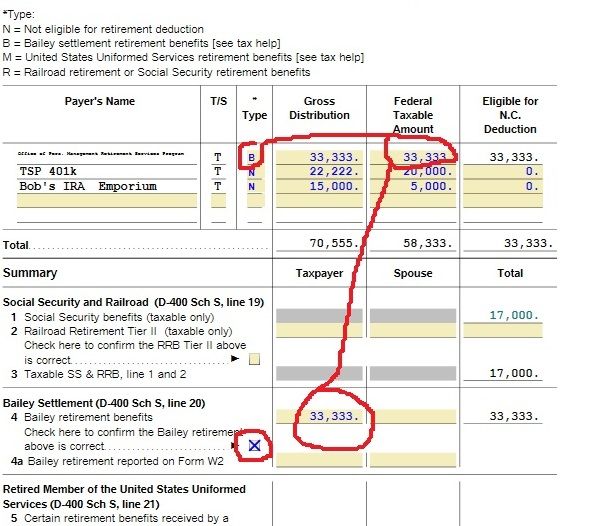

For the taxpayer, does the Federally Taxable number at the top (and coded "B" ) match the taxpayer amount in the section below it on line 4 of the worksheet? Also make sure the Confirmation box is X'ed.

_______________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bailey Settlement on the Retirement Benefits Deduction Worksheet

Thanks for your help. There are three entries under Federally Taxable coded "B". Two for me and one for my spouse. In line 4 below, the number for me, a total of the two for me, and one for my spouse all match from above. THe total in the line 4 matches from Taxpayer and spouse and from the total from above ($86,523)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bailey Settlement on the Retirement Benefits Deduction Worksheet

Well, unless you missed X'ing the checkbox for line 4, I'm not sure what the problem is.

Could be a rounding error of some kind.

On your original 1099-R forms, edit them, and try dropping the state distribution amount a tiny bit on the page where you made the Bailey Settlement selection...... by dropping the cents (called truncating) such that only even $$ amounts are reported. State shouldn't complain too much if you happened to not claim a $1 or$2 less as being exempt from state taxation.

_____

Just make sure your pension $$ are truly Bailey Settlement eligible:

Bailey Decision Concerning Federal, State and Local Retirement Benefits | NCDOR

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bailey Settlement on the Retirement Benefits Deduction Worksheet

I went back and fixed some entries that shouldn't have been classified as Bailey. THe type, Federal Taxable Amoiunt, Eligible for N.C. deduction taxpayer line 4 and Total all match at $79,309.00, but the review continues to take me back to line 4 Taxpayer as needing correction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bailey Settlement on the Retirement Benefits Deduction Worksheet

Also the box for line 4 is checked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bailey Settlement on the Retirement Benefits Deduction Worksheet

This is the first time I have had this problem in many years of filing with the Bailey Settlement.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bailey Settlement on the Retirement Benefits Deduction Worksheet

Another thing I can think of is that the 1099-R forms are assigned to the wrong spouse on the original 1099-R forms......The taxpayer is the first person listed on the Personal Information page.....that may or may not be yourself.

Then the table at top, on the worksheet you are referring to, right next to the Payers Name...the column has a T or an S, for Taxpayer or spouse. Then the $$ from that line that are a "T" or "S" and also marked "B" must go into the appropriate Taxpayer, or spouse column down in line 4. Make sure the $$ are in the correct column at line 4.

Make sure the $$ are not pink/red and "Marked as Estimated"

________________________

Something else too. If the Taxpayer $$ are from a Military pension, that has historically been eligible for the Bailey Settlement exemption.....DO Not double claim it as a Military pension during the NC interview. It's either one, or the other (NC DOR has not said whether former Bailey-eligible Military pensions are supposed to switch over or not)

_______________________

OR....delete any of your 1099-R forms, and re-enter them carefully thru the interview.

I haven't seen such Bailey errors in my test files, but I'll go thru them again late tody to see if soemthing crops up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bailey Settlement on the Retirement Benefits Deduction Worksheet

Thanks soo much for your help. The fatal mistake was putting the Military retirement number in both Bailey and the military pension fields. Once I deleted the pension field, everything was fine and I was able to efile. Thanks again for sticking with me. I am saving that email for the future.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bailey Settlement on the Retirement Benefits Deduction Worksheet

Great.....thanks for letting us know what the solution was.

Not having access to seeing your files (can't do that in this Public Forum) makes troubleshooting problems like this a guessing game, based on what we've seen before.

I hadn't really seen this exact entry error posted before...but it just suddenly occurred to me it might happen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bailey Settlement on the Retirement Benefits Deduction Worksheet

You are great at knowing where to go. I have been filing with the Bailey for years and never filled in that pension field. Just checked Bailey and went on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bailey Settlement on the Retirement Benefits Deduction Worksheet

The Military Refitment field just showed up as something new in 2021, to allow the deduction for all Military retirees (At least 20 years, or medical discharge-retired)...even those not eligible under Bailey. For instance, a military person retiring in 2023 with 20 years, would have entered service in 2003, which is far too late to be Bailey-eligible.

NC DOR didn't indicate whether former Bailey-eligible military folks should change to the new deduction,,, they just said you can't claim both.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bailey Settlement on the Retirement Benefits Deduction Worksheet

Hi!

Here's my Bailey question. I'm getting an error flag on both my Federal and North Carolina "review" which states that the "Retire Ben Wks: Bailey-TP. Your total Bailey retirement benefits deduction cannot exceed $109,156., [note the extraneous '.'before the comma] the total of your total taxable pensions on your Federal return." The amount show as being claimed is $100,802 , which (a) is correct, and (B) appears to be the amount passed to the North Carolina File as the "Bailey Deduction". I cannot "pass" the reviews" because Turbotax seems to think $100,802 is larger than $109,156.

The last time I checked, $100,802 is indeed smaller than $109,156.

TurboTax does indeed seem to be passing the correct amount from the Federal to the North Carolina return, and the adjustment to my federal income is being calculated correctly.

Do you have any suggestions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bailey Settlement on the Retirement Benefits Deduction Worksheet

Perhaps just work thru it in your other post:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bailey Settlement on the Retirement Benefits Deduction Worksheet

I was also dealing with the error message on the Retirement Benefits Deduction Worksheet about Bailey benefits needing to stay below taxable pension:

"Retire Ben Wks: Bailey-TP. Your total Bailey retirement benefits deduction cannot exceed $109,156., the total taxable pensions on your Federal return." [The amount show as being claimed is $100,802.]

In my case, I called the Turbotax help line and the pleasant assistant did some research. She explained that I needed to uncheck the "IRA/SEP/SIMPLE" box for each 1099-R entry in Turbotax, even if that box was checked on the original 1099-R. That fixed it for me.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

taxdean

Level 4

mpwolfe13

New Member

user17539892623

Returning Member

jjgsix

New Member

CYNTHIA1204

New Member