- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Why is the 1041 information not transferring correctly to the K-1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is the 1041 information not transferring correctly to the K-1?

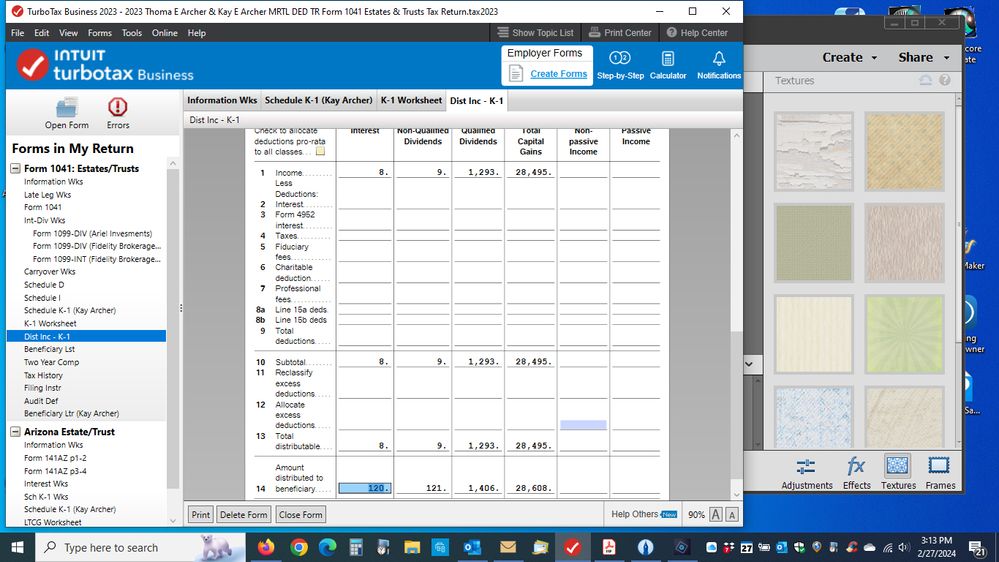

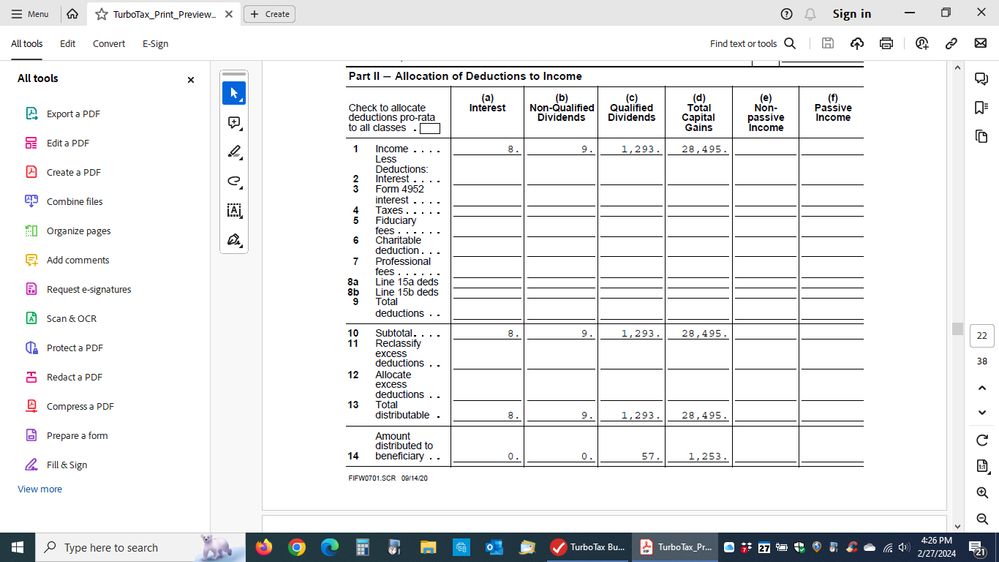

I am preparing a return for a simple trust with brokerage information from two 1099 forms. The total interest is $8. The interest shown on the K-1 is $120. I have gone back and checked my entries in the worksheet and they are correct. The correct amount of interest, $8, is shown under interest on the 1041. Why is this happening and what do I need to do to correct it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is the 1041 information not transferring correctly to the K-1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is the 1041 information not transferring correctly to the K-1?

Thank you for your response.

Yes, I checked and the interest amount was entered correctly on the worksheet and is correct on the 1041. There is also dividend income and Capital Gains income. Both appear to be correct on the K-1. The worksheet and 1041 show $8 in interest, yet the K-1 shows $120.

This is a very simple return with nowhere I can see to make an error. Any help you can give will be sincerely appreciated.

Kay Archer

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is the 1041 information not transferring correctly to the K-1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is the 1041 information not transferring correctly to the K-1?

Curiously, the error looks to stem from the K-1 worksheet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is the 1041 information not transferring correctly to the K-1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is the 1041 information not transferring correctly to the K-1?

I'm not sure which distribution section you are referring to. As I remember there were two places that asked me that question. I listed 100% and then in the other place, I think it referred to capital gains and I entered the total dollar amount in that field.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is the 1041 information not transferring correctly to the K-1?

Looks like the non-qualified dividends also didn't transfer correctly on the K-1 Worksheet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is the 1041 information not transferring correctly to the K-1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is the 1041 information not transferring correctly to the K-1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is the 1041 information not transferring correctly to the K-1?

You are right, the wheels came off somewhere. I deleted the file, rebooted my computer and entered the information again. The result is different from the first time, but still incorrect. How can I get help with this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is the 1041 information not transferring correctly to the K-1?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bhsong206

Level 2

gk2160

Level 2

wendy0205w

New Member

pcpatter

Level 2

kdube271

New Member