- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Where to enter capital gain & interest for a foreign bank account?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter capital gain & interest for a foreign bank account?

I'm using TurboTax Premium online.

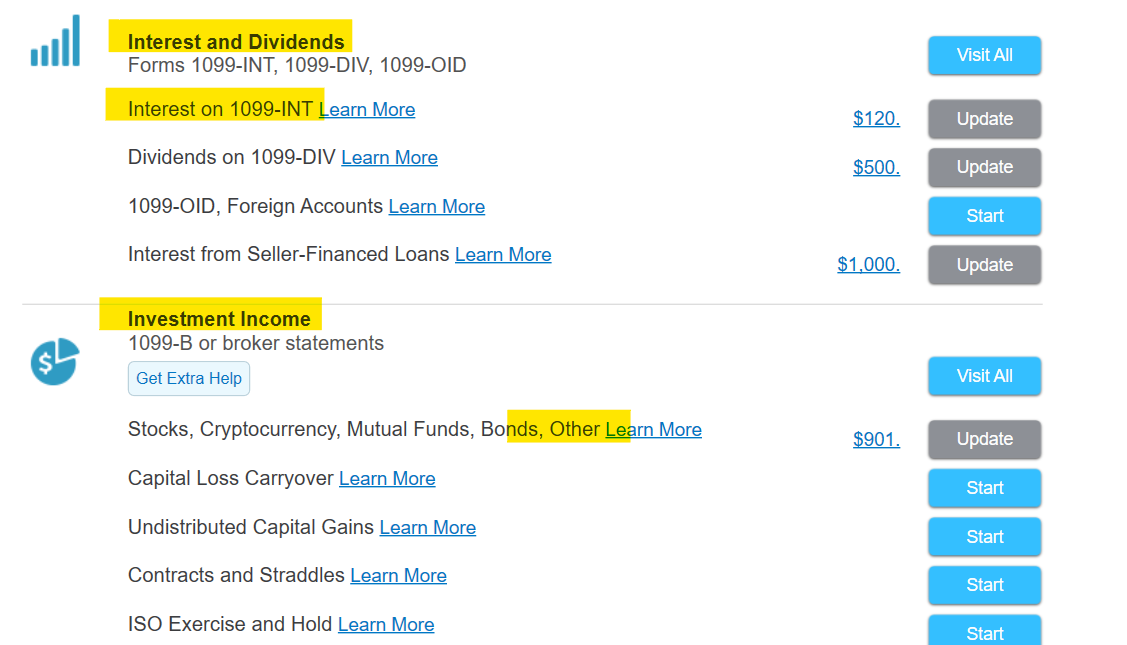

I have a foreign account that generated both some capital gains and interests. Being a foreign account, I did not get any 1099 forms. Where exactly am I supposed to enter this? I tried a couple of things:

I went through the '1099-OID,Foreign Accounts' section, but because my account didn't reach the threshold, it said I didn't need to od anything there.

I tried adding things under the 'Investments and Savings (1099-B, 1099-INT, 1099-DIV, 1099-K, Crypto)', but it expects me to have a 1099. I tried pretending I had one and entering everything manually, and that 'worked', but feels sketchy/wrong.

What is the right thing to do here?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter capital gain & interest for a foreign bank account?

you pretend you got a 1099-INT so use that form

capital gains go on form 8949 - in the investment section in TurboTax

types would be c or f which tells the IRS that neither cost nor proceed was reported to them. in all case you must convert to US Currency

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter capital gain & interest for a foreign bank account?

you pretend you got a 1099-INT so use that form

capital gains go on form 8949 - in the investment section in TurboTax

types would be c or f which tells the IRS that neither cost nor proceed was reported to them. in all case you must convert to US Currency

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter capital gain & interest for a foreign bank account?

Thanks @Mike9241 that is helpful!

For converting to US currency, I'm using the exact exchange rate from the Buy date and separately from the Sell date. I assume that is more correct than using the same exchange rate throughout.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter capital gain & interest for a foreign bank account?

so what did you do? I am in the same situation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter capital gain & interest for a foreign bank account?

Mike is correct for entering interest, pretend you have a 1099-INT and enter it under interest.

For capital gains, enter the sales information under investment income. Select stocks, crypto, mutual funds, bonds, Other.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

catdelta

Level 2

dpa500

Level 2

RicN

Level 2

jerellebutts30

New Member

johntheretiree

Level 2