- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

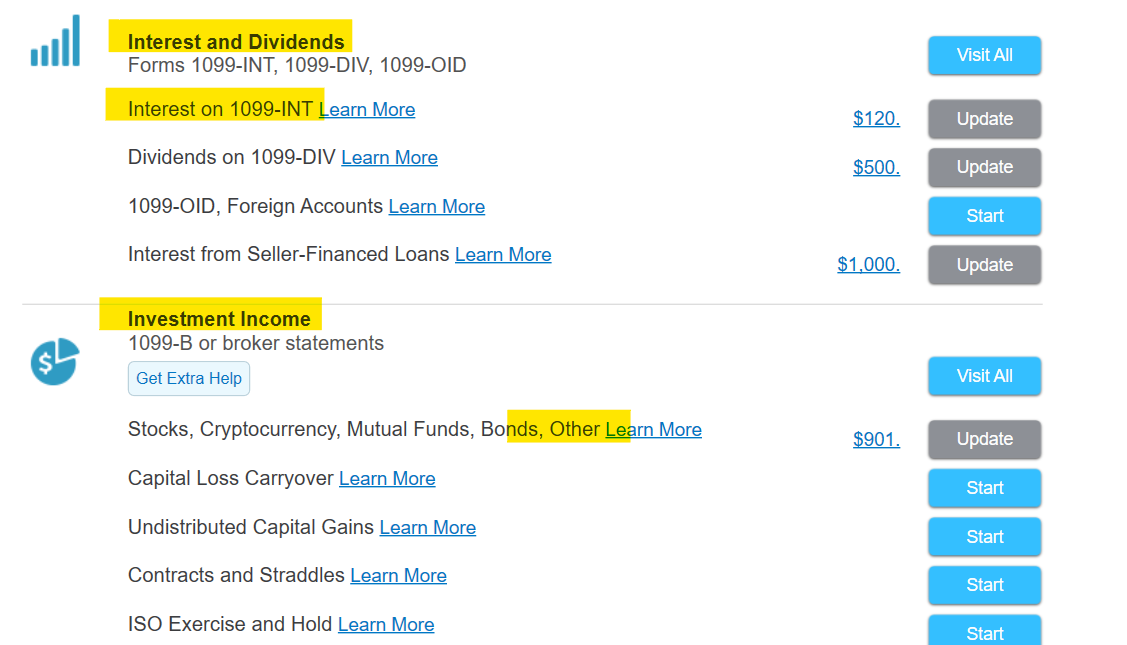

Mike is correct for entering interest, pretend you have a 1099-INT and enter it under interest.

For capital gains, enter the sales information under investment income. Select stocks, crypto, mutual funds, bonds, Other.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 27, 2024

4:30 PM

1,338 Views