- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Unallowed passive losses that not carried over

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unallowed passive losses that not carried over

I converted my primary residence into a rental property in 2012. I just noticed now that I do not see prior years unallowed passive losses in 2015 (8582 form) to enter in 2016 tax filing because I did not carry over these unallowed passive losses in 2014 and 2015 tax filing. Q: Do I need to amend previous years (2014, 2015) tax filing to determine the total unallowed passive losses or can I add up prior years unallowed loss from 2012 to 2015 and enter it in 2016 tax filing?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unallowed passive losses that not carried over

You would need to amend all previous years' tax returns. You start with the earliest year so that the unallowed passive losses of each year are carried over to the following year. After amending your 2015 tax return, you can enter the passive loss carry over on your 2016 return.

Please read to this TurboTaxFAQ on how to amend your returns:

https://ttlc.intuit.com/replies/3288565

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unallowed passive losses that not carried over

Where exactly are those passive losses from prior year's entered in TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unallowed passive losses that not carried over

I just noticed now that I do not see prior years unallowed passive losses in 2015 (8582 form) to enter in 2016 tax filing because I did not carry over these unallowed passive losses in 2014

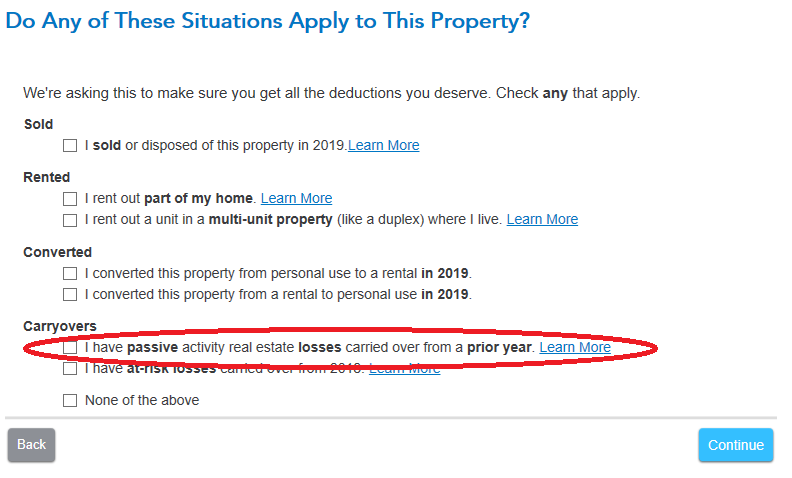

That would be because for whatever reason, you did not selecte the option to indicate you had passive loss carry overs, on your 2015 tax return. You probably haven't made that selection in any year after 2015 too. The selection is in the property profile section.

Take note that you can't use Turbotax 2015 or older to amend your return, as TurboTax only supports their software for the current tax year and three years back. So for TTX 2015 or older i will be impossible to get the *REQUIRED* corrections and updates to the program so that it works correctly. Additionally, support for TTX 2016 will be going away around July 15th of this year.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17524270358

New Member

mjtax20

Returning Member

alex1907

Level 2

superbean2008

Level 2

Mwags300

New Member