- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

I just noticed now that I do not see prior years unallowed passive losses in 2015 (8582 form) to enter in 2016 tax filing because I did not carry over these unallowed passive losses in 2014

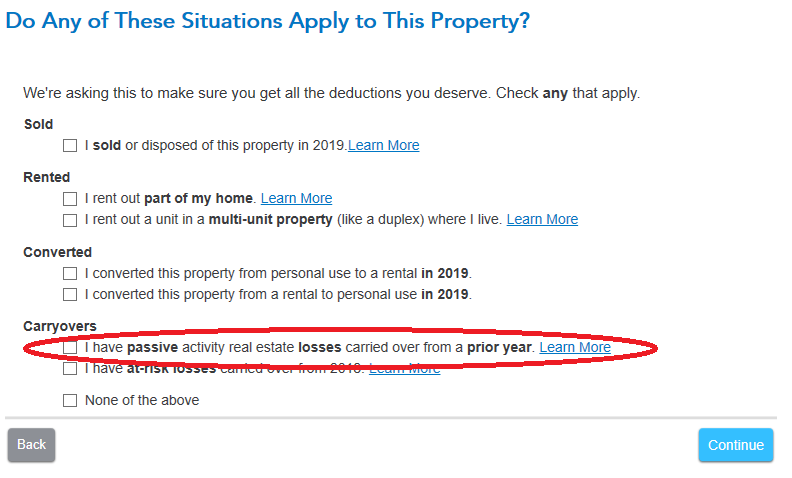

That would be because for whatever reason, you did not selecte the option to indicate you had passive loss carry overs, on your 2015 tax return. You probably haven't made that selection in any year after 2015 too. The selection is in the property profile section.

Take note that you can't use Turbotax 2015 or older to amend your return, as TurboTax only supports their software for the current tax year and three years back. So for TTX 2015 or older i will be impossible to get the *REQUIRED* corrections and updates to the program so that it works correctly. Additionally, support for TTX 2016 will be going away around July 15th of this year.