- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- TurboTax 2020 refuses to correct cost basis for ESPP

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2020 refuses to correct cost basis for ESPP

I have ESPPs from which the Cost Basis reported to the IRS needs to be corrected.

I am following the same steps as I had in previous years with (e.g. with TT 2019, using the same step-by-step method) and some ESPP sale transactions refuse to come up with the right cost basis, insisting instead that it is "$0" and the whole discounted amount must be taxed (even though it was already taxed through the W2). I have tried entering these transactions both manually and by importing the 1099-B from the broker.

I'm pretty sure this is a TT 20 bug , since nothing has changed in the way I enter these transactions.

Has anyone else noticed this? Please be very careful as this may cause you to be double-taxed on the same income.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2020 refuses to correct cost basis for ESPP

Hey, I am seeing the same issue. There is another thread on this forum discussing similar issues.

In my case, part way through the ESPP Step-by-Step, the screen starts saying "shares from Not employer stock".

When you click "Yes" on the "Was this a sale of employee stock?" screen, it creates a worksheet to calculate the adjustments. But, halfway through the process, once you click "Continue" on the OK, we just need a few more details" screen, TT creates another worksheet that is not actually properly connected to the transaction (that seems to be the bug). So you end up with 2 partially filled out worksheets after the whole process, and so TT can't calculate the proper compensation income to do the cost basis adjustment.

Here is the what I found as a work around. I switch between the Step-by-Step view and the Forms view.

Initially populate the share sale data from 1099-B in Step-by-Step view.

When you get to the the Tell us about the ESPP sale screen, select the employer, click next. It brings you to the "OK, we just need a few more details" screen. Switch into the form view (from that point on don't use the Step-by-step interface for the sale). Manually fill out the Employee Stock Transaction Worksheet with data from your form 3922 for this particular transaction. You should scroll down a little bit and confirm you see the correct Compensation Income in that sheet once you fill out the info.

Switch back to Step-by-Step view. Click on some tab like "Personal Info" (so that you don't proceed through the Step-by-Step for the transaction. Then you can go again to the Federal Taxes/Stock Sales/brokerage screen, "Edit" the transaction you just entered, click through "Next/Done/Continue" (without changing any of the data), until you get to the screen where it says "Here are the ESPP purchase lots we have so far", and it should have the correct info associated with that sale. At least this convoluted process works for me.

Now repeat the process for the next ESPP sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2020 refuses to correct cost basis for ESPP

Thank you. Yes, we are seeing the same thing.

I will wait for Intuit to do their job and fix this bug. And if it doesn't happen soon, I will switch to the competition.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2020 refuses to correct cost basis for ESPP

I am seeing a similar bug. I enter in the adjusted cost basis during the interview questions but the adjusted cost basis does not make it through to the 1099 form. I did create a separate manual entry on the 'Capital Gain (loss) Adjustments worksheet and this worked for two separate stock sales. Problem is, when I saved the file and reopened it the next day one of the manual entries was gone! Looks like I need to wait for Turbo tax to fix this. Also, I'm no longer seeing the link to 'Turbo Tax chat help' - can someone please point me to this link? My only option was to call a phone number and wait 45 minutes..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2020 refuses to correct cost basis for ESPP

Thanks for the investigation, I will give it a try later myself.

Hopefully they can fix it soon given your detailed explanation.

I found another thread with the same issue:

If more people reply the threads hopefully they see this and fix the bug.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2020 refuses to correct cost basis for ESPP

Seeing the same thing. My first ESPP entry was fine but the subsequent entries are coming up with $0 costbasis. Uggg.. this the last bit of work I have to do do file.....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2020 refuses to correct cost basis for ESPP

I'm seeing the same issue. Is there a way to submit this to Intuit or get some acknowledgement that it's being worked on?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2020 refuses to correct cost basis for ESPP

I called in and the support staff captured my info (the $0 cost basis) and they are passing this along in an escalation - which may provide some insights when this would be addressed. I'm supposed to get some updates after a bit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2020 refuses to correct cost basis for ESPP

Same issue. Hopefully they will fix it soon

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2020 refuses to correct cost basis for ESPP

I am getting the exact same error, where all my cost basis ESPP adjustments come in at "$0." Hoping Turbo Tax pushes a fix soon as this is the last item I need to update in order to file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2020 refuses to correct cost basis for ESPP

There are still plenty of things being fixed and a ton of forms still being approved by the IRS. This is a late start season.

I wouldn't say they "refuse" - they just haven't gotten to that one on the list yet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2020 refuses to correct cost basis for ESPP

TT has always been difficult with regard to ESPP. It seems they change it every year, but it doesn't get easier. This year is the worst. Come on Intuit. Fix it now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2020 refuses to correct cost basis for ESPP

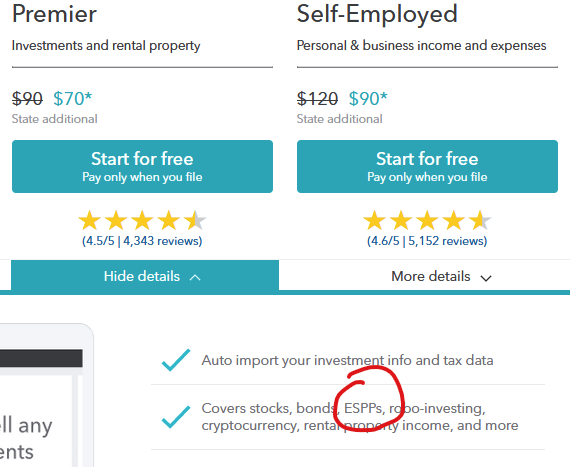

Especially considering they specifically advertise the Premier product handling ESPPs...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2020 refuses to correct cost basis for ESPP

I'm having the same issue. When I tried to put in the adjusted cost basis myself, then it still wasn't giving calculating the correct tax (I was still being double taxed). Be very careful with this or else you could end getting double taxed and not know it. Hopefully they fix this soon.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2020 refuses to correct cost basis for ESPP

I have the similiar problem with a wash sale and sale at a loss on Form 1099-B Worksheet. Turbotax gives the response "Sales Prices is not between the presdribed upper and lower limits" which is Turbotax's way of blocking you as a customer. A Turbotax product expert had not been briefed on Turbotax's refusal of customers from brokerages yet. And then a Technical Support expert from Turbotax informed me that Turbotax has no intention of fixing this intentional bug. "Not that they don't want you're money, they just don't want your business." Your are blocked from filing and blocked from fixing the negative values ourselves "for your convenience." It's not that experts won't help, they can't. Fidelity and the other brokerages are keeping the dirty secret that their advertizing for Turbotax sends customers into a hole from which there seems to be no emerging unless you go to H & R Block perhaps, eh?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Omar80

Level 3

carsonschafer

New Member

dougiedd

Returning Member

doubleO7

Level 4

jjon12346

New Member