- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Tax exempt OID without 1099-OID

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax exempt OID without 1099-OID

I may have accidentally posted my OID question in a non-OID relevant forum out of haste. Sorry about that :(

Greetings all,

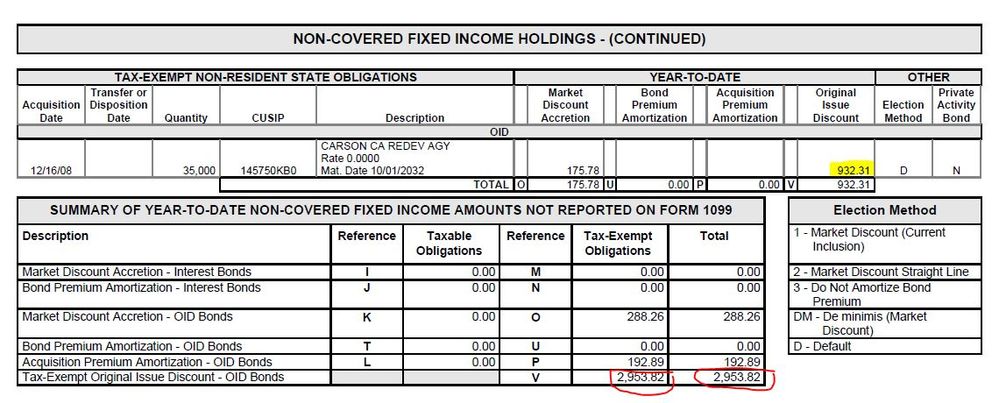

I have a question that's been perplexing me. I have a couple tax exempt bonds (one CA [depicted], others IL). I've never gotten an official 1099-OID form from my broker. Instead, reference to these are listed on a consolidated statement document. As such, there are no boxes 1-11 listed or to choose from. I've read quite a bit and realize I need to depict these within my taxes. And I may have just discovered I was doing it wrong. Obviously as TT user (for many years), I don't have a hired tax expert helping me.

So the question, where should I enter in the information pertaining to annual OID amount within the OID section of TT? I think I mistakenly was using Box 1 and perhaps should have been using Box 11 (Tax Exempt). All of my OIDs are tax exempt and the 2019 total sum of them is the $2,952.82 circled. I have no idea what all the other Reference letters are and if I need to use any of that information each year - or maybe when the bonds mature.

If I've been doing this wrong for some time, I guess I need to ask some seasoned TT/tax vets - how hard or what all is involved in filing amended tax returns since I've never had to do it?

Confused in OID land,

JV

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax exempt OID without 1099-OID

"Where should I enter in the information pertaining to annual OID amount within the OID section of TT?"

The tax exempt interest from your bond will be reported as a net amount on line 2a of Form 1040. See 2019 Form 1040 Instructions. However, TurboTax will carry your entry from Box 11 in the Dividends on 1099-DIV section to this line automatically.

"How hard or what all is involved in filing amended tax returns since I've never had to do it?"

To change the prior periods, consider filing Form 3115 for 2019, which allows you to make all the adjustments in the current year for all the prior years plus 2019. See 2019 Form 3115 Instructions. Note the OID adjustment is automatic accounting method change #72.

Some definitions for the values in your example from three different areas:

- Original Issue Discount: the excess of an obligation’s stated redemption price at maturity over its issue price (acquisition price for a stripped bond or coupon).

- Reference O: Market Discount Accretion - OID Bonds: This is the amount the bond value has grown as the maturity date of the bond approaches. When the bond is purchased at a discount, as the bond nears maturity, the value will increase to match the par value. The ratio includes the Yield to Maturity, YTM as the numerator and the life of the bond in months as the denominator. This 2018 investopedia article gives a simple example for Accretion of Discount that is useful.

- Reference P: Acquisition Premium Amoritzation - OID Bonds: The premium paid for the bond is part of the basis of the bond. A portion of this premium must reduce the basis of the bond annually.

- Covered: For a covered security acquired with acquisition premium, your payer generally must report either

- (1) a net amount of OID that reflects the offset of OID by the amount of acquisition premium amortization for the year, or

- (2) a gross amount for both the OID and the acquisition premium amortization for the year.

- Noncovered: For a noncovered security acquired with acquisition premium, your payer is only required to report the gross amount of OID.

More Resources:

Click the links for more information:

IRS Publication 1212: Guide to Original Issue Discount (OID) Instruments see page 7: Figuring OID on Long-Term Debt Instruments when Form 1099-OID was not received

IRS Cost basis reporting FAQ's starting at #5, what is OID? which goes on to observe that the taxpayer is responsible for reporting the adjustment, but they can make an election with the broker for the treatment if it is done before December 31 of the year in question.

IRS Publication 550, Investment Income and Expenses, page 33, Bond Premium amortization

To enter Form 1099-OID when Form 1099-OID is received, click this link for more instructions: Where do I enter Form 1099-OID?

[Edited 3/24/2020 | 7:30 AM PST]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax exempt OID without 1099-OID

Thank you! I wish I had been paying closer attention to when you responded in hopes of catching you closer to your response time. As for your guidance, thanks. Can you explain why it should go on line 2a? I guess it would help if I read some of your suggestions before replying. Some just seem as if they will take a while. I understand per the instructions why line 2a. But as a non-tax person, it just seems more obvious to use line 11.

"Where should I enter in the information pertaining to annual OID amount within the OID section of TT?"

List the tax exempt interest as a net amount on line 2a of the Interest on 1099-INT section in TurboTax. See page 22 of the 2019 Form 1040 Instructions.

I will read through some of the other links you were so kind to provide. Thanks!

JV

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax exempt OID without 1099-OID

You're welcome--My apologies, to clarify, the reference to Line 2a is for Form 1040. You are correct to enter the tax exempt dividends in Box 11 from Dividends on Form 1099-DIV in TurboTax.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hannahcastellano15

New Member

tivo44

Level 2

annarichard05

New Member

user17524181159

Level 1

DX77

New Member