- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax exempt OID without 1099-OID

I may have accidentally posted my OID question in a non-OID relevant forum out of haste. Sorry about that :(

Greetings all,

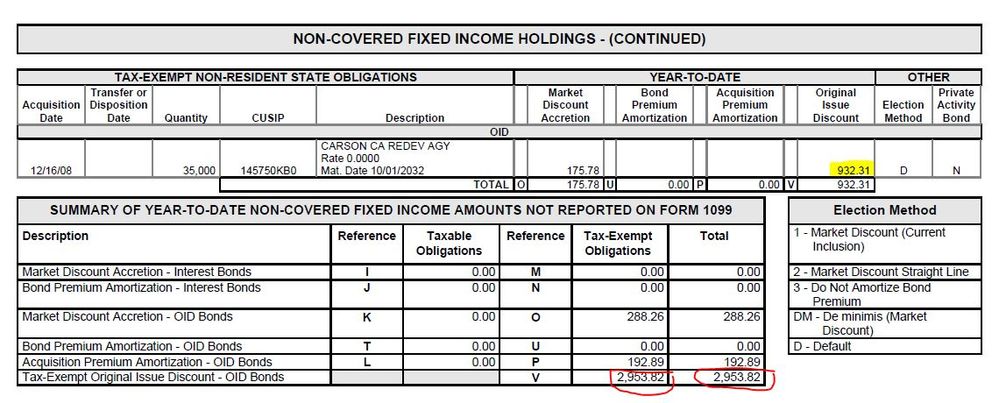

I have a question that's been perplexing me. I have a couple tax exempt bonds (one CA [depicted], others IL). I've never gotten an official 1099-OID form from my broker. Instead, reference to these are listed on a consolidated statement document. As such, there are no boxes 1-11 listed or to choose from. I've read quite a bit and realize I need to depict these within my taxes. And I may have just discovered I was doing it wrong. Obviously as TT user (for many years), I don't have a hired tax expert helping me.

So the question, where should I enter in the information pertaining to annual OID amount within the OID section of TT? I think I mistakenly was using Box 1 and perhaps should have been using Box 11 (Tax Exempt). All of my OIDs are tax exempt and the 2019 total sum of them is the $2,952.82 circled. I have no idea what all the other Reference letters are and if I need to use any of that information each year - or maybe when the bonds mature.

If I've been doing this wrong for some time, I guess I need to ask some seasoned TT/tax vets - how hard or what all is involved in filing amended tax returns since I've never had to do it?

Confused in OID land,

JV