- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Schedule K-1, Box 20, Code Z Stmt calculations

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1, Box 20, Code Z Stmt calculations

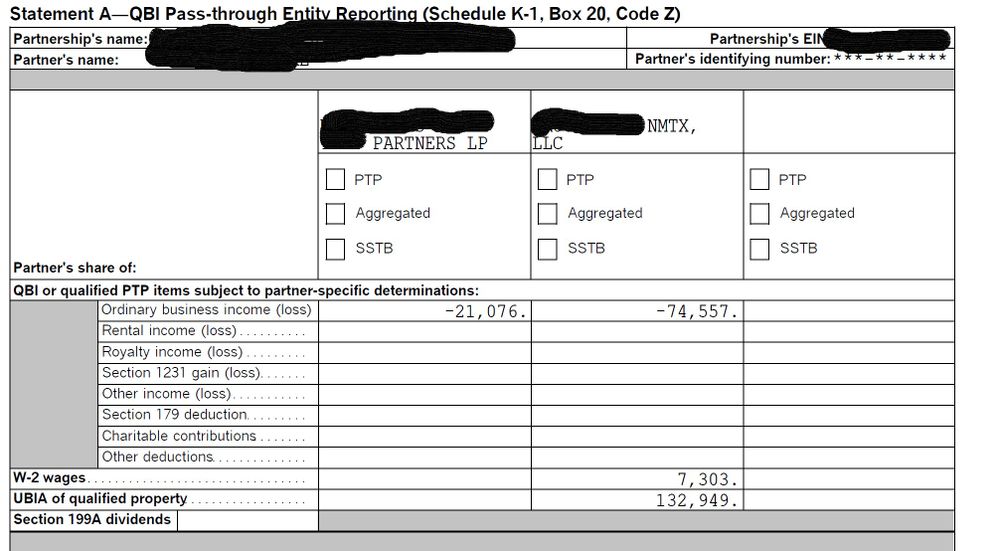

For Box 20 do I simply enter the net amount of QBI, W-2 Wages and UBIA of qualified property in Box 20 with a Code Z? I've attached my statement worksheet for review. Thanks for the help...a little confused on this one.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1, Box 20, Code Z Stmt calculations

So to answer my own question - I had to click on a "zoom" to statement A form and enter all of my numbers there. Hopefully I did that correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1, Box 20, Code Z Stmt calculations

Yes, that is the correct way to enter your K-1 Section 199A information in Forms mode of TurboTax Download/CD.

In both TurboTax Online and TurboTax Download you can enter Section 199A information in the Step-by-Step interview questions. To do that, enter the code Z when you enter the K-1 box 20 screen, but you don't need to enter an amount on that screen. Continue on, and you'll eventually find the screen "We need some more information about your 199A income or loss". When you check the box next to a category on that screen, a place will open up to enter the amounts from the Statement or STMT that came with your K-1. The applicable category (or categories) on that screen, and the following "Let's check for some uncommon adjustments" screen (if applicable), is where you enter your your K-1 Section 199A Statement information in the interview questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

swick

Returning Member

valevitaly

Level 1

garys_lucyl

Level 2

nstuhr

Returning Member

UnderpaidinIndiana

New Member