- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Sale of second home

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

I don't see your screen shots. I have been going around in circles for a week trying to figure out how to enter the sale of a second home correctly. I finally found this conversation string and feel relieved to find out it's not just me. This is definitely not a 1099-B issue. My biggest frustration has been that I could not talk to a person to address this problem in Turbo Tax. I'm using the Turbo Tax Premium online version. It should be where we can easily enter the data from the 1099-S without having to "work around" in the sale of investments section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

Yeah, we're not alone. The best that can come of this prolonged discussion is that if anyone in 2022 searches for 'tax software sale of second home" at least they'll see threads that warn them not to rely on TurboTax because some of its editions don't handle sales of second homes elegantly. I don't have any more homes to sell, so this is only a problem for me this year. I have no idea if there is any tax software that comes close to TurboTax but if I had a second home to sell again, I'd look for an alternative for sure.

I give props to the person who coached us to add an additional sale of home form, but of course there is a difference between 'sale of second home' and 'selling two homes in one year.'

Anyway, the main reason I want a TurboTax question and answer form like they have with nearly every other freaking thing is that I want to know how to calculate the cost basis, and I want to know if anything I did to the home for 10 years, everything from foundation work to a new roof to improvements, matters in any way shape or form. One person above provided a link to an IRS publication so I guess I will look it up there. Of course, one hopes buying TurboTax means you don't have to read IRS publications but oh well.

And I appreciate the people trying to help are relying on the form TurboTax does provide, they're good sports, but what does "Enter the sales expenses not deducted from the sales price entered earlier" mean? Is that a reference to the real estate commission, the cost of improvements to make it ready for sale or ?? I guess I'll read the IRS publication and be thankful TurboTax isn't like this for any other aspect of my taxes (at least I hope, I'm not done yet 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

I have a 1099S for proceeds for sale of a second home. I also bought another second home, an upgrade from the first. Both transactions occurred in 2020. Can I input data in TurboTax Premier? If so where?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

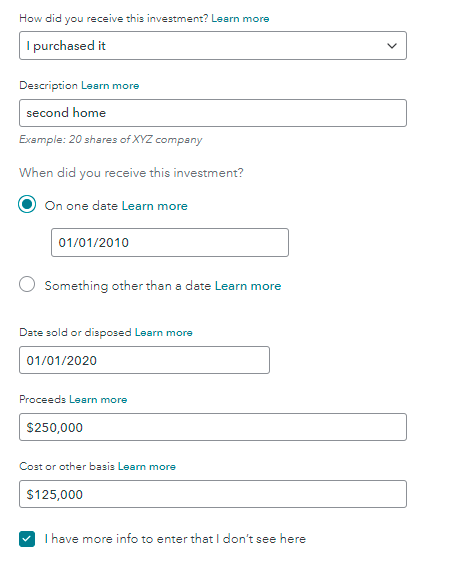

You would enter the sale in the Investment section as "other investment.". You don't enter the purchase of a new home, other than to take the mortgage interest and property tax deductions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

I entered the info on the sale of the second home where it says to do so but I don't have any doument telling me an institution name and account number. It was not an institution that sold the house and it was not the realty company that sold the house, it was me. But turbotax keeps prompting me to go back and put in that information. If I just skip that will it be a proble?. I show the gain, etc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

When you are confronted with the question as to whether you received a 1099-B, answer "No".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

i dont now where to place it in turbo tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

@perez4 wrote:

i dont now where to place it in turbo tax

READ the answers provided on this thread

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

I got the first screen in your example but none of the other screens. I am using TurboTax Premier.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

So what do I do? How do I enter it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

@Cindy777 wrote:

So what do I do? How do I enter it?

The same as you would enter the sale of a stock, bond, mutual fund, or similar investment but do not indicate that you received a 1099-B.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

How do I enter any adjustments to the basis for improvements?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

@Cindy777 wrote:

How do I enter any adjustments to the basis for improvements?

Add the improvements to your cost basis and enter the total into the program (i.e., calculate your total adjusted basis outside of the TurboTax program).

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

littlelindsylue

New Member

sam992116

Level 4

sam992116

Level 4

Mbenci318

New Member

Idealsol

New Member