- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Sale of second home

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

What info on prior years was listed?

I bought this and had it as my main home in 1987, sole property owner. I remarried in 2000 and my husband & I lived there until end of 2011. My son lived there (no rent paid) until I sold the house in August 2021.

What kind of upgrade/remodel expenses can you deduct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

Improvements are not deductible. They are added to the basis of the home and can potentially reduce any gain at the time of sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

I am not seeing any help on this issue that is current to tax year 2021. Someone needs to address this question for the current situation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

@Keith28 wrote:

I am not seeing any help on this issue that is current to tax year 2021. Someone needs to address this question for the current situation.

The original question was "where to enter Sale of Second Home?" and that has been answered (several times, in fact).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

I’m still unsure on those that were asking about “depreciation” on prior years? Would that be due to renting/leasing or using property for short-term rental? I’ve never reported anything but property tax.

Thank you for the help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

I don't know where you are in the program. This is your personal home, a second home, according to your initial post. If you did rent it out to someone, yes, you would have had to take depreciation. At the time of the sale, you would have to recapture it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

SALE OF SECOND HOME

I have a question about the investment section where to enter Sale of Second Home. I'm using the Home and Business edition. Part of the section in investments is missing. No place for sale of second home or any other type of sale. Only 2 check boxes for stocks. Last years software had all boxes available. I may be getting ahead of the game and updates but just want to make sure there is no glitch in my software. The last update was 2/09/2022.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

When you enter the investment section, do not say that you received a 1099-B. That takes you to the stock section. There is a place to say that it was land or a second home.

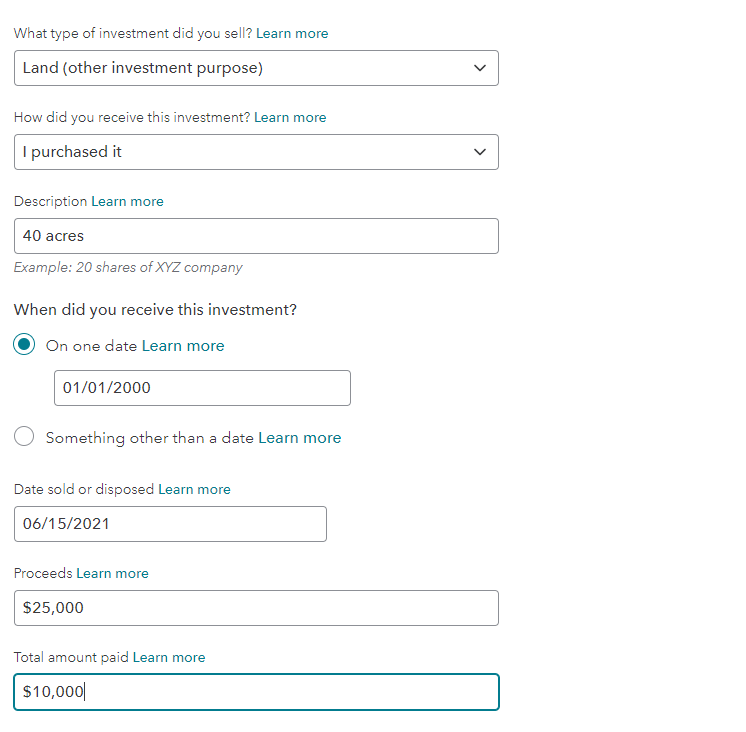

Once you click on that, this screen will open up. Instead of land, enter second home. @Karenfjensen

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

I cannot seem to locate the screen in the screenshot you posted in my copy of Home & Business. After I indicate I did not receive a 1099-B, I get the screenshot shown below.

I believe the online versions may differ from the desktop versions and there is no place to indicate the transaction was actually of a second home (or land).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

@Anonymous_, this is true.

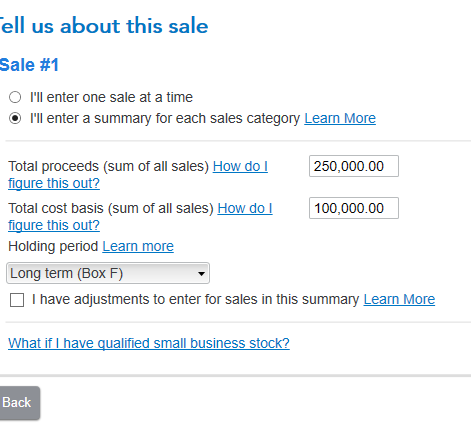

Here is another screenshot from TTD, which shows how you can enter the sales price and basis for the second home. Again, when asked if you received a brokerage statement, answer no. @Karenfjensen

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

Selecting "I'll enter one sale at a time", allows the user to enter a description.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

Thank you @billsmith!

It is a year later - Feb 2022 - exactly the same issue. billsmith answer solved the problem but a royal pain until I found it - nothing about a 1099-S in search bar at all. Nor second home. Nor vacation home. As the online directions claim. I had exactly the same situation that bill smith had - and likewise had to put my lawyer's TIN on the 1099-B worksheet (kind of absurd since it was a 1099-S. If you just put in the numbers as I did at first I would have had a taxable loss of nearly 50K (I just sold a portion of the property). I missed the first time around having to scroll through the following pages where it asks if the sale is from a second home and thus not allowable to claim as a loss. Would have been nice to have clear instructions somewhere in Turbo. I'm using Desktop Home and Business on MacOS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

I reported as a Sale not reported on Form 1099-B

Description "sold 2nd Home"

Gross proceeds per the 1099-S

On Tell us about this Sale "I'll enter one sale at a time"

Kept selecting continue button

On Select any less common adjustment that apply

checked the reported sales price did not deduct all fees or selling expenses

Filled in expenses from Settlement Statement

Checked Any loss from this sale is not deductible

Checked this is person use property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

I sold my 2nd house in IL state, but I lived and worked in California. I looked at Filing Requirements for Illinois IL- Form 1040. I don't have to.

I just want to confirm that Do I have to file IL state tax for this 2nd home?

V/r,

Diane

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

It depends. Generally, you’ll need to file a nonresident state return if you made money from sources in a state you don’t live in. Some examples are:

- Wages or income you earned while working in that state

- Out-of-state rental income, gambling winnings, or profits from property sales (gains on home sales)

- S Corporation or partnership income

How do I file a nonresident state return?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Viking99

Level 2

littlelindsylue

New Member

sam992116

Level 4

sam992116

Level 4

Mbenci318

New Member