- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- RSU cost basis adjustment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RSU cost basis adjustment

I had 20 RSU sales in 2019. Of course, initially the cost basis isn't accounted for when you sync to your investment account. As expected as I entered the cost basis for each RSU sale the amount I owed went down. That said, on the last two transactions the amount I owed did not go down at all. Did something change in the tax code this year because in the past it went down after all my entries?

TIA

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RSU cost basis adjustment

I have the same issue. My ESPP sale accounted for the cost basis adjustment, but the RSU sale will not allow me to enter appropriate information to tie out the correct amount. I also cannot just enter the data for 1e. What recourse do I have other than adjusting the available figures? Please advise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RSU cost basis adjustment

It sounds like your situation may be different. I can enter the cost basis for my RSUs however what I owe didn't go down. I'm wondering if there is some sort of change in the tax code that limits my gains on RSUs?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RSU cost basis adjustment

can you provide some examples with numbers? sounds like you are selling at a loss??????

the cost basis of the RSU is determined when the restriction comes off the shares and it DOES NOT change.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RSU cost basis adjustment

Initially my cost basis was zero for 34k worth of RSUs and after I entered 30k the cost basis it did not change my federal tax due at all.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RSU cost basis adjustment

something in your explanation does not make sense.

first, is there a clear understanding of how RSUs work?

1) your employer gives you RSUs. nothing goes into TT.

2) the restriction expires. The RSU transaction is reported in your W-2. You now have STOCK. you do NOT have RSUs. Nothing special to report in TT; (It's already in your W-2).

3) you sell the shares. you get a 1099-B from your broker, you post the cost basis and sales price in TT

you keep stating you have RSU's, but RSU DO NOT represent a taxable transaction (other than in your W-2.)

Did you sell the STOCK after the restriction expired? for the 1st transaction, please post the following

1) date the restriction expired

2) the cost basis

3) the number of shares

4) the date you sold these same shares

5) the price of the shares on the date you sold

maybe that will help solve this mystery.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RSU cost basis adjustment

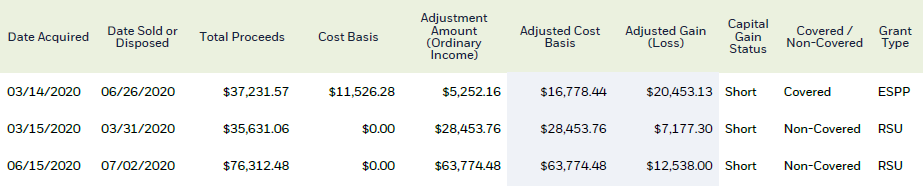

To NCperson. I am not sure if your reply was to me or to the other person in this thread. For my situation, I get what you mean about stock vs. RSUs, but there is a difference between stock acquired through regular purchases and RSUs granted to you by your employer. For my situation, I have a 1099-B and stock plan supplement from eTrade. The 1099-B reflects that the Adjusted Cost Basis and Adjusted Gain/Loss was not reported to the IRS, but those amounts are reflected on the supplement. The Adjusted Cost Basis is the same number as the Adjustment Amount (Ordinary Income) and differs from the 1d Proceeds amount reported to the IRS by approximately $6K.

Entering all the information from the 1099-B, along with following the Step by Step instructions, the Gain/Loss amount for this stock sale is $5200 more than the stock plan supplement and $11K less than the 1099-B Gain/Loss. My dilemma is reconciling the TT number to my form to ensure accuracy. I hope that helps to paint a clearer picture to my situation. Thank you for any help or guidance you can provide.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RSU cost basis adjustment

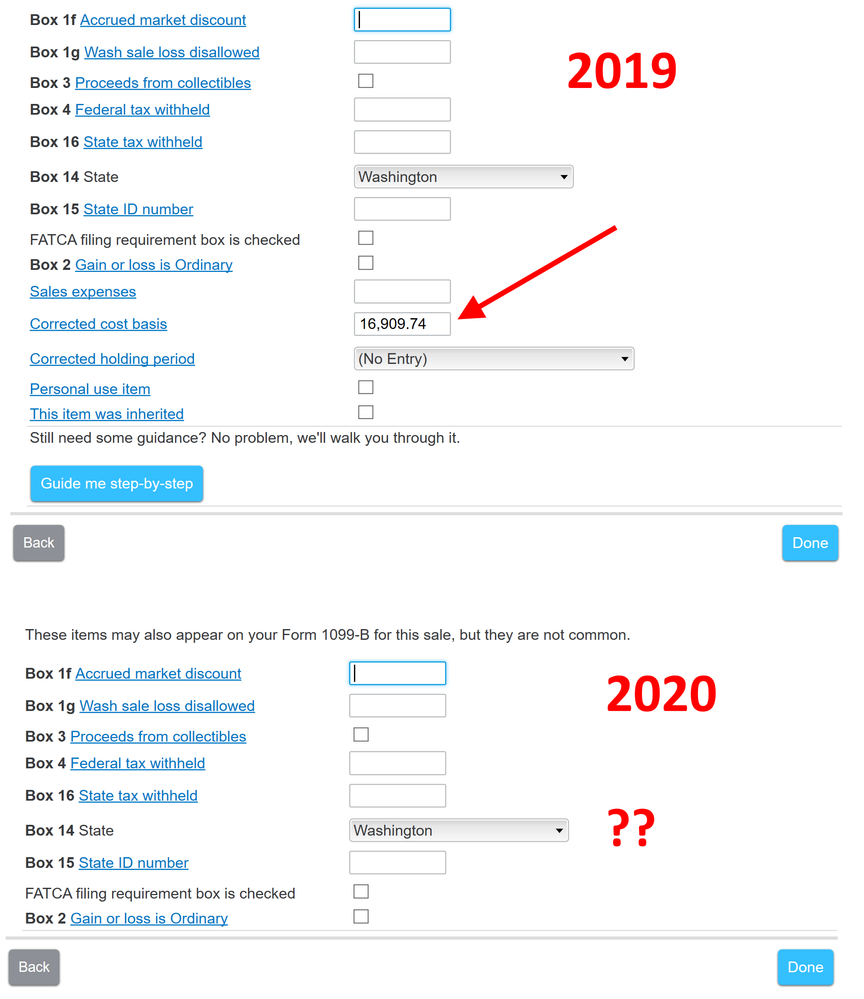

same problem here. I have been using TurboTax for years to report RSU grant and withholding. I have 1099-B and transaction supplement from broker. Usually, the Box 1e (cost or other basis) is ZERO, then in the next page there is "Corrected cost basis" where I can enter Adjusted Cost Basis which is from broker's transaction supplement. then the numbers will go down.

For TurboTax 2020, there is no "Corrected cost basis" available, if I enter the Adjusted cost basis into Box1e, the numbers will not go down. There is definitely something changed for TurboTax 2020 to report RSU.

Where should I enter Adjusted Cost Basis from broker's transaction supplement sheet?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RSU cost basis adjustment

Cost basis is a good place to put the actual basis.

You have to remember that the laws changed on how RSU is reported to the employer also. Employees have the option of when the RSU is reported in their income. This makes you more responsible for tracking your basis. See Employee Compensation, RSU in Tax Cuts and Jobs Act: A comparison for large businesses and international taxpayers.

That being said, you need to enter the correct basis. The broker may not have the correct basis. The IRS puts this in the employee's hands to keep up their own basis. I want to urge you to create a financial notebook that is kept separate from your tax return. Keep it safe and each year, add your year-end statements from all your financial accounts plus a copy of your W2’s. This will protect you down the road as proof of your basis in your various investments. As you go through life, rollovers, RSU basis and sales, and more will be captured for you.

@r40135ca

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RSU cost basis adjustment

To Amy, when you say cost basis, do you mean box 1e? I found that field is overridden by turbo tax when it gets the info on rsu vesting day price, which is not correct. In my case, my distributed RSU shares' cost was adjusted due to wash sale rule when a portion of the lot was sold at loss for tax withholding purposes. How do I correct this turbo tax's mistake so to avoid double taxing?

On the other hand, do I have to choose the "employee stock" option if I know the exact cost basis of the RSU? Can I treat it as normal stock sale instead?

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RSU cost basis adjustment

The RSU ends up on sch D like a regular stock. As long as the sale proceeds match the IRS paperwork and the tax consequence is correct, how you get there is not a problem.

@Anonymous

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RSU cost basis adjustment

@AmyC What I should do if I have different "Cost Basis" and "Adjusted Cost Basis"? That can happen for ESPP shares. Just take a look on the report from my broker.

I just double checked, in the TurboTax 2019 there were different fields to enter "Cost basis" and "Corrected cost basis". Turbotax 2020 doesn't have this field. Can you fix it or provide workaround? If tax software can't prepare my tax form I'll have to go to another vendor.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RSU cost basis adjustment

Yes, your adjusted includes what was added into your W2 income. You may also have had some buy and sell expenses to add to the basis. In box 1e, the program wants the cost or other basis.

Your screen shots start after the cost basis box so back up.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RSU cost basis adjustment

@AmyC What do you mean? Previous screens with box 1e are the same in TurboTax 2019/2020. My question is where to put different numbers, e.g. for ESPP (the first line in my report). I can put $11,526.28 to the box 1e (cost basis), but where I should put $16,778.44 (corrected/adjusted cost basis)?

Please contact to developers, it looks like they literally missed or disabled some functionality from TurboTax 2019. As an option, could you just tell me what I should put and where for my ESPP entry (first row from the screenshot above)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RSU cost basis adjustment

@Alex2021 You put the adjusted cost basis in box 1e where it says cost basis.

The IRS defines the basis as what you paid plus expenses. The adjusted cost basis column in your spreadsheet is the actual legal cost basis.

So, for Mar 14, cost basis, line 1e, is the $16,778.44 and the $11k is not entered at all.

Sorry for the confusion! This may help, Topic No. 703 Basis of Assets

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Idealsol

New Member

SB2013

Level 2

ohjoohyun1969

New Member

ilenearg

Level 2

user17548719818

Level 2