- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Where do I enter last year's QBI loss carryover (Line 3, Form 8995) into 2020 Turbo Tax online?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter last year's QBI loss carryover (Line 3, Form 8995) into 2020 Turbo Tax online?

There will be an update to TurboTax on April 8, 2022, that will resolve this issue. If you are using one of the desktop versions you will need to install updates before you proceed.

@cynthia29

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter last year's QBI loss carryover (Line 3, Form 8995) into 2020 Turbo Tax online?

Has the error been corrected? I don't think so based on what I'm seeing on my return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter last year's QBI loss carryover (Line 3, Form 8995) into 2020 Turbo Tax online?

Hi Alicia,

I still can't find where to add the following:

Qualified business net (loss) carryforward from the prior year (Line 3 from 8995).

Whenever I try to add it to one of the options in "Uncommon Situations" it gives me an error at the end.

I'm using TurboTax premium. Is there a fix to this?

Thanks for your help! @AliciaP1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter last year's QBI loss carryover (Line 3, Form 8995) into 2020 Turbo Tax online?

Can you clarify if you're using TurboTax Premium Online or CD/Download? Also, what is the error you are getting?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter last year's QBI loss carryover (Line 3, Form 8995) into 2020 Turbo Tax online?

Sure thing! I am using TurboTax premium online.

I tried following the instructions here but the only thing I see when I scroll to the bottom of "Wages & Income" is "Uncommon Situations."

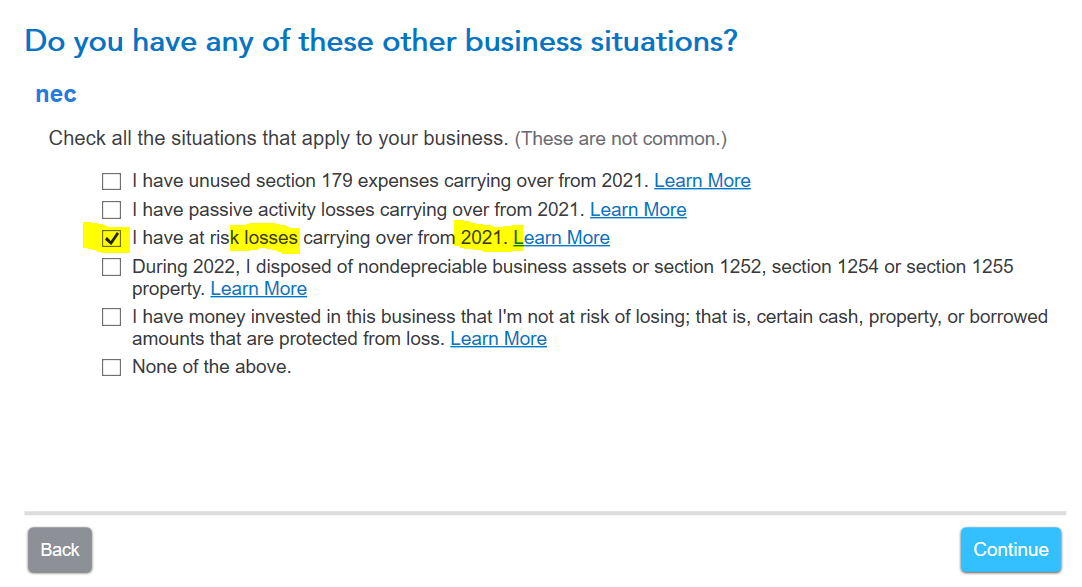

Here, I only have 5 options which include these:

I don't find the QBI loss carryover as the other posts suggest I might find.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter last year's QBI loss carryover (Line 3, Form 8995) into 2020 Turbo Tax online?

You need to mark the I have at-risk losses carrying over from 2021. This box will let you enter any NOLs and QBI losses you may have carried over from prior years that were reported on your 2021 returns.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter last year's QBI loss carryover (Line 3, Form 8995) into 2020 Turbo Tax online?

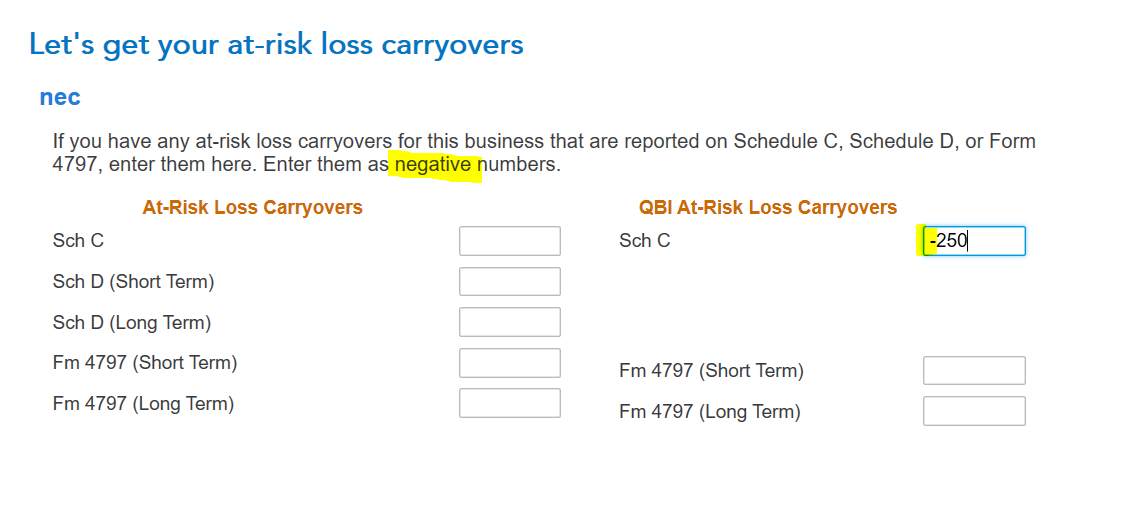

This is where I input the numbers the first time but it gives me this error when I try to file at the end:

It won't let me file unless I set this number to 0, which should not be the case.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter last year's QBI loss carryover (Line 3, Form 8995) into 2020 Turbo Tax online?

You have suspended loss marked rather than QBI loss carryover. Please return to your schedule C business and follow these steps:

- Edit your business

- Select Special Situation

- Select I have at risk losses carrying from 2021, continue

- Enter your QBI carryover loss as a negative number under QBI, continue

- Enter the amount of QBI loss carryover for each year to add to the total. If your only loss was 2021, then total and 2021 would have the same amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter last year's QBI loss carryover (Line 3, Form 8995) into 2020 Turbo Tax online?

Hi Amy,

Thank you so much for your help. These are the exact steps I tried when filling out all of my information and I am still receiving the same error I attached above when trying to file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter last year's QBI loss carryover (Line 3, Form 8995) into 2020 Turbo Tax online?

It would be helpful to have a TurboTax ".tax2022" file that is experiencing this issue.

You can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions:

Go to the black panel on the left side of your program and select Tax Tools.

- Then select Tools below Tax Tools.

- A window will pop up which says Tools Center.

- On this screen, select Share my file with Agent.

- You will see a message explaining what the diagnostic copy is. Click okay through this screen and then you will get a Token number.

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

We will then be able to see exactly what you are seeing and we can determine what exactly is going on in your return and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter last year's QBI loss carryover (Line 3, Form 8995) into 2020 Turbo Tax online?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter last year's QBI loss carryover (Line 3, Form 8995) into 2020 Turbo Tax online?

Upon review, there is an issue with the calculation in TurboTax and I have reported it for review. Once there is an update and Expert will get back to you so you can proceed.

If you have entered any NOL carryovers in TurboTax Premium Online you can follow these steps to remove them:

- Within your return, click Wages & Income in the black menu bar on the left

- Scroll to Self-employment income and expenses and click Edit

- Click Edit for the line of work you need to add the losses to

- Scroll down to Uncommon Situations and click Edit

- Continue to the Let's get your at-risk loss carryovers screen

- Delete your total loss carryovers in the box on the Schedule C line then click out of the box on the screen and click Continue

- Proceed entering/reviewing your return

[Edited 3/7/23 | 12:11 PM PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter last year's QBI loss carryover (Line 3, Form 8995) into 2020 Turbo Tax online?

Got it!

The only issue now is that the return is now impacted significantly. Would this be normal?

I've attached another token number with the new figures added: 1090052

Thank you again for all your help with this!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter last year's QBI loss carryover (Line 3, Form 8995) into 2020 Turbo Tax online?

Taking a closer look at the return you provided through your token number, it appears that you overcame the error message by entering the same amount of loss under the Schedule C Regular Tax suspended loss box as well as the QBI suspended loss box. If that is what is shown on your 2021 carryover worksheet, then you are in good shape. The impact on your return as you mentioned above is due to the entry that you made under the regular tax suspended loss box.

However, if your carryover QBI loss was not an 'at risk' loss then it needs to be entered in a different section of your return where QBI carryover losses are entered.

Use these steps:

- On the top row of the TurboTax screen, click on Search

- This opens a box where you can type in “qbi loss carryover” (be sure to enter exactly as shown here)

- The search results will give you an option to “Jump to qbi loss carryover”

- Click on the blue “Jump to qbi loss carryover” link

This will take you to a screen asking about 2021 Net Operating Loss carryovers where you can just click Continue. The next screen is where you will enter your 2021 QBI carryover amount. This will then be reported as part of Form 8995 and will be taken into account against any QBI income or added to any 2022 QBI losses that are carried into 2023.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bmoore4718

New Member

katyisd20431

New Member

BaliAgnes

New Member

Sbmccor1963

New Member

aptcat93

New Member