- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: UGI's acquisition of AmeriGas APU in 2019 - how to handle this complex series of events for tax purposes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UGI's acquisition of AmeriGas APU in 2019 - how to handle this complex series of events for tax purposes?

Hi everyone,

For those of you who held APU units I am sure you're familiar with the mid-2019 UGI's acquisition of AmeriGas (APU).

The "merger transaction" was a complex series of events, APU was an MLP while the shares we got for UGI in exchange for the merger are regular common stock shares. So clearly a full disposition of an MLP took place. Then on top of that there was a one time cash-in-lieu-of to all prior APU unit holders as part of this merger.

So what is your plan to handle the tax events associated with this mess? I am in this boat and knowing all the problems with TurboTax and MLP dispositions I am weary, the brokerage will show one thing and the MLP final sale schedule another, the usual K1 covering the first part of 2019, re-capture, bases, etc? What a mess? What your plan on how to properly record this with the 2020 tax deadline approaching?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UGI's acquisition of AmeriGas APU in 2019 - how to handle this complex series of events for tax purposes?

@Boyan, thank you for the detailed explanation. The duplicated gains (losses) on 1099-B and K-1 seems to be a well discussed topic here on TT forum. I've spent several days reading through different suggestions and trying to understand what is the best approach.

The main goal is two-fold:

- Adjust the cost basis reported on 1099-B with the information on K-1 sales schedule.

- Exclude the ordinary gain (loss) reported on K-1 from the capital gain reported on 1099-B.

As many people suggest here, the deletion of the sale information reported by the broker on 1099-B accomplishes that. The K-1 sale interview produces the correctly adjusted capital gains as well as captures the ordinary gain (loss). However, the approach didn't feel quite right to me, so I kept searching.

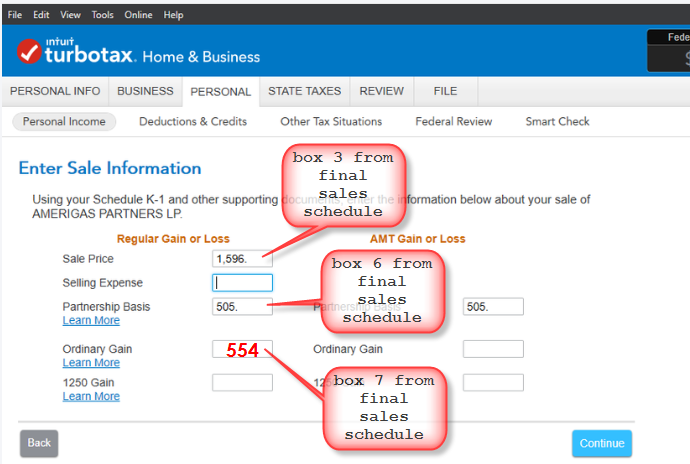

I've found the solution designed by TT buried in the help documentation to the K-1 sale interview. If you right click on the Sale Price input (the one you've highlighted on the last screenshot with "box 3 from final sales schedule") and select "About Part II Line 5" option in the drop-down menu, you'll find the following:

Line 5 - Sales priceEnter the selling price of the interest. For abandonments, enter zero. For liquidations, enter the value of the assets received. NOTE: If this is a disposition of a publicly traded partnership (PTP) or a master limited partnership (MLP) that was reported on a Form 1099-B, enter zero for both the sales price and the basis on lines 5 and 7 here and report the sale as normal on Schedule D, checking the appropriate "Reported on 1099-B" Box A or Box B. By reporting the sale of the PTP or MLP on Schedule D and entering zero as the sales price and basis on this K-1 Worksheet, the disposition will get processed correctly throughout the return.

I did what's suggested there:

- K-1 Sales Interview: Entered $0 in Sale Price and Partnership Basis.

- K-1 Sales Interview: Entered $1,133 in Ordinary Gain. This value is taken from K-1 sales schedule column 7 (Gain subject to recapture as ordinary income).

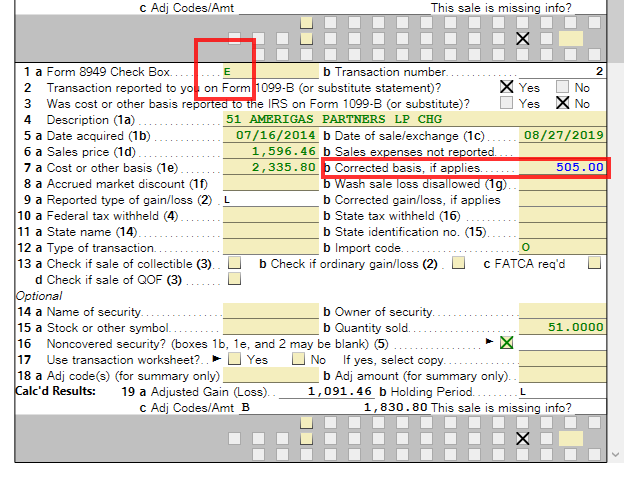

- 1099-B imported from the broker: Entered $640 in Corrected cost basis. That can be done by clicking edit on the sale transaction in 1099-B instead of deleting it. The field is on the second step. This value is taken from K-1 sales schedule column 6 (Cost Basis).

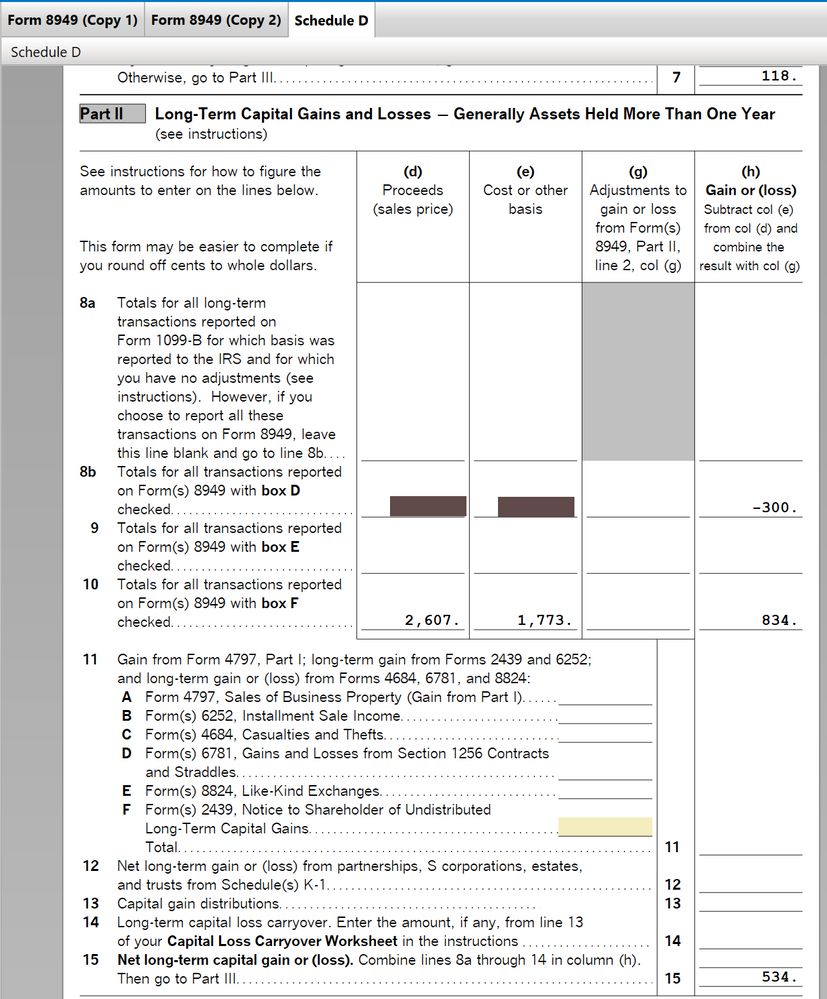

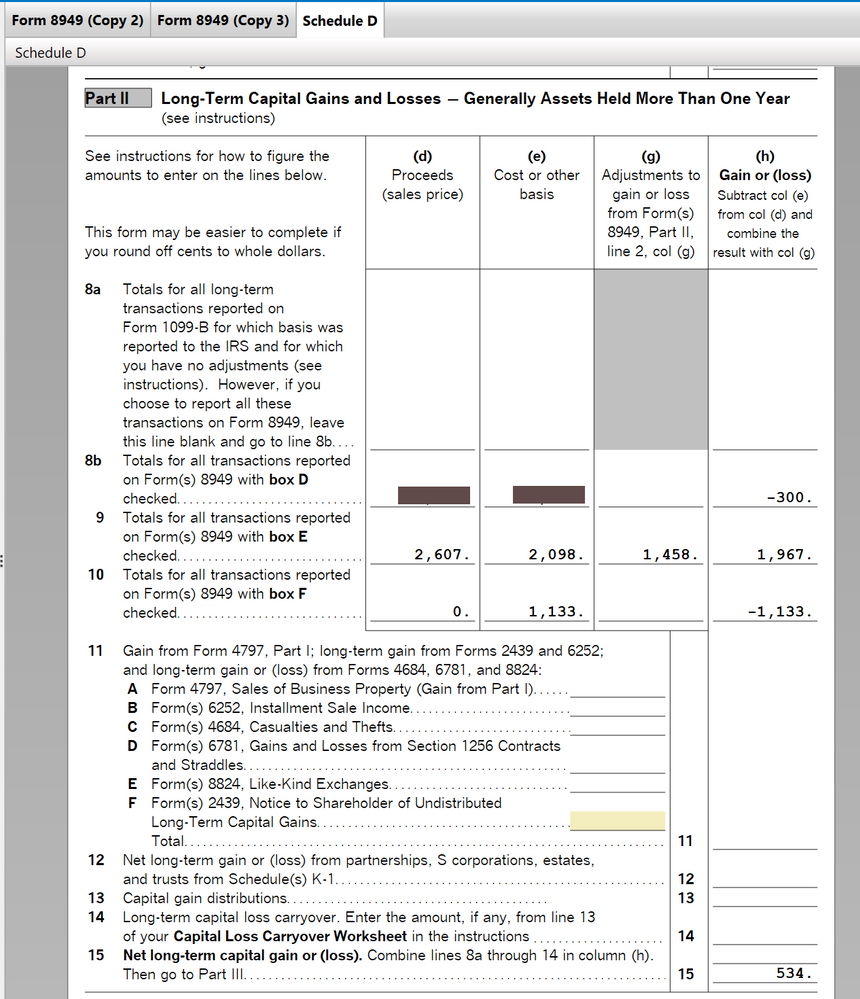

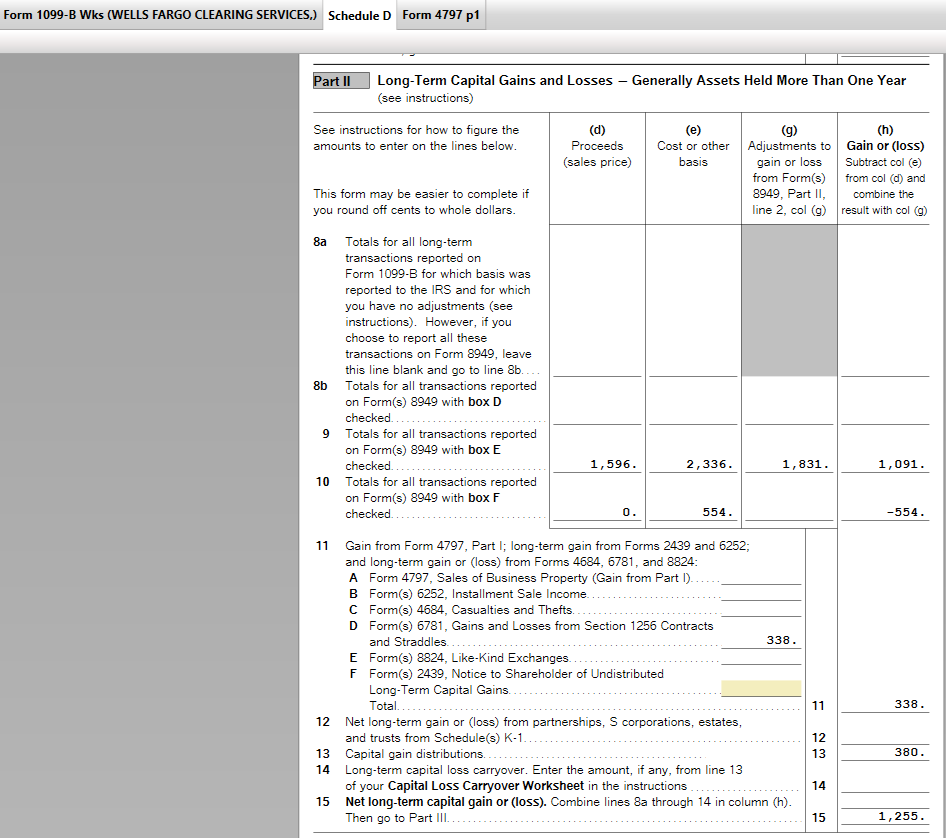

That results in the correct capital gains adjusted with the ordinary gain on Schedule D. Check lines 9, 10 and 15 on the attached screenshots. The refund value is also the same as in the first approach.

Deleted 1099-B sale

Zero Sale Price and Partnership Basis in K-1

As you can see, 1,133.00 ordinary gain is correctly subtracted from the capital gains.

I will use the approach suggested in TT documentation. I hope this can be helpful to anyone looking for a solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UGI's acquisition of AmeriGas APU in 2019 - how to handle this complex series of events for tax purposes?

You should get instructions with your K-1 and they have a web site.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UGI's acquisition of AmeriGas APU in 2019 - how to handle this complex series of events for tax purposes?

It seems you have to look at your brokerage statement , Schedule B to capture the lots that were sold and the proceeds of the merger transaction.

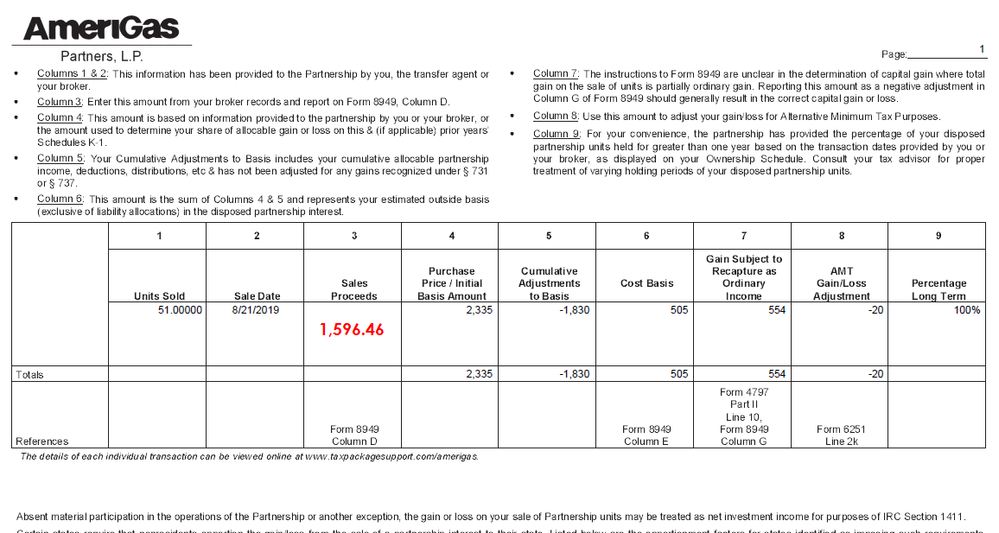

TT should have the basis that was tracked year by year from the K-1 Partner's Capital Account. There is a Schedule in the K-1 that summarizes the sale, sale date, Initial Basis, Cumulative Adjustments to Basis, Cost Basis (the net of the previous two), Gain subject to recapture, AMT and where on the Federal Filing (Form, Line and Column)

Caveat, I'm no tax accountant and went through something similar last year with Energy Transfer Partners, LP. The issue of suspended losses was difficult to treat on TT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UGI's acquisition of AmeriGas APU in 2019 - how to handle this complex series of events for tax purposes?

Hi @Boyan , were you able to figure that out?

APU K-1 is saying that the transaction should be treated as if the units were sold. I've got a single sell transaction on K-1. The 1099-B reports two transactions: 1) Tender, 2) Merger.

Any thoughts on how to enter that in TT?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UGI's acquisition of AmeriGas APU in 2019 - how to handle this complex series of events for tax purposes?

@skhilko hey so my 8949 (Wells Advisers) only reports one event related to this transaction -- total sale and as we know the numbers are wrong since it doesn't take under account the final sale schedule (provided by Tax Package Support) which reflect the accurate basis. So in summary, yes I do agree that "APU K-1 is saying that the transaction should be treated as if the units were sold" and I will prepare my TT taxes based on that: complete disposition of APU.

The only other related transaction shown on my 8949 (Wells Advisers) is the "cash in lieu of" kick back and I will leave that as is. However I will delete the APU sale from the my 8949 (Wells Advisers) and then let the K1 interview generate another 8949 based on the K1's final sales schedule. So I ended up with two forms 8949; one which the K1 generated with just the APU sale and the other 8949 from Wells with all other stock transactions during 2019. Reading the forums having two 8949s is perfectly permissible.

At the end of the day I expect to owe some tax for the recapture but all the suspended losses that the final sale will release will somewhat or mostly off-set the recapture tax liability.

I've been tracking the forums ever since August 2019 when the merger happened in anticipation of my taxes and so far what I described appears to be the general consensus.

So I hope this is helpful to the rest of the APU affected investors. Here's what my final schedule showed and next, here's what I plugged into TT K1 final disposition interview. Don't quote me. You're on your own in terms of risks, this just my interpretation how it's supposed to work and I'm sharing it for the greater good in this total gray mush of rules and uncertainty:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UGI's acquisition of AmeriGas APU in 2019 - how to handle this complex series of events for tax purposes?

@Boyan, thank you for the detailed explanation. The duplicated gains (losses) on 1099-B and K-1 seems to be a well discussed topic here on TT forum. I've spent several days reading through different suggestions and trying to understand what is the best approach.

The main goal is two-fold:

- Adjust the cost basis reported on 1099-B with the information on K-1 sales schedule.

- Exclude the ordinary gain (loss) reported on K-1 from the capital gain reported on 1099-B.

As many people suggest here, the deletion of the sale information reported by the broker on 1099-B accomplishes that. The K-1 sale interview produces the correctly adjusted capital gains as well as captures the ordinary gain (loss). However, the approach didn't feel quite right to me, so I kept searching.

I've found the solution designed by TT buried in the help documentation to the K-1 sale interview. If you right click on the Sale Price input (the one you've highlighted on the last screenshot with "box 3 from final sales schedule") and select "About Part II Line 5" option in the drop-down menu, you'll find the following:

Line 5 - Sales priceEnter the selling price of the interest. For abandonments, enter zero. For liquidations, enter the value of the assets received. NOTE: If this is a disposition of a publicly traded partnership (PTP) or a master limited partnership (MLP) that was reported on a Form 1099-B, enter zero for both the sales price and the basis on lines 5 and 7 here and report the sale as normal on Schedule D, checking the appropriate "Reported on 1099-B" Box A or Box B. By reporting the sale of the PTP or MLP on Schedule D and entering zero as the sales price and basis on this K-1 Worksheet, the disposition will get processed correctly throughout the return.

I did what's suggested there:

- K-1 Sales Interview: Entered $0 in Sale Price and Partnership Basis.

- K-1 Sales Interview: Entered $1,133 in Ordinary Gain. This value is taken from K-1 sales schedule column 7 (Gain subject to recapture as ordinary income).

- 1099-B imported from the broker: Entered $640 in Corrected cost basis. That can be done by clicking edit on the sale transaction in 1099-B instead of deleting it. The field is on the second step. This value is taken from K-1 sales schedule column 6 (Cost Basis).

That results in the correct capital gains adjusted with the ordinary gain on Schedule D. Check lines 9, 10 and 15 on the attached screenshots. The refund value is also the same as in the first approach.

Deleted 1099-B sale

Zero Sale Price and Partnership Basis in K-1

As you can see, 1,133.00 ordinary gain is correctly subtracted from the capital gains.

I will use the approach suggested in TT documentation. I hope this can be helpful to anyone looking for a solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UGI's acquisition of AmeriGas APU in 2019 - how to handle this complex series of events for tax purposes?

@skhilko this is the very first time that right-click has ever been mentioned by anyone. It appears that TT has taken under account the issue - just never exposed the directions clearly. Thank you. I think what you have uncovered is a major breakthrough in the process. Thank you! Basically if I may summarize the official TT approach which you have uncovered (correct me for the benefit of anyone else here):

Capital gains are handled by the brokerage 1099-B which does require end-user edit based on the final K1 sales schedule. Nobody needs to "delete" the brokerage 1099-B, just edit the basis. In the case where we have many 1099-B transactions the "delete it all" just will not work for the modest investor.

Ordinary gains are handled by the K1 interview by means of the generated 8949 which addresses ordinary gains ONLY

So what you have uncovered is how to BLOCK the final K1 interview from generating capital gains (entering ZERO for both selling price and basis) so it only auto-generates 8949 for the ordinary gains and also releases the suspended losses just as you illustrated!

One clarifying question: when you edited the basis in the brokerage imported 1099-B did you copy the number from box 6 of the final K1 sales schedule? Also for the benefit of everyone else reading this can you share your APU final sales schedule (like one I posted so the numbers add up accurately)

This is some awesome work man! Anyway my Schedule D does look good when I test both ways just as you did and that confirms that the right-lick TT instructions are credible (ignore my 1256 and S-Corp distributions line 13, the math works out about APU with Box E and F reported correctly on Schedule D).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UGI's acquisition of AmeriGas APU in 2019 - how to handle this complex series of events for tax purposes?

One clarifying question: when you edited the basis in the brokerage imported 1099-B did you copy the number from box 6 of the final K1 sales schedule? Also for the benefit of everyone else reading this can you share your APU final sales schedule (like one I posted so the numbers add up accurately)

@Boyan that's right. I also updated my steps in the post above with the details where the numbers come from. I also included the actual amounts. I hope that helps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UGI's acquisition of AmeriGas APU in 2019 - how to handle this complex series of events for tax purposes?

I've been following the discussion and have followed the TT note on the bottom of the K-1 regarding how to enter the proceeds, basis and gain.

However, when entering the basis, it doesn't allow a negative basis (I've been a long time holder so my return of capital exceeds my cost basis by $3,517). I can't override the entry nor will the "corrected basis" accept a negative amount. Also, since the APU sales schedule only reports a single cost basis, how do I calculate the long term from short term gain? Is the Column 7 "Gain Subject to Recapture as Ordinary Income" $9,574, is that separate from the calculation of Sales Proceeds minus Cost Basis?.

I'm still a bit confused and glad we have more time to sort this out.

To give you some data, my short term proceeds (per Fidelity) was $2,580.68 and the long term was $29,135.74. The Initial basis was $22,705, Basis Adjustment was $-26,222 so the basis was $-3,517. Recapture was $9,574 and AMT Gain/Loss Adjustment was $-734.

Also TT Note on K-1 says "Enter the 1099-B on Schedule D, checking the box A or B." This doesn't make sense as Fidelity reports the Short Term Proceeds as "Box B" and the Long Term proceeds as "Box E"

Further guidance is MOST appreciated.

Ken

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UGI's acquisition of AmeriGas APU in 2019 - how to handle this complex series of events for tax purposes?

@skhilko thank you. Man for the few grand I made on MLPs this reporting hassle is definitively NOT worth the risk of some bureaucrat going after one's ass just to prove a point. The amount of subjective elements in the entire equation is overwhelming. This isn't how "the rich" do it - I guarantee it LOL

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UGI's acquisition of AmeriGas APU in 2019 - how to handle this complex series of events for tax purposes?

@skhilko I know this is self explanatory but just to be sure on the 1099-B; the corrected basis is entered as a positive number NOT a negative number, yes? The form does the subtraction internally so to speak? For example just as we previously clarified what is entered into 7(b) "Corrected basis, if applies" is the basis straight from box 6 of the final K-1 sales schedule and both numbers are positive, NOT negative? My example shows that. Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UGI's acquisition of AmeriGas APU in 2019 - how to handle this complex series of events for tax purposes?

@Boyan Yes, the basis should be entered as it is reported on K-1, not negative. The program will subtract that basis from the sale price to calculate your capital gain. You can verify the capital gain on Schedule D.

In my example on Schedule D line 9: 2,607 - 640 = 1,967. Where 640 is the corrected cost basis from K-1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UGI's acquisition of AmeriGas APU in 2019 - how to handle this complex series of events for tax purposes?

Sorry, @sansouci don't know how to help with your situation and the negative basis as a long-time holder.

Regarding "Enter the 1099-B on Schedule D, checking the box A or B.". I also noticed that they only mention A or B. I think that's just incorrect messaging.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UGI's acquisition of AmeriGas APU in 2019 - how to handle this complex series of events for tax purposes?

That conflicts with the tax schedule provided by the Partnership with the purchase price of 22,705 minus the "Cumulative Adjustments to Basis" of $-26,222 leaving a cost basis of $-3,517. I will find an accountant to see how this should be reported.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UGI's acquisition of AmeriGas APU in 2019 - how to handle this complex series of events for tax purposes?

@sansouci hey I think I could make a suggestion, your case is clearly more complex than the common issue with UGI merger that I discussed with @skhilko here; we both had the easiest task on our hands: complete disposition of all-long units. For the negative basis question I would ask one of the masters on this 14 page long chain How to record MLP sale I hope you can get helpful replies there or the answer may already be hidden in those pages, I vaguely remember seeing negative basis being discussed. Hope that's helpful!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Fliparagon1

Level 1

angelaboone

New Member

cparke3

Level 4

FoxyLoxy

Level 2

wokndadog

Returning Member