- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

@Boyan, thank you for the detailed explanation. The duplicated gains (losses) on 1099-B and K-1 seems to be a well discussed topic here on TT forum. I've spent several days reading through different suggestions and trying to understand what is the best approach.

The main goal is two-fold:

- Adjust the cost basis reported on 1099-B with the information on K-1 sales schedule.

- Exclude the ordinary gain (loss) reported on K-1 from the capital gain reported on 1099-B.

As many people suggest here, the deletion of the sale information reported by the broker on 1099-B accomplishes that. The K-1 sale interview produces the correctly adjusted capital gains as well as captures the ordinary gain (loss). However, the approach didn't feel quite right to me, so I kept searching.

I've found the solution designed by TT buried in the help documentation to the K-1 sale interview. If you right click on the Sale Price input (the one you've highlighted on the last screenshot with "box 3 from final sales schedule") and select "About Part II Line 5" option in the drop-down menu, you'll find the following:

Line 5 - Sales priceEnter the selling price of the interest. For abandonments, enter zero. For liquidations, enter the value of the assets received. NOTE: If this is a disposition of a publicly traded partnership (PTP) or a master limited partnership (MLP) that was reported on a Form 1099-B, enter zero for both the sales price and the basis on lines 5 and 7 here and report the sale as normal on Schedule D, checking the appropriate "Reported on 1099-B" Box A or Box B. By reporting the sale of the PTP or MLP on Schedule D and entering zero as the sales price and basis on this K-1 Worksheet, the disposition will get processed correctly throughout the return.

I did what's suggested there:

- K-1 Sales Interview: Entered $0 in Sale Price and Partnership Basis.

- K-1 Sales Interview: Entered $1,133 in Ordinary Gain. This value is taken from K-1 sales schedule column 7 (Gain subject to recapture as ordinary income).

- 1099-B imported from the broker: Entered $640 in Corrected cost basis. That can be done by clicking edit on the sale transaction in 1099-B instead of deleting it. The field is on the second step. This value is taken from K-1 sales schedule column 6 (Cost Basis).

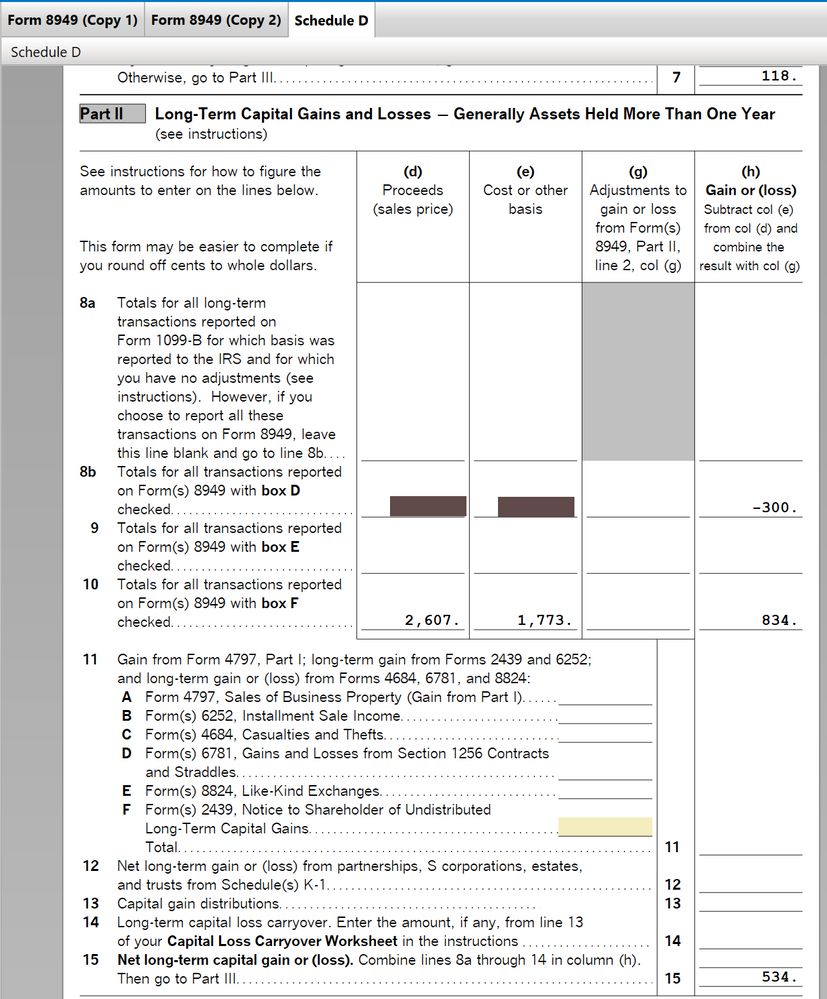

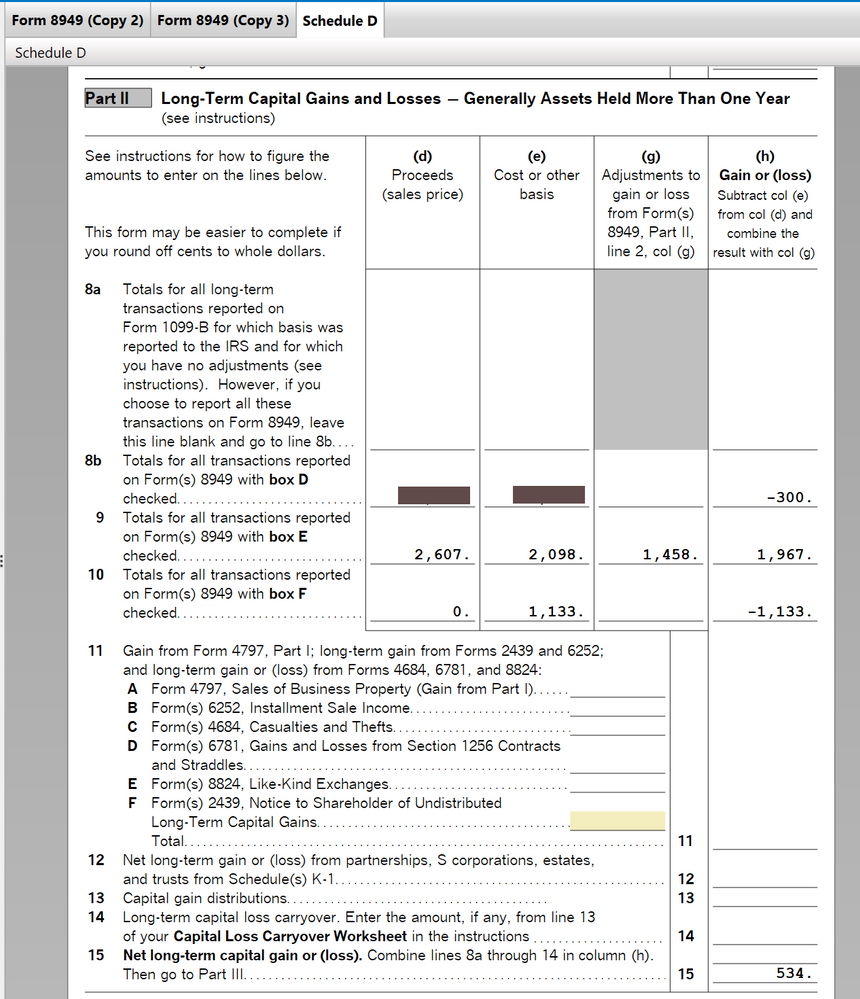

That results in the correct capital gains adjusted with the ordinary gain on Schedule D. Check lines 9, 10 and 15 on the attached screenshots. The refund value is also the same as in the first approach.

Deleted 1099-B sale

Zero Sale Price and Partnership Basis in K-1

As you can see, 1,133.00 ordinary gain is correctly subtracted from the capital gains.

I will use the approach suggested in TT documentation. I hope this can be helpful to anyone looking for a solution.