- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

@skhilko this is the very first time that right-click has ever been mentioned by anyone. It appears that TT has taken under account the issue - just never exposed the directions clearly. Thank you. I think what you have uncovered is a major breakthrough in the process. Thank you! Basically if I may summarize the official TT approach which you have uncovered (correct me for the benefit of anyone else here):

Capital gains are handled by the brokerage 1099-B which does require end-user edit based on the final K1 sales schedule. Nobody needs to "delete" the brokerage 1099-B, just edit the basis. In the case where we have many 1099-B transactions the "delete it all" just will not work for the modest investor.

Ordinary gains are handled by the K1 interview by means of the generated 8949 which addresses ordinary gains ONLY

So what you have uncovered is how to BLOCK the final K1 interview from generating capital gains (entering ZERO for both selling price and basis) so it only auto-generates 8949 for the ordinary gains and also releases the suspended losses just as you illustrated!

One clarifying question: when you edited the basis in the brokerage imported 1099-B did you copy the number from box 6 of the final K1 sales schedule? Also for the benefit of everyone else reading this can you share your APU final sales schedule (like one I posted so the numbers add up accurately)

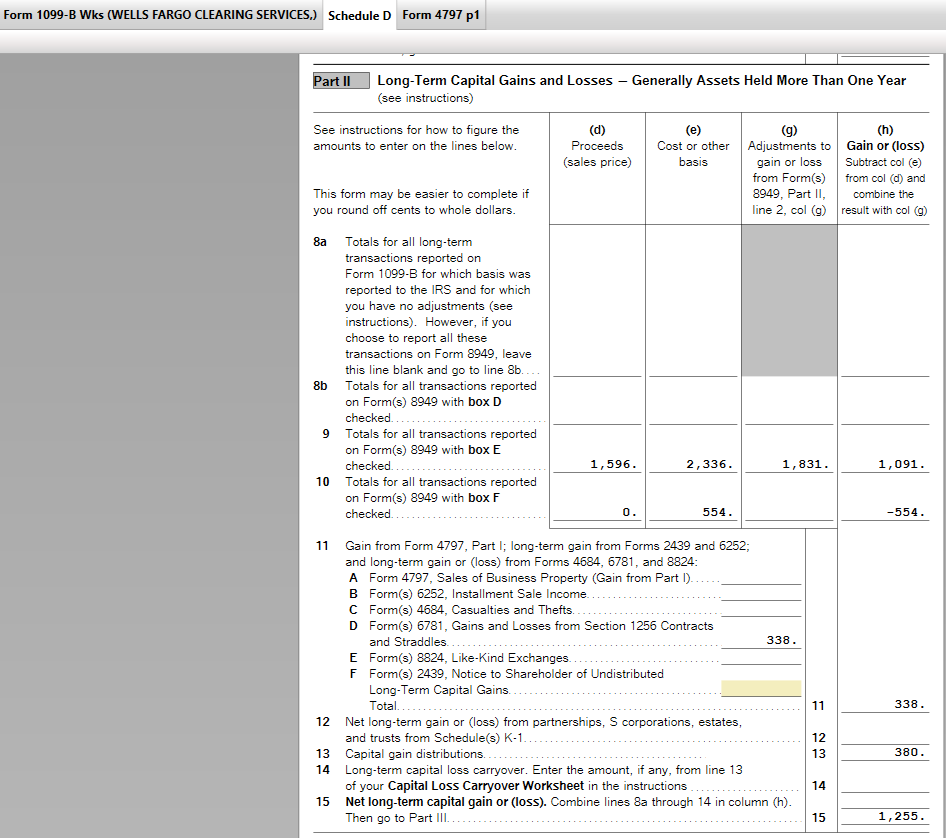

This is some awesome work man! Anyway my Schedule D does look good when I test both ways just as you did and that confirms that the right-lick TT instructions are credible (ignore my 1256 and S-Corp distributions line 13, the math works out about APU with Box E and F reported correctly on Schedule D).