- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

@skhilko hey so my 8949 (Wells Advisers) only reports one event related to this transaction -- total sale and as we know the numbers are wrong since it doesn't take under account the final sale schedule (provided by Tax Package Support) which reflect the accurate basis. So in summary, yes I do agree that "APU K-1 is saying that the transaction should be treated as if the units were sold" and I will prepare my TT taxes based on that: complete disposition of APU.

The only other related transaction shown on my 8949 (Wells Advisers) is the "cash in lieu of" kick back and I will leave that as is. However I will delete the APU sale from the my 8949 (Wells Advisers) and then let the K1 interview generate another 8949 based on the K1's final sales schedule. So I ended up with two forms 8949; one which the K1 generated with just the APU sale and the other 8949 from Wells with all other stock transactions during 2019. Reading the forums having two 8949s is perfectly permissible.

At the end of the day I expect to owe some tax for the recapture but all the suspended losses that the final sale will release will somewhat or mostly off-set the recapture tax liability.

I've been tracking the forums ever since August 2019 when the merger happened in anticipation of my taxes and so far what I described appears to be the general consensus.

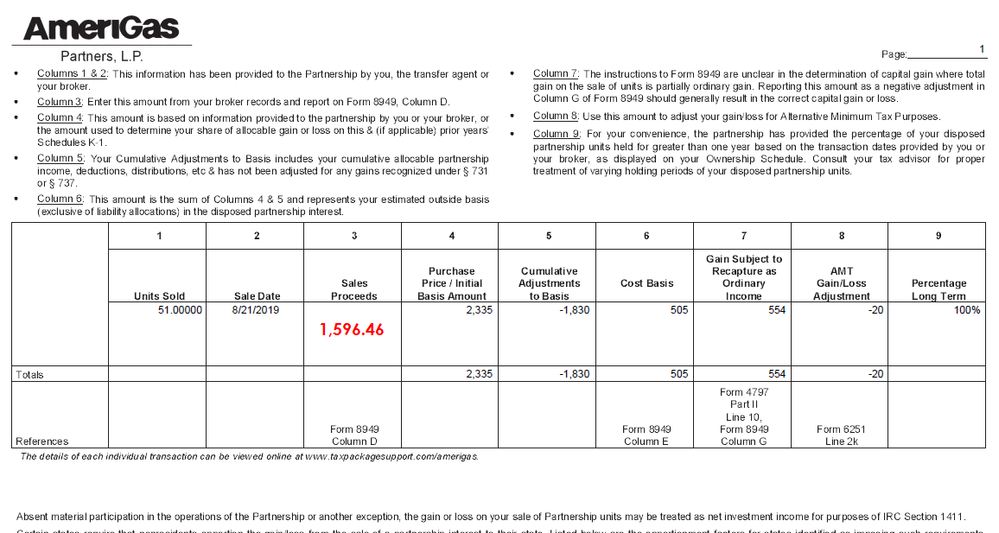

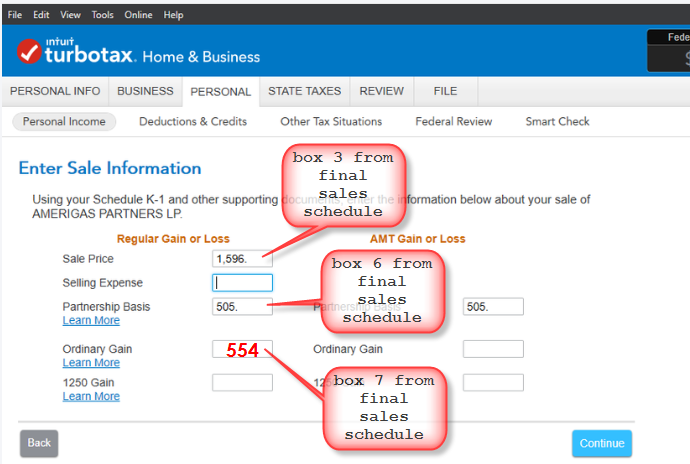

So I hope this is helpful to the rest of the APU affected investors. Here's what my final schedule showed and next, here's what I plugged into TT K1 final disposition interview. Don't quote me. You're on your own in terms of risks, this just my interpretation how it's supposed to work and I'm sharing it for the greater good in this total gray mush of rules and uncertainty: