- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Transfer of Rental Property from Personal name to an LLC in Texas

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Transfer of Rental Property from Personal name to an LLC in Texas

I have owned a rental property in Texas under my name since 2018, and I have been including it in my individual tax return using Schedule E (Form 1040) with TurboTax. Recently, I formed an LLC in Texas with my wife and I'm considering transferring the rental property from myself to this LLC. In Texas, when an LLC has both spouses as members, it is treated as a single member LLC or a disregarded entity.

Considering the information above, I have several questions regarding the tax implications and complexities when I file my return in 2024 for the year 2023:

Does TurboTax provide a provision to facilitate this switch? I'm particularly concerned about handling the depreciation aspect.

What challenges might arise during this process?

How can I plan ahead to smoothly execute this change within TurboTax?

I have been using TurboTax for my tax returns for more than 15 years, and I prefer to continue using it rather than working through a CPA for my taxes next year.

Please help.

Regards

Sangeet

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Transfer of Rental Property from Personal name to an LLC in Texas

All of your questions will be answered the same way ... there is NO change as to how this will be filed on your tax return. You will continue to file this on the Sch E on the personal return as long as you do NOT incorporate the LLC or register it as a Partnership with the IRS. Personally this step is really a waste of time, effort and money. There is no difference between having the rental in an LLC with a good liability insurance policy and not having the rental in an LLC with a good liability policy. Seriously ... don't get sucked into the hype/fantasy of having an LLC ... it is only a state desination (not a federal one) that does nothing more to protect you then a good liability policy which is the only thing that will actually save your butt.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Transfer of Rental Property from Personal name to an LLC in Texas

Thanks for your help. With IRS this company is registered as sole member.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Transfer of Rental Property from Personal name to an LLC in Texas

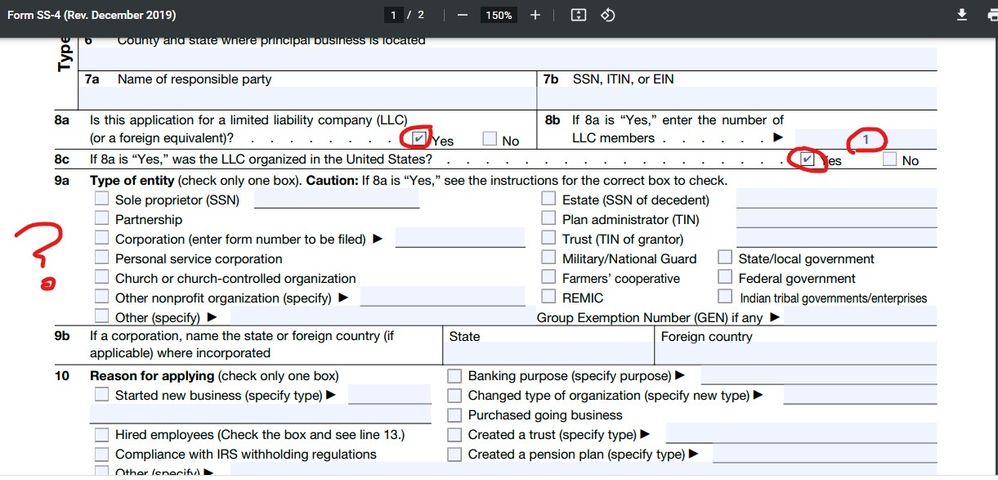

Ok ... so you already got the EIN for the LLC as a single member then you filled in the SS-4 form boxes 8a,8b, 8c but what did you choose for box 9?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Transfer of Rental Property from Personal name to an LLC in Texas

Yes, this is an old LLC that I had formed last year but till date has no activity. I was thinking about moving the rental property to this LLC as I already have it.

I did not fill the physical version of the SS-4 form as I did everything online. I'm 99% sure that I clicked on "Sole Proprietor". Is there a way I can get this information online? Like download the information that I had filled ? I tried to get this information online but did not find anything.

Regards

Sangeet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Transfer of Rental Property from Personal name to an LLC in Texas

Ok... Did you NOT save the SS-4 application you filled in at any time ? You had the option before you finished. Once done they give you the option to get the final paperwork buy mail or you could have downloaded it. That notice would give you the EIN & the information on what you need to file and when. If you choose the Sole Prop in error then you will simply NOT use that EIN for any reason. Start the SS-4 again and get an EIN for the LLC correctly if you insist on getting a number you have no need to have.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Transfer of Rental Property from Personal name to an LLC in Texas

Sorry please ignore earlier msg.

I searched my PC and found this. This is how I had filled up application. Please see below picture.

- The first question system asks is what type of what type of legal entity is applying for EIN - To this I said LLC. - - The next question is "How many members" and I put 2 (me and my wife).

- Next question is "which state" and I put Texas.

- The next question was whether the 2 members are "Husband and wife" and I said "yes".

- Once I said "yes" I got following screen and I selected "we elect to be classified as single member LLC"

Please see bottom part of the image explaining the tax filing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Transfer of Rental Property from Personal name to an LLC in Texas

Just providing some clarification, along with a "heads up" on possible issues you may experience down the road.

I formed an LLC in Texas with my wife

The above statement conflicts with the statement in your 2nd post which reads;

With IRS this company is registered as sole member.

So you did not form any type of company with your spouse, or anyone else. What you have is a single member LLC that you, and you alone are the owner of. This changing nothing what-so-ever in how you report your rental income/expenses on your tax return. If rental property is the only thing the LLC will own, then you have no need to file SCH C at all. All rental income/expenses continues to be reported on SCH E, as you have been doing in prior years.

The above is assuming you do not/did not file IRS form 2553 to have your LLC treated "like an S-Corp", or IRS form 8832 to have your LLC treated "like a C-Corp" *for tax purposes only*.

Now for the heads-up on potential problems this could cause.

If you have a mortgage on the property (I assume you do) then typically you can't change anything on the deed for that property as registered with your county, without the written permission of the lender. Also typically, lenders will not give that permission either. Do so, could very well be in violation of your mortgage terms. While the lender may not find out about it immediately, they will most definitely find out when they (or the excrow account manager) receives your property tax bill and/or property insurance bill. When the lender files out, they typically give you a fixed period of time (usually 30 days) to "make it right" or pay the full balance of the mortgage immediately.

Also, when you change the ownership of the property you'll need to notify the property insurance provider if you want to keep your property insurance valid.

Now most folks do this because of what they refer to as "added protection" it provides if a tenant sues the landlord. Being the owner of 3 rental properties myself, it makes no sense for me to jump through hoops, when it;s a whole lot cheaper and a lot less hassle to just increase my liability coverage from the standard $300K to a full $1M. The insurance increase for the added liability coverage was around $150 a year. A one time deal and I'm done with it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Transfer of Rental Property from Personal name to an LLC in Texas

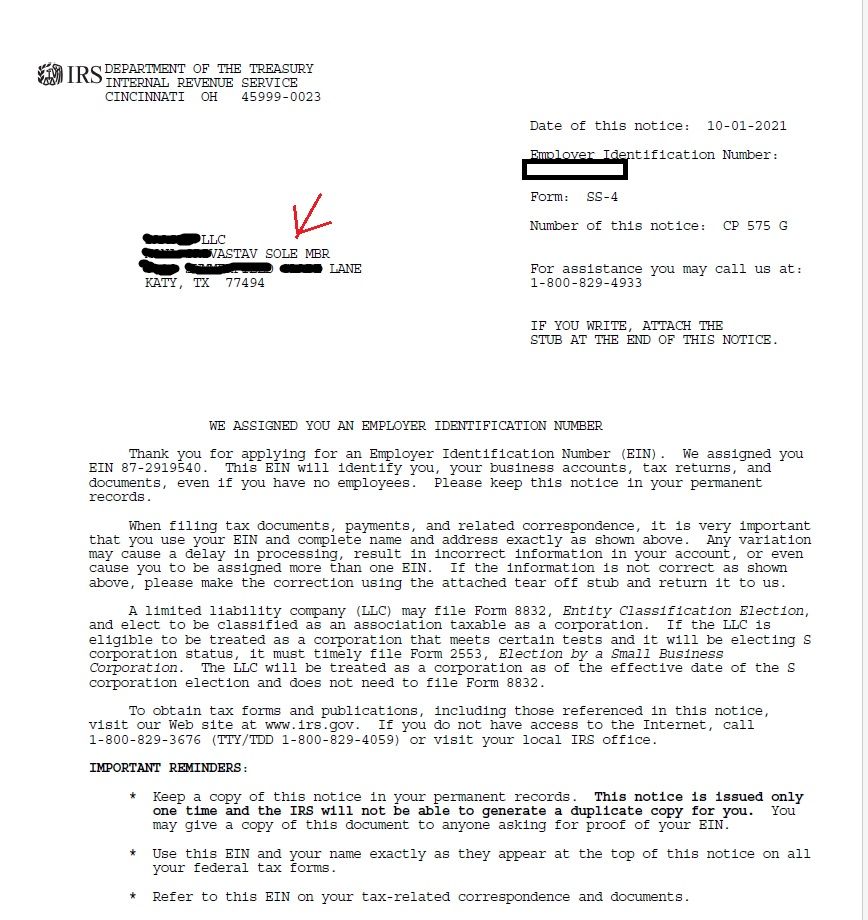

Thank you for your prompt response and exceptional guidance. Upon reviewing my IRS EIN documents, I can re-confirm that my company is registered as a "sole Member," which, in the case of a husband and wife in Texas, can be considered as having two members. I have attached a picture of the EIN acknowledgement I received from the IRS after submitting my online application. This pertains to matters concerning the IRS and EIN.

In regard to the registration of my LLC with the Texas Secretary of State, my company is registered with two members. Member 1 is my wife, and member 2 is myself. If you could provide me with an email address, I would be happy to share the certificate of formation documents for your review. To be honest, no one has explained all of this to me in such detail before. I genuinely appreciate your assistance and guidance in this matter.

Now, concerning Form 2553 and/or 8832, I can confirm that I do not file these forms.

Regarding the mortgage, I can confirm that there are no outstanding payments. The property has been fully paid for.

The reason I am pursuing this is to protect my personal assets, investments, and other businesses. I believe I need to seriously reconsider your suggestion regarding increasing the liability limit and go with that.

I have one question: Even if I increase the liability to 1 million dollars, if the property is under my name, could the tenant not come after me and attempt to access my hard-earned money? From what I have gathered, having the LLC would prevent the tenant from targeting my personal assets and other businesses. Frankly, the more research I conduct, the more confused I become.

.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Transfer of Rental Property from Personal name to an LLC in Texas

OK ... you are NOT a sole prop ... you are a single member LLC which can file a Sch C, Sch E or Sch F. DONE... you will continue to file the same Sch E as you always have done in the past. The LLC is a DISREGUARDED entity and is really totally useless for "protection" purposes if that is why you did it as I mentioned before ... get a really good liability insurance policy in case you are sued. Trying to veil the property from your other assets using an LLC that is not incorporated is totally useless.

Technically you should have done a multimember LLC and filed a partnership however once again totally useless and a waste of time, energy and money as you would have had to file a separate partnership return. Please stop where you are.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Transfer of Rental Property from Personal name to an LLC in Texas

Thanks for your help.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

SB2013

Level 2

Idealsol

New Member

user17550205713

Returning Member

eric6688

Level 2

user17523314011

Returning Member