- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

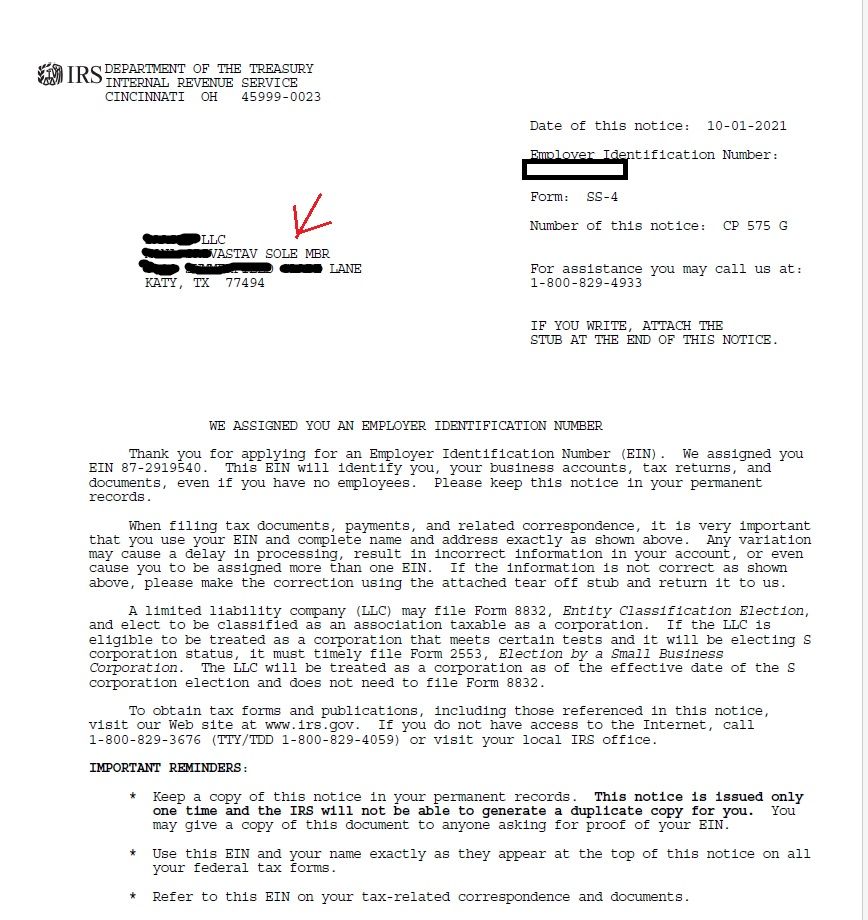

Thank you for your prompt response and exceptional guidance. Upon reviewing my IRS EIN documents, I can re-confirm that my company is registered as a "sole Member," which, in the case of a husband and wife in Texas, can be considered as having two members. I have attached a picture of the EIN acknowledgement I received from the IRS after submitting my online application. This pertains to matters concerning the IRS and EIN.

In regard to the registration of my LLC with the Texas Secretary of State, my company is registered with two members. Member 1 is my wife, and member 2 is myself. If you could provide me with an email address, I would be happy to share the certificate of formation documents for your review. To be honest, no one has explained all of this to me in such detail before. I genuinely appreciate your assistance and guidance in this matter.

Now, concerning Form 2553 and/or 8832, I can confirm that I do not file these forms.

Regarding the mortgage, I can confirm that there are no outstanding payments. The property has been fully paid for.

The reason I am pursuing this is to protect my personal assets, investments, and other businesses. I believe I need to seriously reconsider your suggestion regarding increasing the liability limit and go with that.

I have one question: Even if I increase the liability to 1 million dollars, if the property is under my name, could the tenant not come after me and attempt to access my hard-earned money? From what I have gathered, having the LLC would prevent the tenant from targeting my personal assets and other businesses. Frankly, the more research I conduct, the more confused I become.

.