- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: To enter Passive Activity Loss Carryovers from a Prior Ye...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Where do I enter prior year passive losses on rental property?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Where do I enter prior year passive losses on rental property?

To enter Passive Activity Loss Carryovers from a Prior Year for your Rental Property in TurboTax Premier:

- Click the Federal Taxes tab

- Click Wages & Income

- Scroll down to the Rental Properties and Royalties section

- Click the blue Show More in this section

- Click Start (or Revisit) next to Rental Properties and Royalties (Sch E)

- Click Yes

- Click Continue

- Click the blue Edit button next to the rental you'd like to add info for

- Click Continue until you reach the screen entitled Do any of these situations apply to this property?

- Scroll to the bottom of this page and check the box next to I have passive activity real estate losses carried over from a prior year. (see first attachment for reference)

- Click Continue

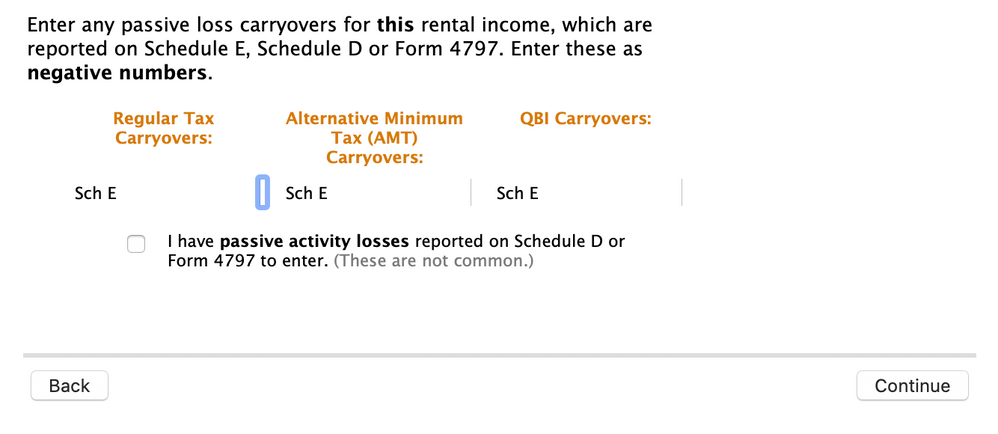

- You'll be able to input the carry over amounts on the next screen (see second attachment for reference)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Where do I enter prior year passive losses on rental property?

I follow the instructions, but at step #12 I was unable to enter an amount.

When I saved my Turbo Tax return from 2018, it was saved as a PDF file. It seems to NOT TRANSFER into the 2019 Home and Business Turbo Tax any of the PAL carryover. Like I mentioned, I am unable to enter the PAL carryover AMOUNT from the 2018 return after step #12. What am I missing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Where do I enter prior year passive losses on rental property?

If you are using the TurboTax Home & Business software, you can add or verify your passive activity loss carryover by following these steps:

- Click on the "Business" tab at the top of the screen and select Continue

- Click "I'll choose what I work on"

- Select Update next to Rental Properties and Royalties and then select Yes

- Answer the questions and select Continue. Then select Edit next to your rental property

- Select Update next to Property Profile. Continue through the screens until you get to the section "Do Any of These Situations Apply to This Property?"

- Click on the option "I have passive activity real estate losses carried over from a prior year" See screenshot below.

7. Select Continue and the next screen "Passive Losses from Prior Years" allows you to enter your passive activity loss carryover from 2018. See screenshot below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Where do I enter prior year passive losses on rental property?

I've gotten to that point, the problem is...the program does not allow me to actually enter a number at step #7. There is no box that opens up to allow a figure to be entered. I have the amount from last year's PDF file. It's just frustrating not being able to show it.

Is there a fix/update to the program forthcoming?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Where do I enter prior year passive losses on rental property?

No manual entries are permitted on form 8582 where you will find details of carryovers. You will have to enter any carryover information in schedule E.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Where do I enter prior year passive losses on rental property?

How do you make the entry (reflecting PAL carryover) on Schedule E.

Previous instructions would not allow an amount to be entered as the box would not open.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Where do I enter prior year passive losses on rental property?

Try to enter the Passive Activity Losses directly on the Schedule E Worksheet in "Forms" mode. Here are the steps:

1. Click on Forms in the upper right-hand corner of the screen

2. Scroll down on the "Forms in my return" column on left-hand side of the screen and click on "Schedule E Wks" for your rental property.

3. Scroll all the way down on the "Schedule E worksheet" until you get to "Carryovers to 2019 Smart Worksheet." Enter your passive activity losses on line G, Schedule E Suspended Loss.

Note: Please be sure to enter the passive activity loss as a negative amount.

4. Click on "Step-by-Step" in the upper right-hand corner of the screen

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Where do I enter prior year passive losses on rental property?

Thank you, BarbaraW22!!!

Those instructions worked!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Where do I enter prior year passive losses on rental property?

There appears to be some kind of glitch in the 2019 Mac software that prevents the input boxes from displaying correctly. You can actually enter numbers only in the AMT Carryovers block where the blue is below in the picture but you won't be able to see the numbers on the screen....but you can see it in Worksheets. I actually paged through the screen dozens of times and the boxes displayed one time correctly for both AMT and regular carryovers. I could not get them both to show correctly again. Took me a while to figure out what was going on. Best way is to enter directly on the Schedule E Worksheet as shown to ensure it is correct....Thank You!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Where do I enter prior year passive losses on rental property?

I am using turbo tax business partnership to generate the 1065 and K1 for my own husband wife rental property LLC.

Where can I enter the last year suspended passive loss as a carryover in 1065 or some other forms ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Where do I enter prior year passive losses on rental property?

Please click the link below for this answer from BarbaraW22:

If you are using the TurboTax Home & Business software, you can add or verify your passive activity loss carryover by following these steps:

- Click on the "Business" tab at the top of the screen and select Continue

- Click "I'll choose what I work on"

- Select Update next to Rental Properties and Royalties and then select Yes

- Answer the questions and select Continue. Then select Edit next to your rental property

- Select Update next to Property Profile. Continue through the screens until you get to the section "Do Any of These Situations Apply to This Property?"

- Click on the option "I have passive activity real estate losses carried over from a prior year"

- Select Continue and the next screen "Passive Losses from Prior Years" allows you to enter your passive activity loss carryover from 2018.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Where do I enter prior year passive losses on rental property?

I am on Turbo Tax Premier. On the sale of rental property I have prior years unallowed loses. Where do I enter them? It will not let me type it in on the worksheet. Can’t find it paging thru.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Where do I enter prior year passive losses on rental property?

If you used TurboTax last year, the carryover should be entered for you, but check your Schedule E Wks - Carryforward from last year for an amount.

If you didn't use TurboTax last year, check last year's Form 8582, Page 2 for an amount.

Click this link for info on How to Enter Passive Loss Carryover.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Where do I enter prior year passive losses on rental property?

I know the amount, that’s not the question. I need to know exactly where to enter the prior years passive loss carryover on the sale of the property.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dinesh_grad

New Member

HNKDZ

Returning Member

yingmin

Level 1

ilenearg

Level 2

user17524270358

New Member