- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Sale of second home

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

It is possible to switch from the Online Version to the CD/Desktop version. See this article:

Switch from Online to Desktop/CD

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

Those screen shots are not what I see in the 2020 Home and Business. That is what was available last year in the 2019 software. I have completed all updates and kept hoping it would change. I am using a Macbook.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

My residence is Florida and I owned a home in Alabama. In 2020 I sold the Alabama home. How do i report the sale to Alabama since I do not normally file a state return for Ala?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

Nonresidents

The taxpayer as a nonresident of Alabama must file an Alabama state tax return if he or she received taxable income from an Alabama source or performed services within Alabama and the gross Alabama income exceeds the allowable personal exemption. The personal exemption is prorated based on the amount of Alabama income compared to the amount of federal income.

When you file your return, you will be asked if you made money in any other state. Answer yes and file the nonresident AL return, with only the sale of the house included.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

I have TT Premier Where do i report the sale of a personal cabin at a profit? Schedule D

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

Yes, it will be reported on Schedule D. A second home sale is reported as an investment sale for tax purposes. A gain will be taxable but a loss would not be allowed due to personal use of the property.

To report your second home sale you can use the steps outlined here.

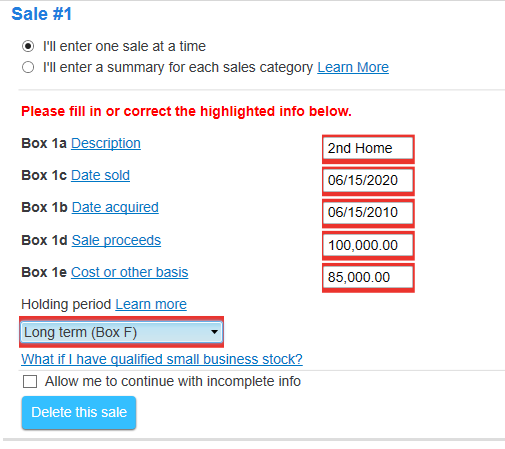

As you go through the sale of your second home, there is a dropdown to select 'second home' (see the image below). Also you likely did select the correct box to enter the sale after you select Stocks, Mutual Funds, Bonds, Other (1099-B), be sure you selected the 'Other' box (see image below).

The second home sale can be entered into TurboTax CD or Desktop version by following the steps below.

- Open your TurboTax account > Select the Personal tab then Personal Income > I'll choose what I want to work on

- Scroll to Investment Income > Select Stocks, Mutual Funds, Bonds, Other > Start or Update

- Add or Edit your sale that is NOT reported on a Form 1099-B > Select to enter a summary of each sale (you only have one)

- Enter the Total Proceeds > Cost Basis (includes any capital improvements while you owned the property)

- Enter the holding period - if you owned the property for more than one year the it is long term, one year or less is short term

- Continue to finish your sale.

The gain from the sale will be fully taxable because a second home is not eligible for the home sale exclusion. See the image below for assistance. Whether you specifically select Second Home is not relevant for the tax return itself.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

I feel your dissatisfaction with TT. I'm a Deluxe man myself, and they totally botched Deluxe this year.

The Answer us YES, 1099B Treat it as an investment. I think I entered "Sale of 2nd home" in the space where we are supposed to enter the name of a company or stock, et al. I just entered cost ( including improvements), net sale proceeds, not gross sale price, and then the Net Net.

That 's what I did. Hope it works for you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

Yes, you actually should enter the address of the real property being sold in the column for the name of the item sold.

Enter your adjusted basis in the cost basis column (adjusted by appropriate closing costs at purchase and sale).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

How do I file for taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

You can enter the information regarding the sale of a second home in the investment section of TurboTax.

Note: To report investment sales, you’ll have to use TurboTax Premier, TurboTax Self-Employed, or TurboTax Home & Business.

Here is a link to a thread with more instructions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

@ReneeM7122 What confuses everyone is that experts keep referring to instructions that no longer match the software. In TurboTax Deluxe Desktop edition, there is no longer a way to "Select Second Home" per your linked instructions. The application just generically wants you to enter the home sale numbers and related data using screens that really look like they were designed to capture a stock investment sale. Will it work? I guess. But Intuit should really stop giving guidance like the software is obviously set up for the entry of second home sale data.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

@PaunchyPirate wrote:

@ReneeM7122 What confuses everyone is that experts keep referring to instructions that no longer match the software. In TurboTax Deluxe Desktop edition, there is no longer a way to "Select Second Home" per your linked instructions.

Actually, the problem is that there are two sets of instructions; one for the online versions of TurboTax and another for the desktop versions.

If anything is learned from this experience, hopefully it is that the developers need to maintain consistency across versions and platforms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

It works for me. Two notes,

I put "Sale of second home" in the non-1099-B wizard description field. It shows up in the generated form 8949 column (a) Description of Property.

It puts code E in column (f) for adjustment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

So...let's complicate this even further. I received a 1099-S. I see I can enter the sale of my second home in Investments section as a capital gain like any other "stock" transaction, but I can also enter the 1099-S in the "Less Common Income" section and "Sale of a home (gain or loss)" section at the end of the income transactions. I realize that this section is more for the sale of a first home, but it is the only section for entering a 1099-S.

The tax difference is huge!! If I treat it as an investment, and capital gain, I will owe $3,300 in taxes. If I enter the 1099-S in Sale of a Home, my taxes go from paying $3,300 to getting a refund of $3,300. It seems the difference is living in the house for 24 months during a five year period, which I did.

I need help! Can I enter the transaction as my 1099-S or do I have to enter it as an investment??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

@tecoulter wrote:I need help! Can I enter the transaction as my 1099-S or do I have to enter it as an investment??

If you owned and used the home as your main home for a period aggregating at least two years out of the five years prior to its date of sale, then you should qualify for the home sale exclusion.

See https://www.irs.gov/taxtopics/tc701

If that is the case, then you should enter the transaction under Sale of Home.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

risman

New Member

Viking99

Level 2

littlelindsylue

New Member

sam992116

Level 4

sam992116

Level 4