- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Sale of second home

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

My screenshot is from the online program. You will not see it in the Desktop version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

So what do I do about the sale of a second home if I have the desktop version? Will this be fixed soon?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

Please see the conversation in this LINK. Another user has found a solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

Unfortunately I don't believe that is a fix if you received a 1099-S on the sale, and won't allow to record exceptions to the 2/5 year rule. IRS will flag for an audit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

The 2/5 rule applies to your principal residence, and not a second home.

In the CD/Download version of TurboTax, you can report the sale of a second home and list the sales expenses separately by using these steps:

- Open or continue your return in TurboTax.

- In the Search box, enter sold second home and select the Jump to link in the search results.

- Answer Yes on the Did you sell any investments in 2020? screen.

- Answer No on the “Did you get a 1099-B or a brokerage statement for these sales?” screen.

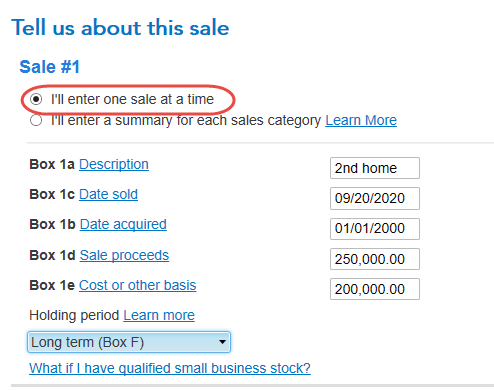

- The next screen is “Tell us about this sale”. Mark the radio button next to I’ll enter one sale at a time

- On the screen, Tell us about this sale, enter the total sales proceeds as well as the other information requested. [See Screenshot #1, below.]

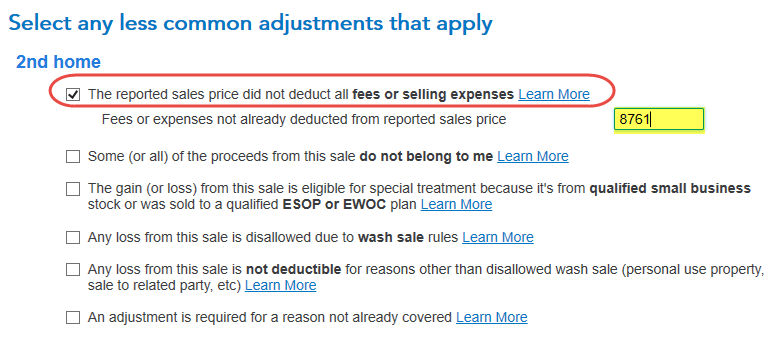

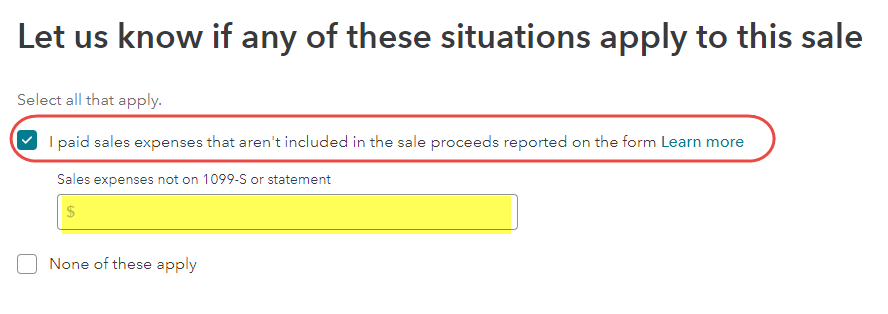

- Continue to the screen, Select any less common adjustments that apply. (In TurboTax Online: Let us know if any of these situations apply to this sale)

- Mark the first box The reported sales price did not deduct all fees or selling expenses. [Screenshot #2] (In TurboTax Online: I paid sales expenses that aren't included in the sale proceeds reported on the form.) [Screenshot #3]

- Enter the sales expenses not deducted from the sales price entered earlier.

SCREENSHOT #1

SCREENSHOT #2

SCREENSHOT #3

@cracomb

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

I received form 1099-S from a Title Agency. Is there an IRS form that I need to complete??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

Yes, you need to enter the information in the return. It will be entered on Form 8949 and Schedule D. You may be able to exclude the gain if this was your main home. A loss is not deductible.

How your sale qualifies. Your sale qualifies for exclusion of $250,000 gain ($500,000 if married filing jointly) if all of the following requirements are met.

- You owned the home and used it as your main home during at least 2 of the last 5 years before the date of sale.

- You didn’t acquire the home through a like-kind exchange (also known as a 1031 exchange), during the past 5 years.

- You didn’t claim any exclusion for the sale of a home that occurred during a 2-year period ending on the date of the sale of the home, the gain from which you now want to exclude.

To enter the sale:

- Click on Federal Taxes (Personal using Home and Business)

- Click on Wages and Income (Personal Income using Home and Business)

- Click on I'll choose what I work on

- Scroll down to Less Common Income

- On Sale of Home (gain or loss), click the start or update button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

@pws37 If what you sold is a second home, or investment property, then you need to enter the sale in the Investment Income section of the program, the same as if you sold a stock, mutual fund, or other type of investment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

HI Irene2805,

I entered data in SS#1 just fine. BUT I do not get SS#2 as you posted. My SS#2 looks like below. What do I do? How do I get your SS#2?

thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

I'm having the same problem as the others, but thanks to the answers given, I think I can plow through my federal return. My problem is that I sold a second home in SC, and as a non-resident, the 7% capital gains tax is withheld at closing. I have not figured out a way to account for this in my SC return and now it says I owe them money, even though I (over)paid at closing. Any help would be appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

Where in Turbo Tax Deluxe is the page you displayed 3 weeks ago(maybe above) regarding the sale of a second home. I can't find that page , any input screens like the ones you 'allude' to anywhere. This is a total let down by Intuit. I've been singing Turbo

Tax's praises for 15+ years. So far, this year is a total waste.

Alan McD

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

Read the entire thread. SOME of the screenshots are from the online (web based) version of TurboTax. If the screenshot specifically refers to a second home, it is from the online version. If you’re using the CD or downloadable version you install on a computer, that version no longer has a process specific to a second home. We have been told to use the investment income screens (as if you was old shares of a stock) but answer the question based on your proceeds and basis from the second home sale. It’s kludgy, at best.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

I've figured out how to get to Irene2805 Screen shot #2 which she never did answer back unfortunately.

First you type in Sold Second Home in SEARCH Box and Go directly to the Page.

that is how you get to SS#1.

Hit Continue on SS#1, you will get to the next screen SS#2 (Perhaps this is where you enter your Federal Tax Withheld jwhyres. check with them).

Click Done here to get to next screen SS#3

Check NO on 'is this Sale of employee stock'. Then click Continue

This will bring you to Irene2805 SS#2 in which you can check on 'Report sale price did not deduct all fees or selling expenses. ENTER your Closing Cost, fee, Commissions fee here.

they seem to limit number of pic i can post. So I post only my SS#2 here...

Best of luck everyone . and I totally agree as this is so 'Un-Turbo Tax' like that I used to know and love for so many years!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

Where is that screen shot from. Im using turbo tax premier and that is not on there

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

That screenshot is from the TurboTax CD/Desktop version.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Mbenci318

New Member

Idealsol

New Member

rwsharp21

New Member

joebisog

New Member

charles232

Level 1