- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Sale of Rental Property - When Property Purchased an Incorrect Purchase Price Was Entered in TT

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property - When Property Purchased an Incorrect Purchase Price Was Entered in TT

When I originally entered the purchase price in TT of my rental property that was purchased in 2014 I entered and incorrect amount which is $12,000 less than it should have been. I sold the property in 2022. How do I adjust the cost basis when entering the sale of the property in TT. I have computed the amount of additional depreciation that should have been taken each year but how do I enter. Is there anything else that I have to consider. I also have fully depreciated improvements/assets. How do I account for them in the sale? Do I add the original expense for them back into the cost basis or because they are fully depreciated do I ignore them?

Thanks for any help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property - When Property Purchased an Incorrect Purchase Price Was Entered in TT

I also have fully depreciated improvements/assets.

If you would have taken the correct depreciation, and the asset(s) would still have been fully depreciated, then your cost basis on that asset is still zero. (not including the land, since land is not depreciated.)

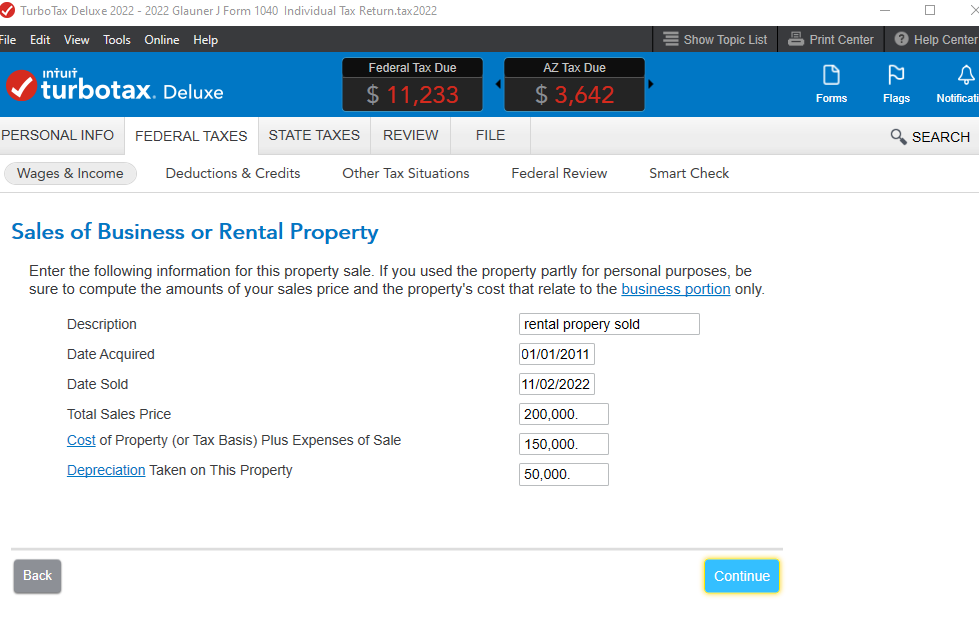

Assuming you do not qualify for the capital gains tax exclusion, you can just report the sale in the Sale of Business Property section. There you can use the correct cost basis. When asked for the depreciation amount, You'll enter the "higher" of the depreciation actually taken, or the depreciation you should have taken. While the capital gain realized will be taxed at the capital gains tax rate, the recaptured depreciation will be taxed at the ordinary income tax rate, which can be anywhere from 0% to a maximum of 25%.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property - When Property Purchased an Incorrect Purchase Price Was Entered in TT

Since you are selling your Rental Property, it would be counterproductive to file Form 3115 with the IRS now. If you stopped renting your property, and it was then vacant for a time before the sale (while you did repairs/improvements, etc.) in the Rental section, indicate that you 'converted the property to personal use' with the date the last renter moved out.

Then report the sale in 'Sale of Business Property'. Search for sale of business property (use this exact phrase—copy/paste if necessary) and then select the Jump to link at the top of your search results.

Add the $12,000 amount to the Cost when reporting the sale (which is the sum of the remaining cost basis, less total depreciation taken, plus sales costs). Add Prior Depreciation and Current Year Depreciation Amounts from Form 4562 for Depreciation Taken, and subtract from Original Cost Basis for Remaining Cost Basis amount.

If the Assets are fully depreciated, there is no basis to add to the sale.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property - When Property Purchased an Incorrect Purchase Price Was Entered in TT

@Carl wouldn't the taxpayer miss out on the additional depreciation deduction?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property - When Property Purchased an Incorrect Purchase Price Was Entered in TT

You say that in a way that gives the impression that depreciation is a permanent deduction, when it's not.

They've already missed out on it, by not having taken it to begin with. They still have to recapture and pay taxes on it, weather they took the depreciation or not. Having sold the property, fixing the past with the 3115 or anything else is just a waste of time, effort and money. That's why I say just recapture what you should have taken, pay the tax (if any) and be done with it.

I have a name for these situations, that I really don't like to use in these forums, because one can easily be offended by it. When communicating in a text based communications media such as this forum, it can be difficult for the poster to invoke the desired emotion in their response, and much easier for the reader to invoke their own opinion about what the emotion intended by the poster.

The name I use is "stupid tax", and I had that term long before Dave Ramsey was around. It's additional tax paid because the payer incorrectly "assumed" they knew better.

We all pay it at one time or another in our lives, and we pay it more than once. But so long as we don't pay it twice for the same thing, it's part of the learning process. I've probably paid more stupid tax in my time than a vast majority of others. So far, (fingers crossed) I haven't paid it for the same dumb thing I've done, twice. Will I pay some other stupid tax in the future? You can count on it. So will everyone else at some point in time.

Warren Buffet has a great story about a stupid tax he paid that was millions. To long a story to share here, and I can't find the link to the podcast where he tells it. It's a conversation between him and Bill Gates. You've probably seen it, but this was probably 10 years ago, give or take.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property - When Property Purchased an Incorrect Purchase Price Was Entered in TT

Just to clarify, the Property was purchased as a rental and was rented until the day I closed which was in 2022. It was never converted for personal use. Can I still report this in Sale of Business Property?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property - When Property Purchased an Incorrect Purchase Price Was Entered in TT

Can I still report this in Sale of Business Property?

Yes, you should since the SCH E section of the program has incorrect numbers in it, combined with the fact that you stated you have already figured the correct numbers.

What you do, is work through the SCH E first. Namely, the assets/depreciation section. You need to convert each asset to personal use, with a conversion date of the closing date of the sale. Then report the sale in the Sale of Business Property section using the correct amounts which you have already done the math to obtain.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property - When Property Purchased an Incorrect Purchase Price Was Entered in TT

How do I handle the question "did you sell this property" I think it is asked when starting schedule E. I said yes, should I change that to no since I will be entering the sale in another area of TT? When I convert the assets to personal use does that include the property itself, in addition to all of the improvements?

Thanks for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property - When Property Purchased an Incorrect Purchase Price Was Entered in TT

Since you're be reporting it in the Sale of Business Property section, when working through the SCH E section do not indicate in that section that you sold it. Instead, indicate that you converted it to personal use with a conversion date of the date you closed on the sale.

Remember, you have to work through each asset also, in the assets/depreciation section of the SCH E and indicate you converted each individual asset to personal use. That is the only way that you can get the total depreciation taken on each asset up to the date of the coversion/sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property - When Property Purchased an Incorrect Purchase Price Was Entered in TT

Carl - Thanks for the help and for answering all of my questions. I know how to proceed and enter into TT now.

Nice to know that there are people out there willing to help on complicated issues. If I get stuck, I will be back.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

VITO_R

Level 1

twde191226

New Member

Itty211

New Member

nickzhm

New Member

jtomeldan

Level 1