- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Since you are selling your Rental Property, it would be counterproductive to file Form 3115 with the IRS now. If you stopped renting your property, and it was then vacant for a time before the sale (while you did repairs/improvements, etc.) in the Rental section, indicate that you 'converted the property to personal use' with the date the last renter moved out.

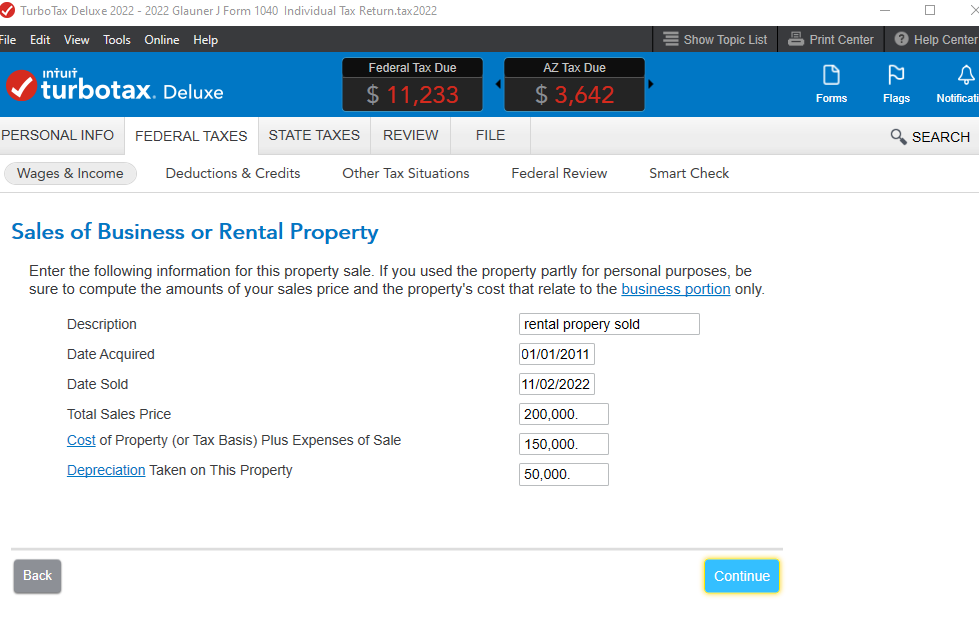

Then report the sale in 'Sale of Business Property'. Search for sale of business property (use this exact phrase—copy/paste if necessary) and then select the Jump to link at the top of your search results.

Add the $12,000 amount to the Cost when reporting the sale (which is the sum of the remaining cost basis, less total depreciation taken, plus sales costs). Add Prior Depreciation and Current Year Depreciation Amounts from Form 4562 for Depreciation Taken, and subtract from Original Cost Basis for Remaining Cost Basis amount.

If the Assets are fully depreciated, there is no basis to add to the sale.

**Mark the post that answers your question by clicking on "Mark as Best Answer"