- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Restricted Stock and Cash Merger

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Restricted Stock and Cash Merger

November 21st 2019 Milacron was acquired by Hillenbrand. They accelerated the vesting schedule for the non-vested RSU's and RSA's and gave cash for these Milacron vested shares at $11.80 per share plus 0.1612 new shares in Hillenbrand for every share in Milacron. The FMV at close for Milacron shares was $16.8391. The Hillenbrand shares at the close of business was 31.26 from form 8937. If you multiply 31.26 x 0.1612 = 5.0391(stock portion). If you had this to the $11.80 (cash portion) + 5.0391=16.8391 the FMV at close of business for Milacron.

So I have two questions:

1) How do I enter this into Turbotax, I don't seem to be able to find the right place in the step by step interview.

2) Would there be any gain or loss as the cash and stock portion appear to balance each other out?

The way Turbotax has calculated this right now is showing a capital gain loss because the Milacron FMV was originally $16.8391 per share but the net proceeds on 1099B is showing the cash portion only $11.80 so it shows a capital loss of 5.0391 per share.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Restricted Stock and Cash Merger

"The FMV at close for Milacron shares was $16.8391."

I'm not sure exactly where that number is coming from. The relevant number for you is the "fair market value" used by your employer to calculate the compensation created by the (accelerated) vesting of the RSUs and RSAs. If the $16.8391 you've posted is the same as the FMV used by the employer, then all's good.

"1) How do I enter this into Turbotax, I don't seem to be able to find the right place in the step by step interview."

You don't need to use the RSU/RSA "guided" interviews if the compensation created by the vestings is properly reported on your W-2, and I assume it is. There is no "Income Tax Return Reporting Requirement" to use these guided interviews as, generally, nothing on Form 8949 (where security trades are reported) or anywhere else in your income tax return states "this is how I acquired the stock that I sold." You simply use the "regular" 1099-B entry form, and then correct the incorrect basis reported by the broker using the mechanism provided by TurboTax to do so. (In the desktop versions you click on the blue "I'll enter additional info on my own" button and then enter the correct basis in the "Corrected basis box."

"2) Would there be any gain or loss as the cash and stock portion appear to balance each other out?

The way Turbotax has calculated this right now is showing a capital gain loss because the Milacron FMV was originally $16.8391 per share but the net proceeds on 1099B is showing the cash portion only $11.80 so it shows a capital loss of 5.0391 per share."

On these "cash plus stock" deals it seems like some brokers report only the cash proceeds while some brokers report the sum of the cash proceeds plus the FMV of the stock. (I'm sort of guessing here but that's my impression having answered lots and lots of these "cash plus stock" questions over the years.)

Generally a "same day" sale (vesting and sale happening simultaneously) reports a small loss due to selling commissions and brokers fees. Given what you've posted here I'd say your sales should, more or less, be reported as "no gain or loss" or a small loss. Is depends on whether the 1099-B is really using the $11.80 or a slightly reduced figure due to broker commission.

I'd say "use the cash proceeds reported by the broker to enter your sales and derive a basis figure that gives you the correct gain or loss." If you report the correct gain or loss then you've fulfilled your obligation as a taxpayer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Restricted Stock and Cash Merger

Thanks Tom.

For the merger I was offered $11.80 cash per share for my current stock and 0.1612 shares in the new company (valued at $31.26 per share from merger agreement) for each share I had in the old company (valued at $16.8391).

I think my main problem is around Capital gain / loss.

So for example my old shares had vesting accelerated and I was taxed at:

497 shares x $16.8391 = $ 8369.0327 Taxable income Restricted stock awards and units

but on my 1099B

497 shares x 11.80 = $5864.60 Net Proceeds. The cash portion offer of the merger agreement

In Turbotax its calculating 8369.0327 - 5864.60 = (2504.4327) has a capital gains Loss

There is no way to account for the value of the new stock also received as part of the merger 0.1612 x 31.26 = 5.0391 in Turbotax. The stock portion of the merger agreement.

11.80 +5.0391 = 16.8391 = valuation of my old shares

I think there should in essence be no net gain or loss. I need to try and find away to represent this in Turbotax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Restricted Stock and Cash Merger

I've told you how to handle this. Enter the proceeds as they read on the 1099-B then enter a derived basis that gets you to the correct answer - either "no gain or loss" or "a small loss due to selling commissions and fees."

Now, you could handle it the obvious other way: Enter the 1099-B with a derived proceeds number - cash + FMV of stock - and enter the "correct" basis. Either way you'll need to correct the basis reported on the 1099-B - I assume the 1099-B will report $0 as the basis - and either way you'll have stated your income correctly.

Personally I'd use the first method as that allows the IRS to "match" your income tax return to their 1099-B, lessening the chance that the IRS will contact you. But either way is perfectly safe as long as you state your income correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Restricted Stock and Cash Merger

Hi Tom,

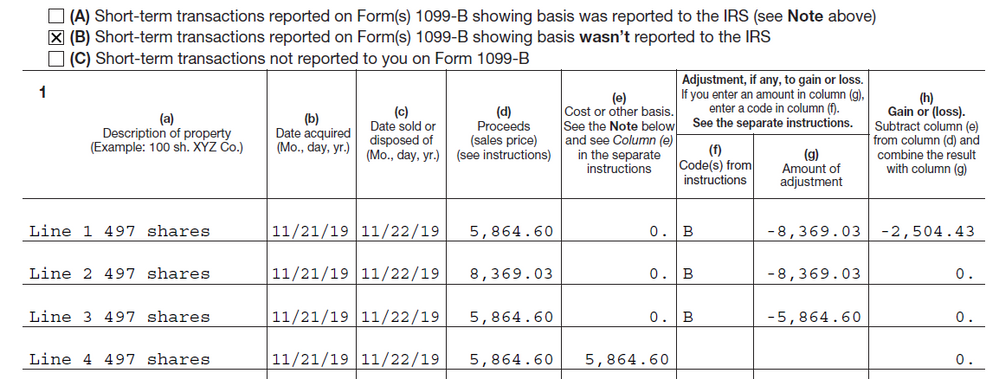

I really appreciate your help and apologies for my ignorance but I am really struggling with this and deadline is near and I'm just trying to get this done. So I wonder if you could take a look at a snip from my 8949 below. In my 1099B only Box 1d (proceeds) was filled out with $5864.6 (Cash I received for 497 shares in my old company) and box 1e Basis was left empty. So in the snip I have entered these shares in 4 different ways. Line 1 was the original way I did it using RSA/RSU worksheet, I know you said I didn't need to use this but I thought I needed to because I also had compensation income tax on these RSA / RSU's, which is in my W2. Line 1 shows a Capital loss of $2504.43, and this amount actually is the same value I received back, from the merger, in shares in the new company.

Line 2, I over-rode the proceeds value entered in box 1d on the 1099B and put the FMV of $8369.03 as the proceeds (value of 497 shares in my original company), then did a corrected cost basis correction of 8369.03 using code B, on the 8949 resulting in a zero gain/loss situation. Can you use code B as the correction on 8949 if the basis was left empty on the 1099B or should it be code O?

Line 3, I entered the proceeds as per the 1099B ($5864.60 cash portion of merger) then did a corrected cost basis correction of $5864.60 using code B, on the 8949, resulting in a zero gain/loss situation.

Line 4, I entered the proceeds as per the 1099B ($5864.60 cash portion of merger) then just entered $5864.60 as the cost basis (NOT corrected cost basis), although this was blank in 1e on the 1099B, resulting in a zero gain/loss situation.

I wondered if any of these seem viable options or have I done this totally wrong. For me I felt that Line 3 or 4 seemed to make the most sense but I am not showing the shares I received from the new company of $2504.43 and yet income tax on my W2 was for the $2504.43 (New Company stock portion) + 5864.6 (Cash portion) = $8369.03 (FMV of shares in original target company)

One last question if I don't use the RSA/RSU interview will the compensation income tax from these still be figured into the total return. I know the taxes came out of my W2.

Thanks for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Restricted Stock and Cash Merger

"One last question if I don't use the RSA/RSU interview will the compensation income tax from these still be figured into the total return."

Yes, of course it will because it's already included on your W-2. One of the "legitimate" reason to use the RSA/RSU guided interview is if the compensation income wasn't included in your W-2. After using the RSA/RSU guided interview, you continue on the very end of the "Stocks, Mutual Funds, Bonds, Other" interview. On the very last page of that interview - a page titled "Your Employee Stock Plan Results - TurboTax shows you the amount of compensation it has calculated and asks you if it's on your W-2. If you say "No" TurboTax makes an entry on your income tax return for the "missing" compensation. If you say "Yes" TurboTax makes no entry because that compensation is already on your W-2.

"I know the taxes came out of my W2."

That raises an issue that we haven't talked about, and I don't know that I even want to go down this particular rabbit hole, but the issue is where did the cash for those taxes come from? In a "normal" RSA/RSU "same day sale" situation some of the shares in the grant are either withheld by the employer or are sold "for taxes" with that money being passed back to the employer. Of course that means that the employee doesn't deposit in their brokerage account the GROSS number of shares, only the NET number of shares ("after tax") but the compensation on the W-2 still reflects the GROSS number of shares. (This is exactly the same as a regular paycheck, you simply got paid "in shares" instead of "in cash.")

I assume this has all been properly handled?

LINE 1 trade:

"I did it using RSA/RSU worksheet, I know you said I didn't need to use this but I thought I needed to because I also had compensation income tax on these RSA / RSU's, which is in my W2. Line 1 shows a Capital loss of $2504.43"

This entry is clearly wrong since we know that "same day" sales typically result in a small loss due to selling commissions and fees. If there were no selling commissions and fees then the correct answer is a $0 result. The compensation issue is a red herring since it's already there on your W-2. If you use the RSA/RSU interview absolutely none of the "compensation" aspect of the sale shows up in the income tax return you send to the IRS. The trade itself on Form 8949 looks like any other sale of a security with a basis adjustment and there's no page included in the income tax return that says, in effect "I got compensation as a result of this transaction and here's how that compensation was calculated." DELETE THIS.

I'd go with the line 3 entry as it "ties" to the proceeds on the W-2, shows an "adjustment" from the basis reported on the 1099-B which is stylistically correct, and results in the correct answer. Delete everything you've done and go back through the "Stocks, Mutual Funds, Bonds, Other" one last time to enter the trade accordingly. TurboTax will put an "O" in the code column, which is fine. (Realistically the codes are pretty meaningless. The IRS isn't going to come crashing down on you for a "wrong code" if your capital gain or loss is stated properly.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Restricted Stock and Cash Merger

Thanks Tom

I was also leaning towards line 3 as well but I still can't fathom how the IRS knows that in addition to the $5864.60 (Cash portion reported on the 1099B) I also received new stock in the new company of $2504.44, which doesn't appear to be accounted for other than I was taxed on the FMV of my original shares which was $8369.03. I should say that I haven't sold the the new stock in the new company and they have been converted to common stock to the value of $2504.44.

Regarding where did the cash payment originate, I have attached a summary of the broker transaction below:

| Award Type | Restricted Stock Award |

| Award Date | 3/1/2019 |

| Vest Date (Merger Date) | 11/21/2019 |

| Election Method | Cash |

| Shares Vested | 497 |

| Fair Market Value Per Share | $16.8391 |

| Taxable Income 497 x 16.8391 | $8,369.03 |

| Taxes | |

| Federal | 1841.19 |

| State | 292.92 |

| Local | 175.75 |

| FICA Medicare | 121.35 |

| Total Taxes | 2431.21 |

| Fees | 0 |

| Gross Proceeds = Taxable income minus Total Taxes and fees | |

| Gross Proceeds Reported on 1099B Box 1d (497 x $11.80) | 5864.60 |

| Net Proceeds = Gross proceeds minus Taxes and Fees | |

| Net Proceeds - Check issued | 3433.39 |

| Note Cash Portion at merger =497 x 11.8 | 5864.6 |

| Note New Stock Portion at Merger = 0.1612 x 497 x 31.26 | 2504.44 |

| 8369.04 |

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Restricted Stock and Cash Merger

OK , the taxes did result in a "net check" to you, everything's good.

"but I still can't fathom how the IRS knows that in addition to the $5864.60 (Cash portion reported on the 1099B) I also received new stock in the new company..."

On a "normal" same day sale of employer stock the broker is not obligated to send you a 1099-B. So in that situation the IRS doesn't really know if you ended up with "cash" or "stock" or some mixture in between. And you don't routinely report your purchases of stock that you make through your broker, right? The issue of the stock you received will come up, down the road, if you sell it. You've got "this years" income properly stated and that's all you're obliged to do.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Matthew B

New Member

thomaswreese

Level 3

thomaswreese

Level 3

tizianadipucchio

New Member

margaretelisebyers

New Member