- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Hi Tom,

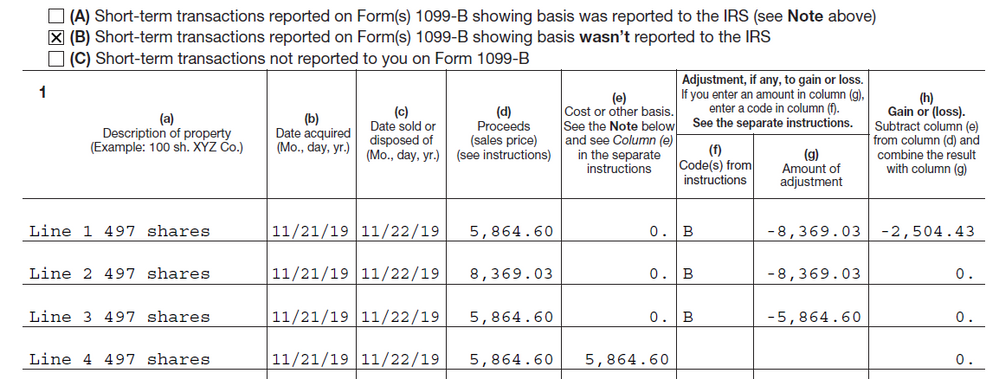

I really appreciate your help and apologies for my ignorance but I am really struggling with this and deadline is near and I'm just trying to get this done. So I wonder if you could take a look at a snip from my 8949 below. In my 1099B only Box 1d (proceeds) was filled out with $5864.6 (Cash I received for 497 shares in my old company) and box 1e Basis was left empty. So in the snip I have entered these shares in 4 different ways. Line 1 was the original way I did it using RSA/RSU worksheet, I know you said I didn't need to use this but I thought I needed to because I also had compensation income tax on these RSA / RSU's, which is in my W2. Line 1 shows a Capital loss of $2504.43, and this amount actually is the same value I received back, from the merger, in shares in the new company.

Line 2, I over-rode the proceeds value entered in box 1d on the 1099B and put the FMV of $8369.03 as the proceeds (value of 497 shares in my original company), then did a corrected cost basis correction of 8369.03 using code B, on the 8949 resulting in a zero gain/loss situation. Can you use code B as the correction on 8949 if the basis was left empty on the 1099B or should it be code O?

Line 3, I entered the proceeds as per the 1099B ($5864.60 cash portion of merger) then did a corrected cost basis correction of $5864.60 using code B, on the 8949, resulting in a zero gain/loss situation.

Line 4, I entered the proceeds as per the 1099B ($5864.60 cash portion of merger) then just entered $5864.60 as the cost basis (NOT corrected cost basis), although this was blank in 1e on the 1099B, resulting in a zero gain/loss situation.

I wondered if any of these seem viable options or have I done this totally wrong. For me I felt that Line 3 or 4 seemed to make the most sense but I am not showing the shares I received from the new company of $2504.43 and yet income tax on my W2 was for the $2504.43 (New Company stock portion) + 5864.6 (Cash portion) = $8369.03 (FMV of shares in original target company)

One last question if I don't use the RSA/RSU interview will the compensation income tax from these still be figured into the total return. I know the taxes came out of my W2.

Thanks for your help.