- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Residential Rental Property Improvement and Sale in the Same Year

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Residential Rental Property Improvement and Sale in the Same Year

Just asking.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Residential Rental Property Improvement and Sale in the Same Year

@Critter-3, @DianeW777, @RobertB4444

Please can Diane and Robert respond to what @Critter-3 is saying. We are so conflicted on how to treat this and it is important to get this right for us. I thought this was resolved until I saw these new round of questions and answers. Also, please can you get other Turbo Tax experts involved in this question (especially those that specialize in this area). There are clearly different opinions being shared by the Tax experts and there is only one right answer. Please can you experts share this question with your other colleagues that are experts in this area. We would tremendously appreciate it!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Residential Rental Property Improvement and Sale in the Same Year

The thing is that the IRS makes no distinction between major improvements made in the year of the sale or any other year. If the improvements made have more than a year of useful life and they are above the de minimus amounts requiring capitalization then they get added to the basis.

IRS rules on residential rental property

The de minimus amounts that you can expense in the year are under $10,000. So you could expense part of the improvements and capitalize the rest.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Residential Rental Property Improvement and Sale in the Same Year

Please can you explain the step by step process of how you would enter it in TT based on your recommendation of my tax situation as described above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Residential Rental Property Improvement and Sale in the Same Year

If you stopped renting the property, then made improvements in preparation for sale, you can indicate that you 'converted to personal use' and the date the last renter moved out in the Rental section and be done with Schedule E. Note the Accumulated Depreciation and Current Year Depreciation amounts TurboTax reports.

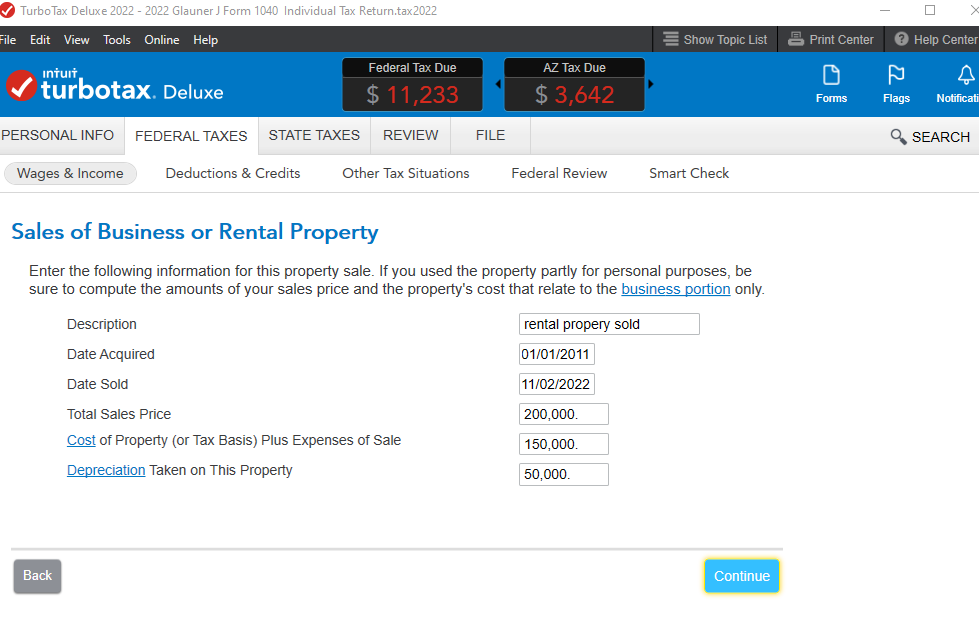

Then, report the sale of the rental under 'Sale of Business Property'. Add the value of the improvements to the Cost (remaining undepreciated basis , plus improvements, plus sales expenses), and enter the total of the two depreciation amounts for Accumulated Depreciation.

Type 'sale of business property' in the Search area, then 'Jump to sale of business property' to get to this section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Residential Rental Property Improvement and Sale in the Same Year

I will have an almost identical situation to johnjames in 2023 and appreciate the three of you who have replied on this issue. So I am clear though, I have two questions:

1) Are improvements made in the same year of the sale, after the renter has moved out, added to cost basis as undepreciated, 100% of the dollar amount of the improvement, and

2) Are expenses under $10,000 or 2% of original basis, whichever is less, deducted as sales expenses just like real estate broker commissions or as repair expenses on Schedule E, even if the renter has already moved out?

And if so, isn't the effect the same, i.e. reduces my capital gain regardless of where I enter them? Just seems like a complicated way to do it if they both have the same tax effect.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Residential Rental Property Improvement and Sale in the Same Year

Hi - I just finished reading this thread as I am going to have the same situation in 2023. I came to the same conclusion as you - there's two very different answers here. I agree with your statement that listing the current year improvements as repairs will result in more tax savings than showing that as part of the selling expenses.

Can I ask where you ended up on this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Residential Rental Property Improvement and Sale in the Same Year

Assets placed in service and removed from service in the same tax year are NOT depreciated so your only options are to list them as repairs on the Sch E or added to the cost basis along with the closing costs.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Residential Rental Property Improvement and Sale in the Same Year

Double check your depreciation recapture (you show + $131K) the tax rate is 25%. ($131 x 25%)=$32K is your tax bill for depreciation. So if your are doing it as shown you might be using a long term rate (~15%) which is incorrect for depreciation recapture or you might be double counting. I'm working on a rental property sale myself.

Also you should use percentages derived tax records, not the stated value for land $. (Tax assessments don't usually equal the true market value at time of purchase or when converting to a rental). Thus when you sell you will take the Sales price 2022 * land % from 2010 = land value in 2022. Land can appreciate in value (regional dependent).

Not a tax professional, but have owned rentals for 30 years and have had to do lots of reading and research.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Residential Rental Property Improvement and Sale in the Same Year

Technically, Turbotax will allow it. I had to make the in service date the same as the sale date for each capital improvement I listed so it would stop trying to depreciate it for one month and then TT trying to recapture it. Regardless, although I put my capital improvement in the correct place (same page as where you depreciate your rental), the losses from my capital improvements were not applied to cost basis of rental but instead used to offset other income on schedule 1 and then went to 1040 Line 7. Im still trying to get help on this but I thing it is because I chose the option "active participant" which allows you to carry over rental losses to offset ordinary income up to $25,000. Turbotax always tells you the good side but not the bad side. I think by choosing active participant, this disallows you from offsetting your capital gains with your losses from the capital improvements (ie new roof, addition to house, etc). Im not talking about expenses here that offset your rental income each year.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

timeflies

Level 1

garys_lucyl

Level 2

mpen007

New Member

tim191919

New Member

erwinturner

New Member