- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

If you stopped renting the property, then made improvements in preparation for sale, you can indicate that you 'converted to personal use' and the date the last renter moved out in the Rental section and be done with Schedule E. Note the Accumulated Depreciation and Current Year Depreciation amounts TurboTax reports.

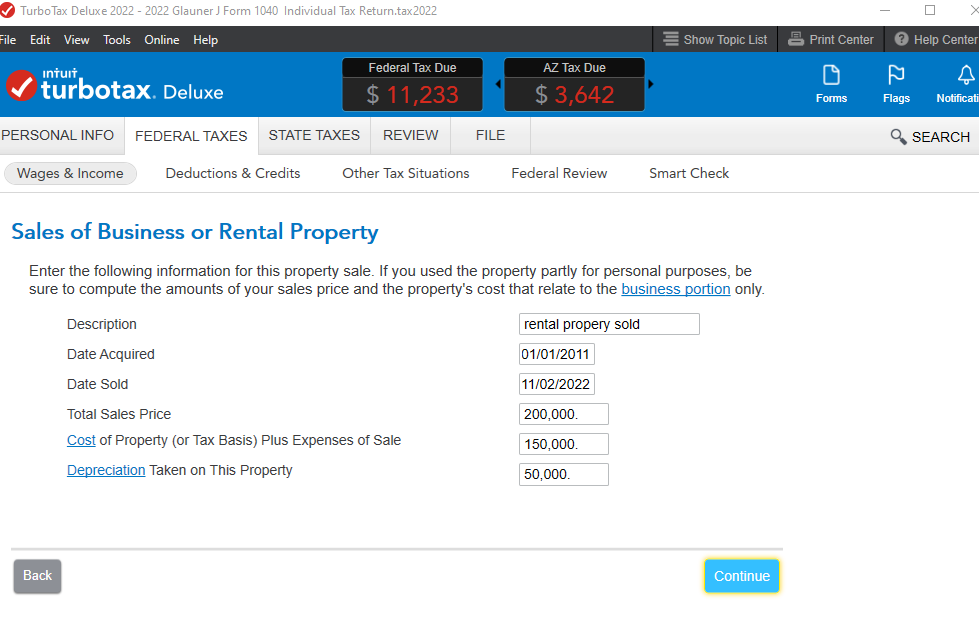

Then, report the sale of the rental under 'Sale of Business Property'. Add the value of the improvements to the Cost (remaining undepreciated basis , plus improvements, plus sales expenses), and enter the total of the two depreciation amounts for Accumulated Depreciation.

Type 'sale of business property' in the Search area, then 'Jump to sale of business property' to get to this section.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 7, 2023

7:25 PM