- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: QBI carryover from prior year for Sch E

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI carryover from prior year for Sch E

2023 has a QBI loss carryforward as shown on 2023 Form 8995 line 16 for rentals reported on Schedule E. I don't see a way to report this carryover in Turbotax.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI carryover from prior year for Sch E

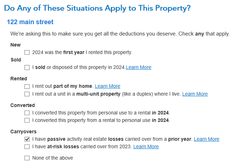

For rental properties, the QBI carryover can be reported in the carryover interview for each rental activity (check the box that you have At-Risk, PAL or 179 loss carryovers). The following screen will ask for the QBI.

In TurboTax Online, you can see this screen under "Less common situations" in the Rental/SCH E section. @midtowncpa Thanks for the question.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI carryover from prior year for Sch E

For rental properties, the QBI carryover can be reported in the carryover interview for each rental activity (check the box that you have At-Risk, PAL or 179 loss carryovers). The following screen will ask for the QBI.

In TurboTax Online, you can see this screen under "Less common situations" in the Rental/SCH E section. @midtowncpa Thanks for the question.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Rblot44

New Member

ricw23

Level 2

N-Atchley15

New Member

kgargasz

New Member

ping_wen

New Member